The Allahabad High Court in a ruling, addressed an issue related to the E-way bill under the Goods and Services Tax (GST). The court remarked that furnishing a different address in the E-way bill rather than the consignee’s address can be attributed to human error. Mentioning the absence of intent to evade tax, the court quashed the order.

It was observed by the bench of Justice Piyush Agrawal that no finding was recorded by any of the councils below that there was a mens rea to evade tax payment. Even before the court, no pleading was made on behalf of the state that there was any intent to evade tax.

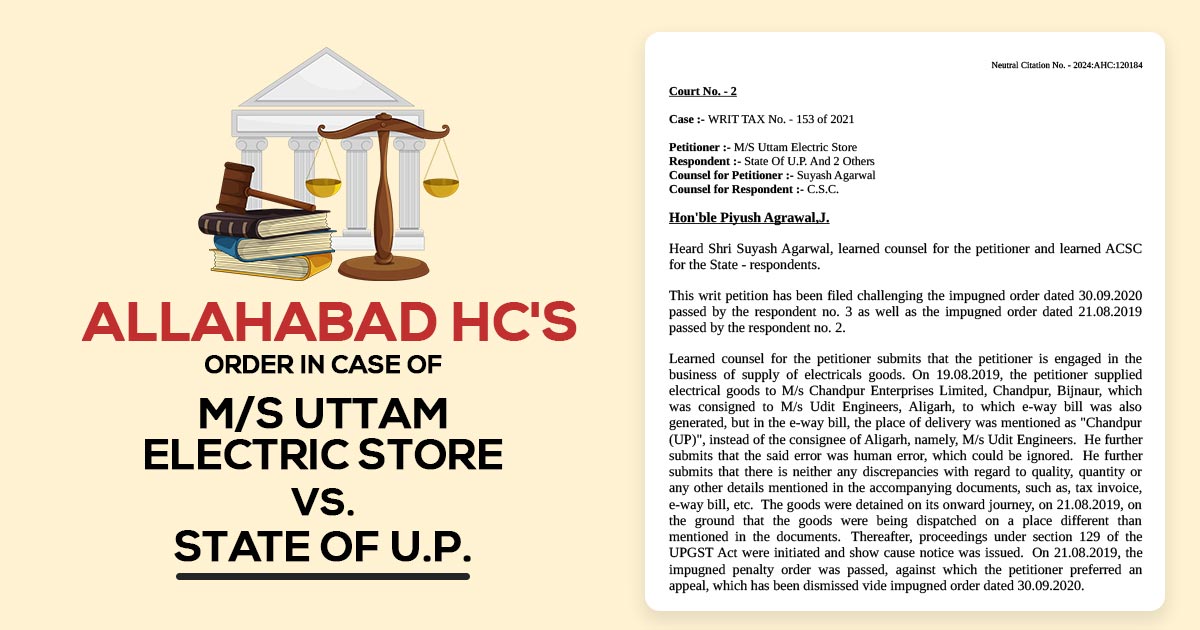

The assessee-petitioner, Uttam Electric Store is engaged in supplying electrical goods. It filed a writ petition contesting the order passed by the GST department. The taxpayer provided goods to M/s Chandpur Enterprises Limited, Chandpur, Bijnaur, on 19.08.2019.

The goods were consigned to M/s Udit Engineers, Aligarh, and a GST E-way bill was generated. However, the E-way bill erroneously listed the place of delivery as “Chandpur (UP)” instead of Aligarh.

The taxpayer said the same was a human error that could have been prevented. Also, there were no differences in the quality, quantity, or other details cited in the accompanying documents, like the tax invoice and E-way bill.

On 21.08.2019 the goods were detained as of the difference in address, directing to the proceedings u/s 129 of the Uttar Pradesh GST Act and the issuance of an SCN. A penalty order was passed dated 21.08.2019, which the petitioner appealed. The appeal was dismissed dated 30.09.2020.

Suyash Agarwal the counsel of the taxpayer argued that the lower authorities have not made any mens rea, which is critical to impose a penalty u/s 129(3) of the GST Act. The court’s ruling has been referenced by the counsel in Nancy Trading Company Vs. State of U.P. & 3 Others and Shyam Sel & Power Limited Vs. State of U.P. to support his argument.

It was discovered by the court that the difference in the e-way bill could also be a human error and observed the absence of findings by the authorities for the mens rea for tax evasion. The counsel of the respondent losses to furnish any argument or proof to recommend the intentional tax evasion by the applicant.

Read Also: GST E Way Bill Registration Quick Guide with Full Procedure

The bench repeated the observations from the matter of Nancy Trading Company Vs. State of U.P. & 3 Others to support the decision of the court. As per that the bench has quashed the order issued via the department. The department was asked to return the amount if deposited within 1 month.

| Applicant Name | M/S Uttam Electric Store Vs. State Of U.P. |

| GSTIN of the applicant | WRIT TAX No. – 153 of 2021 |

| Date | 26.07.2024 |

| Counsel for Petitioner | Suyash Agarwal |

| Counsel for Respondent | C.S.C. |

| Allahabad High Court | Read Order |