Taxpayers are encouraged by the Income Tax Department to correct any erroneous refund claims or exemptions. This can be done by submitting revised returns for the current assessment year and updating filings for previous assessment years (ITR-U).

For filing ITR-U you need to pay certain additional taxes. The additional tax shall be equal to 50% of the aggregate of tax and interest payable by a person on the filing of the updated return.

However, in case the updated return is furnished after the expiry of the due date of filing of belated or revised return but before completion of a period of 12 months from the end of the relevant assessment year, the additional tax payable shall be 25% of the aggregate of tax and interest payable.

The deadline for filing Income Tax Returns (ITR) for the assessment year (AY) 2024-25 was July 31, 2024. If missed, taxpayers have the opportunity to file a belated return until December 31, 2024.

Tweet from the Income Tax Portal’s Official ‘X’ Handle

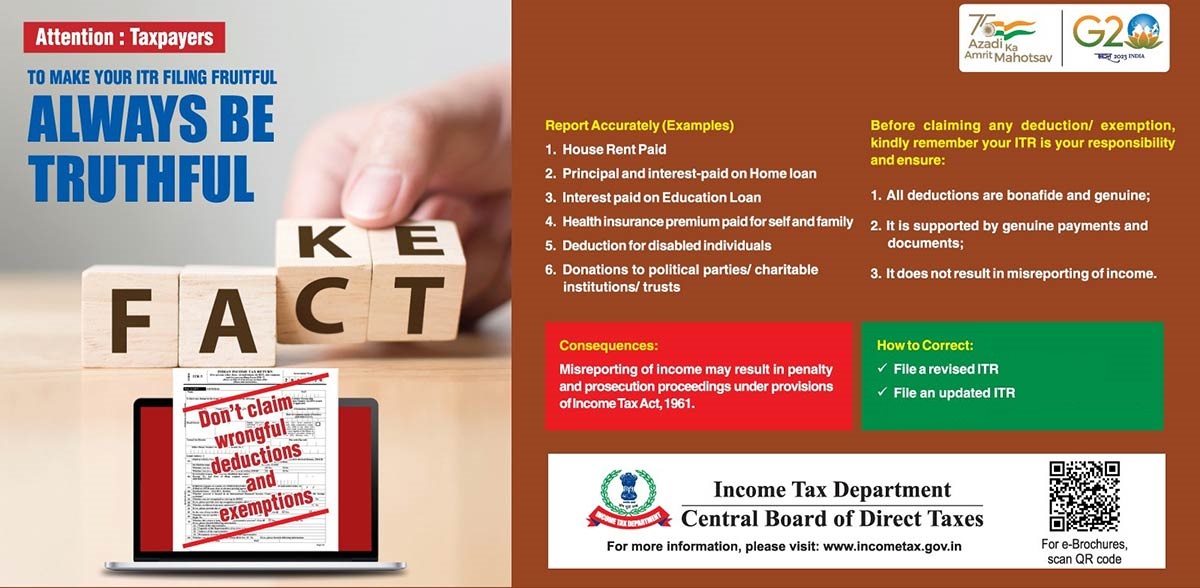

Accuracy in reporting various deductions and exemptions is stressed by the Income Tax Department for all stakeholders. These encompass deductions such as house rent payments, education loan interests, both principal and interest on home loans, health insurance premiums for oneself and family, deductions for individuals with disabilities, and contributions to political parties, charitable institutions, and trusts.

Reporting Accurate Income and Ensuring Claims’ Authenticity

When including deductions or exemptions in your Income Tax Return (ITR), it’s crucial to verify that all claims are authentic, backed by legitimate payments and proper documentation. This highlights the importance of avoiding misrepresentation of income.

False claims for deductions under the Income Tax Act. constitute a type of tax evasion, potentially resulting in penalties imposed by tax authorities. The Annual Information System (AIS) and Transaction Information System (TIS) provide tax authorities with extensive taxpayer data, allowing thorough scrutiny of deductions and exemptions.

Misreporting income encompasses misrepresentation or concealment of facts, failure to record investments in financial records, unverified claims of expenses, falsified entries in financial records, failure to document pertinent receipts, and omission of reporting international transactions.

A Summary of IT Penal Provisions

Penalties according to the IT Act. are applicable under Section 270A for instances of under-reporting or misreporting income. The penalty can equate to 50% of the tax due on under-reported income or escalate to 200% in cases of deliberate misreporting.

Section 271(1)(c) specifically addresses penalties for income concealment or providing inaccurate particulars. Intentionally furnishing incorrect details about deductions might incur penalties ranging from 100% to 300% of the evaded tax.

Under Section 140A(3), failure to pay self-assessment tax could lead to penalties determined by the Assessing Officer. Offences such as willful attempts to evade tax or failure to furnish returns per Section 276C(1) may result in both imprisonment and fines.

Revised Income Tax Returns

Taxpayers have the option to rectify errors or omissions in their returns by filing revised returns as per Section 139(5) of the Income Tax Act. This provision allows for corrections to be made in case of mistakes. In instances where the initial ITR remains unverified, taxpayers can utilize the ‘Discard’ feature on the income tax portal.

Belated Income Tax Returns

Filing returns after the deadline, as per Section 139(4) of the Income Tax Act, may incur penalties under Section 234F. The penalty stands at Rs 5,000, reduced to Rs 1,000 for individuals with a total income below Rs 5 lakh. Furthermore, interest under Section 234A, calculated at one per cent per month, is imposed on the outstanding tax amount for each month or part thereof in cases of delayed filing.