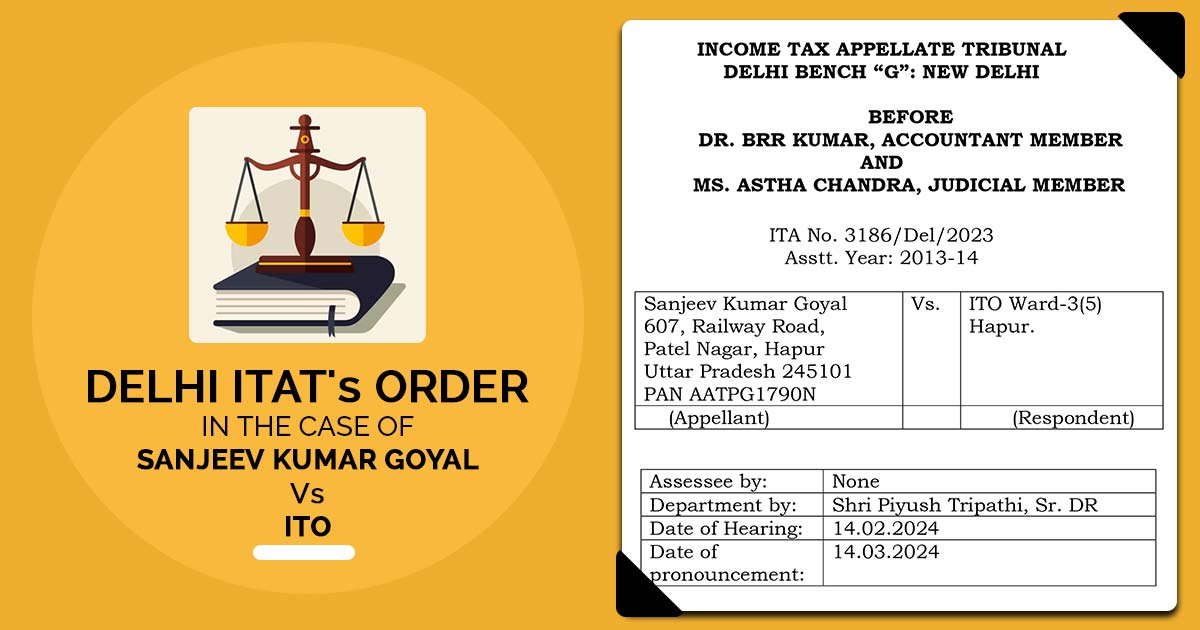

The Income Tax Appellate Tribunal (ITAT) Mumbai in the recent case analyzed the petition furnished by the taxpayer against an order via the Commissioner of Income Tax (Appeals), National Faceless Appeal Centre, Delhi. From the addition of Rs 11,33,000 as undisclosed income by the Assessing Officer the dispute emerged. U/s 148 of the Income Tax […]