A Goods and Services Tax ( GST ) demand order has been set aside by the Madras High Court specifically addressing a difference in Reverse Charge Mechanism ( RCM ) liability. The court regarded the petitioner’s argument for the accidental errors in filing GSTR 3B returns, prompting a remand of the matter for further consideration.

The petitioner, Arupadai Infrastructure proposed that they were not furnished with a reasonable chance to challenge the tax demand on merits, as they were not learned of the proceedings leading to the impugned order till after its issuance. After the rejection of a rectification petition, the petition was filed.

Applicant’s counsel said that two problems are been addressed by the impugned order. Firstly for the discrepancy between the applicant’s GSTR 3B returns and the GSTR 1 statement, the applicant has remitted the tax dues concerned with it earlier. Secondly, the RCM liability mismatch, the same was attributed to an accidental error in filing the GSTR 3B returns at the time of the related assessment duration. To argue the same problem the applicant asks for another chance.

For the respondent, Mr. V. Prashanth Kiran, Government Advocate, accepted the notice and cited that the impugned order was preceded by an intimation, an SCN, and personal hearing notices.

The applicant furnished the payment of proof of tax dues for the GSTR 3B and GSTR 1 discrepancies. The petitioner for the RCM liability mismatch, proposed pertinent GSTR 3B returns to assist the claim of inadvertent error. As the tax dues appeared to have been recovered, revenue interest was secured in this phase.

Accordingly, the impugned order was set aside by a single bench of Justice Senthilkumar Ramamoorthy on 17.11.2023 concerning the RCM liability mismatch, and the case was remanded for reconsideration by the first respondent. The applicant was asked to propose a reply to the SCN within 15 days of the receipt of the order of the court.

The Madras High Court demanded the first respondent- Deputy State Tax Officer to deliver a reasonable chance to the applicant, along with a personal hearing, and issue a fresh order within 3 months from the receipt of the response of the applicant. It was stated that the amounts concerned with the RCM liability mismatch shall be stayed by the result of the remand.

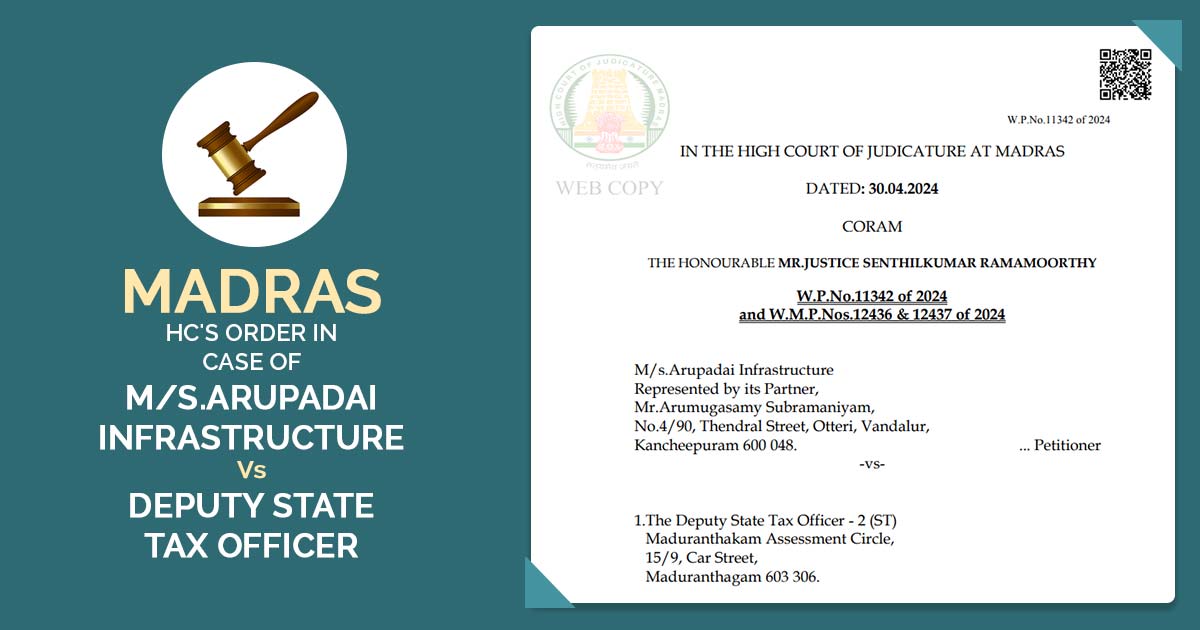

| Case Title | M/s.Arupadai Infrastructure Vs. The Deputy State Tax Officer |

| Citation | W.P .N o.11342 of 2024 W.M.P.Nos.12436 & 12437 of 2024 |

| Date | 30.04.2024 |

| For Petitioner | Ms.S.P.Sri Harini |

| For Respondent 1 | Mr.V.Prashanth Kiran, GA (T) |

| Madras High Court | Read Order |