The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) ruled that the addition could not be deleted for the only cause that the section under which the addition is made is cited incorrectly and that it is essential to look into the merits of the case.

The bench of Anikesh Banerjee (Judicial Member) and Padmavathy S (Accountant Member) noted that the addition is made for the reason that the taxpayer does not provide the details to verify the authenticity of the impugned transactions, thereby not releasing the onus. The taxpayer does not appear before the CIT(A) to assert the problem on legal foundations including on merits.

The taxpayer is in the business of manufacturing display items. The taxpayer furnished the income return for AY 2011-12, returning a loss of Rs. 7,96,993. The Assessing Officer (AO), reopened the assessment by issuing notice u/s 148 of the Income Tax Act based on information that the taxpayer had made bogus purchases from diverse parties totalling Rs. 15,51,506.

In response, the taxpayer asked that the AO treat the original return as the return furnished in answer to the notice u/s 148. At the time of the course of reassessment proceedings, AO saw that the taxpayer had incurred the investments for the immovable property for an amount of Rs. 52,23,570 and called on the taxpayer to produce the information, along with the source for the purchase of the property.

The taxpayer argued the source was the withdrawals via the proprietary concern and loans from other parties. From the provided details, the AO saw that the taxpayer had borrowed a loan from four parties to the tune of Rs. 31,89,681 and called on the taxpayer to prove the identity, creditworthiness, and genuineness of such parties.

The AO treated the loan as non-genuine and made the addition u/s 69 for the entire loan since the taxpayer did not provide the loan confirmation, income tax returns, copy of bank account, etc. The Assessing Officer on the fake purchases made an addition of Rs. 1,93,938 through applying a profit ratio of 12.5%.

Before CIT(A) the taxpayer appealed. It said that beyond the basis of merits the taxpayer argued that the statute problem that addition cannot be incurred u/s 69 as the impugned transaction has been recorded before in the books of accounts of the taxpayer.

The CIT (A) dismissed the appeal confirming both the additions made by the AO, as the taxpayer did not appear or make any submissions to the CIT (A). On merit based on materials available on record the CIT (A) recorded findings while ensuring the additions. The taxpayer before the tribunal is in appeal, arguing the addition made u/s 69 to the loan transactions.

The taxpayer argued that the addition need not have been incurred u/s 69 as the loan transactions are recorded in the books of accounts of the taxpayer. The AO has incurred the addition without regarding the information furnished before him. Before the CIT (A) the taxpayer does not appear for the reason that the taxpayer does not obtain the hearing notice.

The department argued, that the taxpayer has not appeared before the CIT (A) and has not cooperated with the appellate proceedings. Thus, the department kept the order of the lower authorities, furnishing that the taxpayer has not released the onus of establishing the genuineness of the loan transaction.

The tribunal carried that, in the interest of natural justice and fair play, we suppose it fit to remit the matter back to the CIT(A) for acknowledgement of the issue afresh. The taxpayer is demanded to provide the critical particulars in support of the claim that the loans are real without asking for any adjournments and to cooperate with the appellate proceedings.

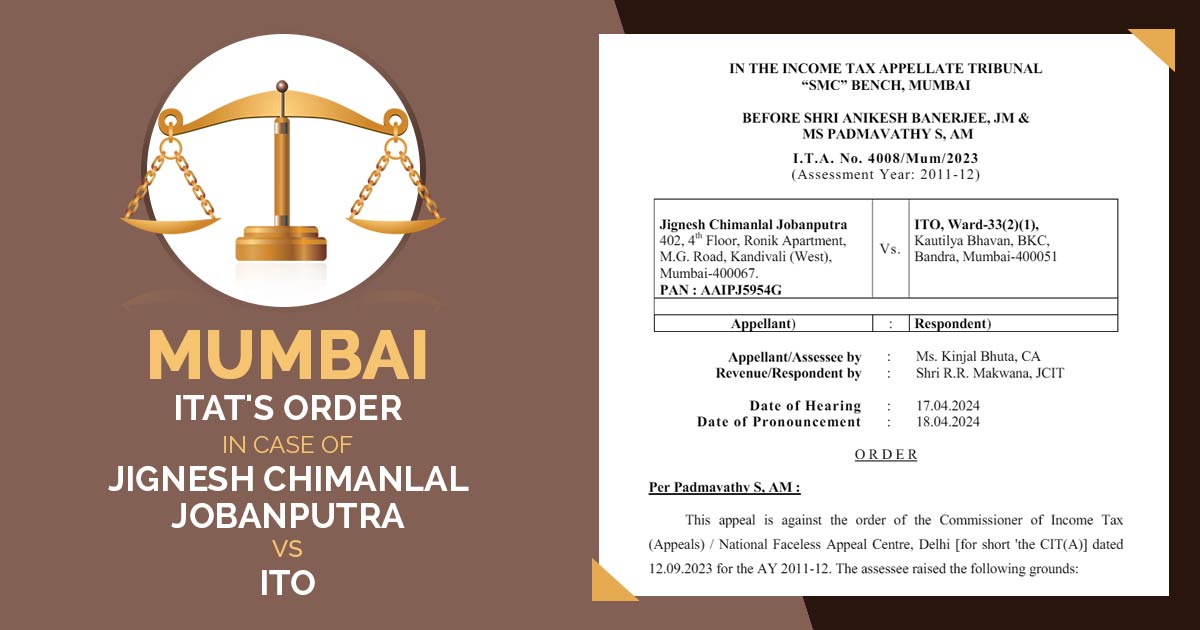

| Case Title | Jignesh Chimanlal Jobanputra Vs. ITO, Ward-33(2)(1) |

| Citation | I.T.A. No. 4008/Mum/2023 |

| Date | 18.04.2024 |

| Appellant/Assessee by | Ms. Kinjal Bhuta, CA |

| Revenue/Respondent by | Shri R.R. Makwana, JCIT |

| Mumbai ITAT | Read Order |