Section 44AB of the Income Tax Act emits an obligation on the taxpayer to get accounts audited prior to the cited date and provide by that date the report of such audit, New Delhi ITAT ruled.

The ITAT while learning that there was reasonable cause for failure in providing the Tax Audit Report in time, clarified that the current case is not a case of not getting the accounts audited in time, and hence, ruled that the penalty under section 271B is not exigible

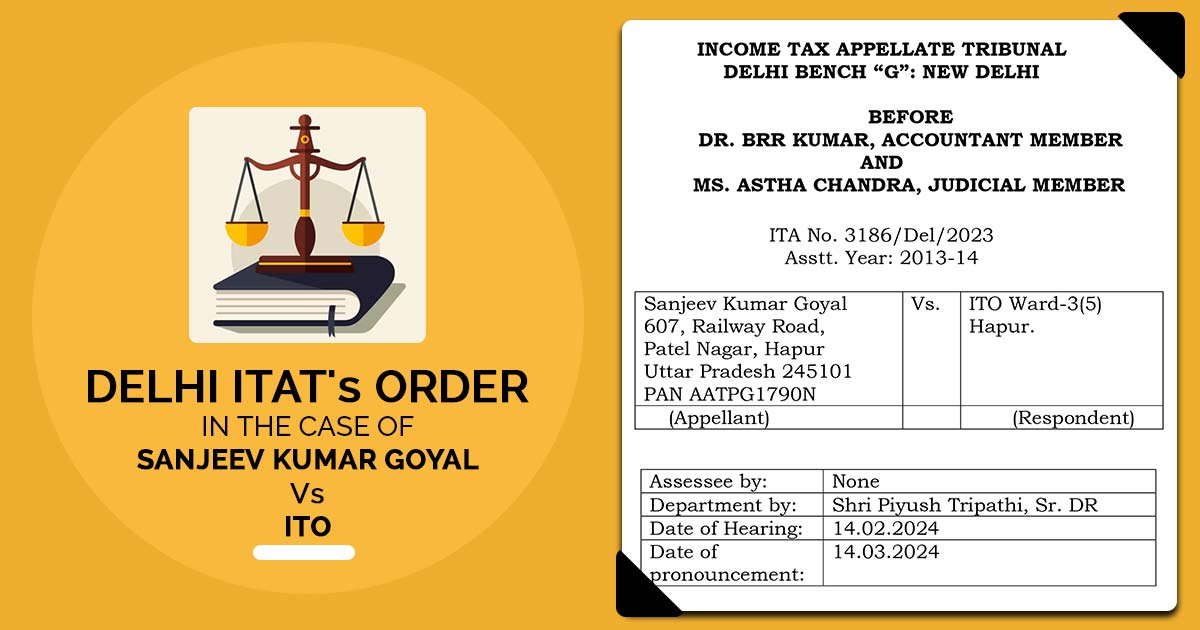

The Bench of Dr. BRR Kumar (Accountant Member) and Astha Chandra (Judicial Member) noted that It is not the Revenue’s matter that the original return e-filed dated 04.10.2013 was not within the said time under section 139(1) of the Act. Section 139(5) of the Act allows a taxpayer to file a revised return before the completion of assessment.

Within the legally permissible time along with the Audit Report, the taxpayer has filed a revised return. In the course of the assessment proceedings itself, the taxpayer explained that the delay was caused by of death of his elder brother who was looking after the financial affairs of the taxpayer’s business. (Para 6)

Read Also:- Delhi ITAT Deletes Tax Penalty U/S 271B, NLU-Delhi Not Committed to Business

In this case, the taxpayer is an individual engaged in the business of trading and manufacturing of timber products and firewood. He e-filed his return declaring income of Rs. 4,82,499 which was later revised to Rs. 6,34,500/-. on 17.06.2014.

During an assessment, it was detected that as per the copy of the audited P&L A/c filed along with the revised return, the gross receipts were Rs. 17,89,07,251. As the taxpayer had failed to get his account audited under section 44AB of the Act, proceedings under section 271B were initiated. Post disposal of the quantum first plea, the AO issued an SCN and charged a penalty for want of compliance by the taxpayer.

From the assessment order, the Bench discovered that the taxpayer furnished the Tax Audit Report on 04.08.2013 including a revised return dated 17.06.2014 which has been duly regarded.

the AO in the assessment order noted that the audit report has been provided dated 17.06.2014 with the revised return and therefore it was not filed within the prescribed time, hence, the AO initiated the penalty proceedings under section 271B for non-furnishing of Tax Audit Report in time, the Bench said.

On 06.10.2021 before the CIT(A) in reply uploaded on the ITBA Portal, the Bench expressed that it was provided that the taxpayer was going with a medical condition in the year under consideration.

The Bench, the taxpayer has submitted that the delay in providing the Audit Report in time was caused by to inadvertent mistake executed by his Chartered Accountant, but the explanation of the taxpayer has just been disbelieved.

ITAT permitted the appeal of the taxpayer and vacated the penalty.

| Case Title | Sanjeev Kumar Goyal verses ITO |

| Case Number: | ITA No. 3187/Del/2023 |

| Date | 14.03.2024 |

| Counsel For Appellant | None |

| Counsel For Respondent | Piyush Tripathi |

| Delhi ITAT | Read Order |