The Institute of Chartered Accountants of India (ICAI) has criticised a Chartered Accountant for failing to exercise due diligence while certifying Form AOC-4 filed with the Ministry of Corporate Affairs (MCA).

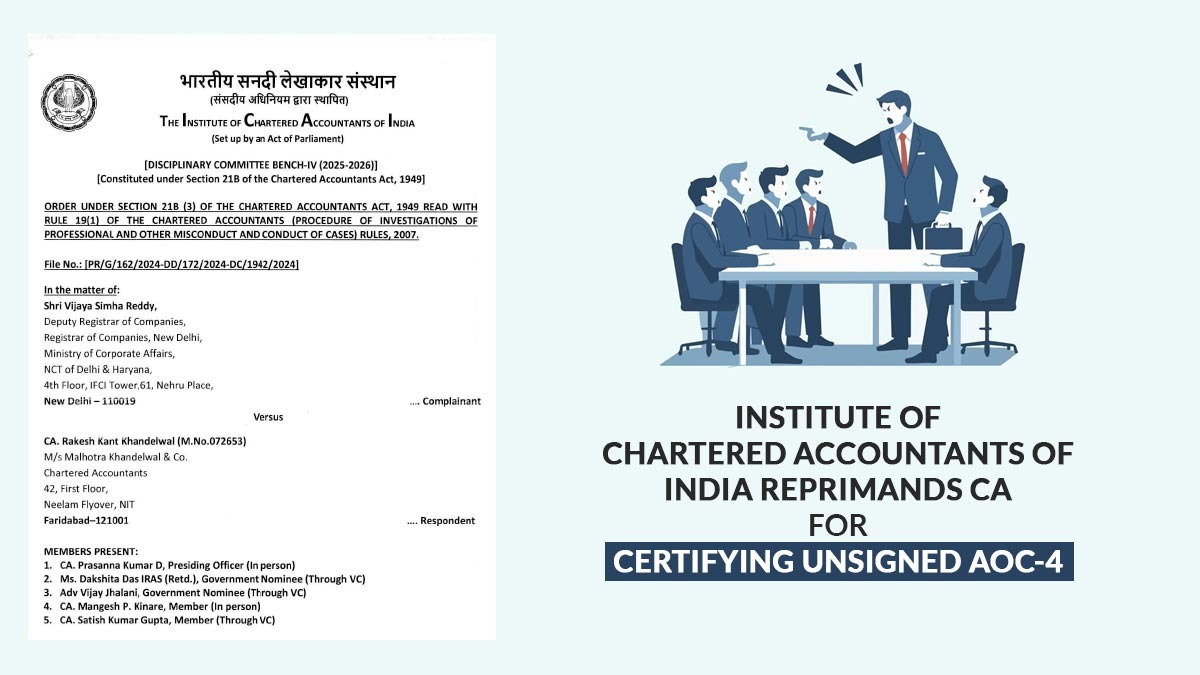

The Disciplinary Committee (Bench-IV) passed the order u/s 21B(3) of the Chartered Accountants Act, 1949, in the matter titled Shri Vijaya Simha Reddy, Deputy Registrar of Companies vs. CA. Rakesh Kant Khandelwal.

The Case

The Deputy Registrar of Companies, New Delhi, filed the complaint under the Ministry of Corporate Affairs, after an inspection into the affairs of M/s. Unik Springs India Private Limited.

There were claims that during the financial years 2014-15 and 2015-16, the official Audit Report and Balance Sheet submitted with Form AOC-4 were missing the actual signatures of both the auditor and the company’s directors. Instead, the documents only had markings saying “SD,” which stands for signed copy.

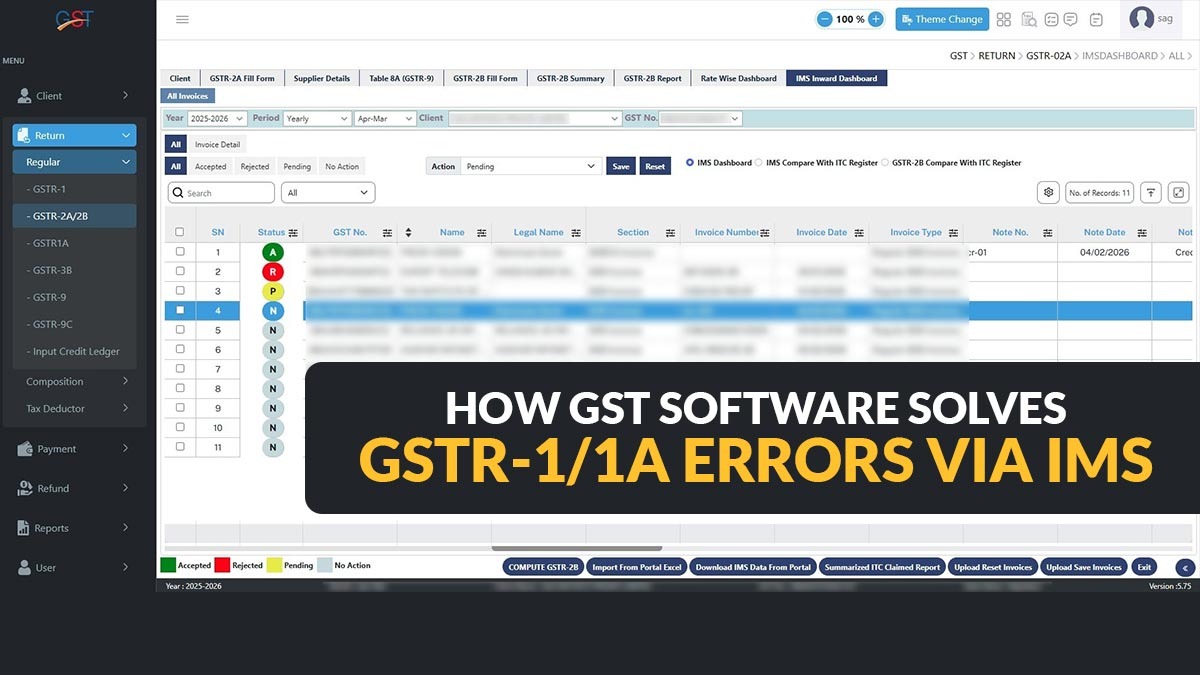

Recommended: How ROC Software Solves Key Challenges in Annual Audits

Even after the same, the e-form AOC-4 was certified by the auditor, validating that the attachments were complete, correct, and duly signed as per statutory pre-requisites.

Examined Regulatory Provisions

The Committee examined compliance with:

- Section 134(1) of the Companies Act, 2013, obligates that financial statements should be signed by authorised directors before submission.

- Rule 8 of the Companies (Registration Offices and Fees) Rules, 2014, mandates that scanned documents attached to e-forms should be copies of originally signed documents.

The certification clause in Form AOC-4 keeps the certifying professional responsible for verifying that attachments are correctly signed and compliant with the law.

Response of the Auditor

The Respondent stated that:

- There were no statutory guidelines mandating verification of original signatures in the uploaded copy.

- The shortcoming in filing Form AOC-4 was curable and did not lead to professional misconduct.

- The omission was an oversight resulting from dependence on MCA’s instruction kit.

In the hearing, the auditor considered that the documents were submitted without affixing the original signatures.

Findings of the Disciplinary Committee

ICAI Disciplinary Committee stated that:

- The prerequisite to upload duly signed documents is statutory and mandatory.

- A certifying professional is obligated to ensure compliance with applicable legal provisions.

- The appeal that the instruction kit did not require signature verification is not a valid justification.

- The auditor failed to practice due diligence in certifying the form and attachments.

Thereafter, the committee sees that the member was guilty of Professional Misconduct under Clause (7) of Part I of the Second Schedule to the Chartered Accountants Act, 1949, which pertains to failure to exercise due diligence or gross negligence in professional duties.

Reprimand Issued by ICAI Disciplinary Committee

Acknowledging facts and situations of the case, the Committee ordered that CA. Rakesh Kant Khandelwal (M.No. 072653), Faridabad, be charged u/s 21B(3)(a) of the Chartered Accountants Act, 1949.

The order specifies the significance of robust compliance in e-filings and repeats that certification responsibilities extend to verifying the authenticity and completeness of attached documents.

Compliance Lessons for Professionals

The ruling acts as a reminder to CAs that:

- Certification of MCA forms brings a statutory responsibility.

- Due diligence comprises verifying that scanned attachments comprise actual signatures.

- Procedural lapses in electronic filings can draw disciplinary action.

The stance of ICAI has been supported by the decision to maintain professional norms and accountability in corporate compliance filings.

Read the ICAI Order