What is AOC 4 Form in MCA?

Financial statements are the source on which the Board of Directors and shareholders can evaluate the performance of a company. MCA form AOC 4 is for filing the company’s financial statement for every financial year with the Registrar of Companies. The company is responsible for duly furnishing the form within 30 days of its Annual General Meeting.

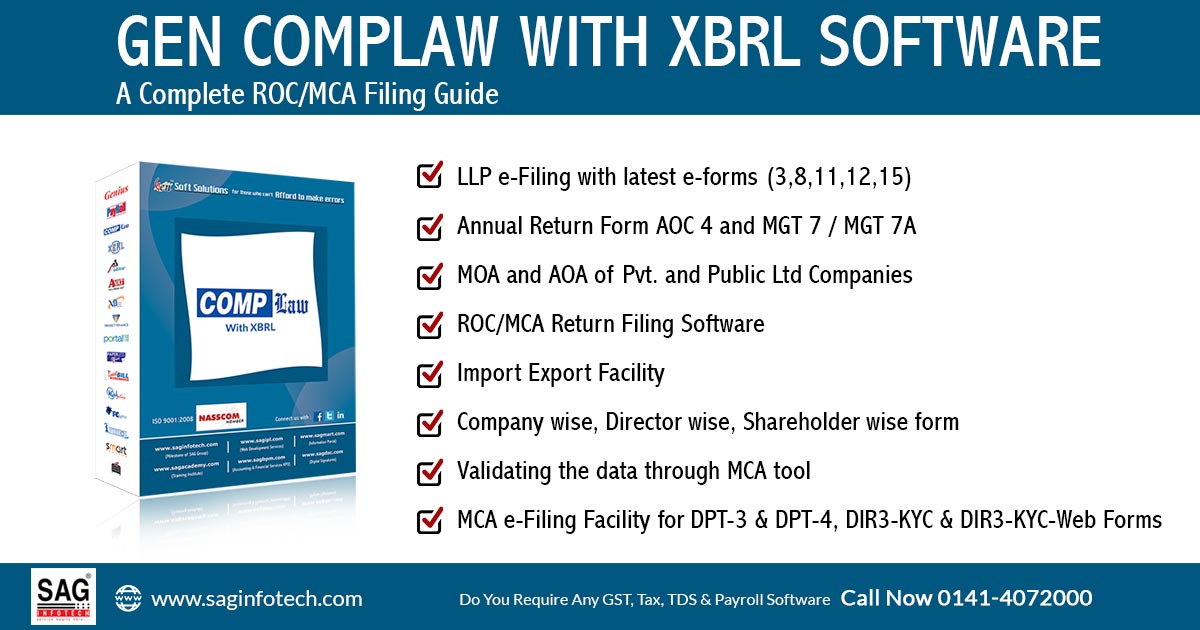

File AOC 4 Form Via Gen CompLaw Software, Get Demo!

- What Documents are Needed

- Guidelines to Follow

- Due Dates of Form AOC 4 Filing

- Who Needs to File

- Filing Fees for AOC 4 Form

- Penalties on Delay

- AOC 4 General Queries

What Documents are Needed with Form AOC 4?

- Balance Sheet with its Notes

- Profit and Loss Statement with its Notes

- Cash Flow Statement.

- Statement of Change in Equity.

- Reports from the Auditor

- Reports from the Board

- Corporate Social Responsibility Report, if Any

- Statement of Subsidiaries in Form AOC-1, if Any

- Other Relevant Documents, if Any Required

In the case of other than the small company and OPC, a certified professional is required i.e. practising Company Secretary (CS) or Chartered Accountant (CA). for Filing form AOC-4

Guidelines to Follow While Filing the AOC 4 Form

As per the Companies Act 2013, all the registered Companies in India need to furnish Form AOC 4 for every financial year. Any failure or delay in filling out the form may attract fines/penalties for the company

Directions for Filing Company Annual Returns & Annual Accounts

- The company must appoint and authorise auditors for the audit of the financial statements.

- As per the Companies Act, the directors, with the help of other key officials, have to prepare a board report.

- In the Board Meeting, the Financial Statement and the Board report have to be approved.

- The financial statement shall be framed after the conclusions of the Annual General Meeting (AGM). After all, shareholders’ approval is the ultimate requirement for accepting financial statements.

Read Also: Know the Due Dates of ROC Return Filing Forms

Due Dates of Form AOC 4 Filing for FY 2025-26

The AOC 4 form is to be filed by 29th October 2026 or within 30 days from the annual general meeting for the FY 2025-26; therefore, it is mandatory to file the form before the due date arrives. Also, there is a provision of a penalty if the AOC 4 e-form is missed.

It is to be noted that the AOC 4 e-form is to be filed within 30 days from the conclusion of the AGM, in the case of OPC, within 180 days (27th September 2026) from the end of the financial year.

| E-FormYearlyE-Form | Purpose of Form | Periodicity | Last Date to File | Remark |

|---|---|---|---|---|

| AOC-4 | Filing of the Financial Statement of the Company | Yearly | 29th October 2026 | If the AGM of the Company is held on 30th September 2026 |

Who Needs to File AOC 4 Form XBRL?

There are certain parameters for the applicability of filing a financial statement in XBRL format. Here is the list of companies that are required to file the AOC 4 form XBRL for every financial year:

- The companies have paid capital of Rs. 5 Crores or more.

- Companies with an annual turnover of Rs 100 Crores or more.

- Companies listed on the stock exchange in India and their subsidiaries.

Filing Fees for AOC 4 Form

The fee structure for filing the AOC 4 form is based on the authorised capital of the company:-

| Authorized Capital | Fee Per Document |

|---|---|

| Less than 1,00,000 | INR 200 per document |

| 1,00,000 to 4,99,999 | INR 300 per document |

| 5,00,000 to 24,99,999 | INR 400 per document |

| 25,00,000 to 99,99,999 | INR 500 per document |

| 1,00,00,000 or more | INR 600 per document |

Similar: ADT-1 Form Due Date and E-Filing Documents

Penalties for Delay of E-Form AOC 4

From 01st July 2018, the late filing of Form AOC-4 shall attract a penalty of Rs. 100 per day till the date of filing.

As per the Company’s fresh start scheme, the 2020 AOC-4 for previous years can be filed without paying late fees till 30th September 2020

Earlier, there was a penalty slab for late filing of E-form AOC-4:-

- Delay up to 30 Days – 2 times the normal filing fees

- More than 30 days and up to 60 Days – 4 times the normal filing fees

- More than 60 days and up to 90 Days – 6 times the normal filing fees

- More than 90 days and up to 180 Days – 10 times the normal filing fees

- More than 180 days and up to 270 Days – 12 times the normal filing fees

Apart from penalties, there are even worse consequences for the delay; the Directors, Managing Director or Chief Financial Officer of the company may get convicted and sent to jail or may be bound to pay the sum of a fine as per the provisions of the Companies Act 2013.

Note: “Stakeholders may note that the Financial Statements of Producer Companies shall be required to be filed with the Registrar within sixty days of the date on which the annual general meeting is held as per section 378ZA(10) of the Companies Act, 2013. It is at this moment informed that additional fee logic changes in AOC-4 forms will likely be deployed in the next week to enable filing within 60 days with a Normal fee instead of 30 days. Stakeholders may kindly note and plan accordingly.”

Related to Approval and Certification

The data presented in the form needs approval from the director, manager, CFO and CEO. Given that the information is accurate and in compliance with the law. The E-form AOC 4 shall be digitally signed by one of the following authorised people:

- Director

- Manager

- CFO

- CEO

A statement confirming the authenticity of the information entered in the form is required by a full-time practice CA or CS. Such a professional shall also digitally sign the document and affirm that the information is verified by them. The membership number and the Certificate of Practice number have to be mentioned in the form.

General Queries on Filing Form AOC 4

Q.1 – What is an AOC 4 Form?

An AOC Form is a Form with which the Financial Statements of a company are filed to the Registrar of Companies (ROC) every year for each Financial Year. All the attachments, financial statements are uploaded along with e-AOC 4 Form. The documents and financials statements should be duly signed as per the provisions of the Companies Act 2013.

Q.2 – Who needs to file AOC 4? Which companies must file their financial statements in XBRL?

Every public and private company needs to file e-Form AOC4. Companies which need to file their Financial Statements using XBRL under section 137 of the Companies Act, 2013 for F.Y. starting on or after 1st April 2014, are as follows:

- Companies listed under any Stock Exchange(s) in India and their India-based subsidiaries;

- Companies having paid-up capital of INR 5 crore or above;

- Companies having a turnover of INR 10 crore or above;

- Companies which were still registered under the Companies Rules, 2011 which mandates the Filing of Documents and Forms in XBRL

Q.3 – What is the due date for file AOC 4 Form?

Under normal circumstances, the due date for filing AOC 4 is 30 days from the date of AGM held. For example: If the AGM is held on 30th October, the Form AOC 4 should be filed before October 30th of the suitable Assessment year.

Q.4 – Which companies are exempted from filing financial statements with Form AOC-4 in XBRL?

- Non-Banking Financial Companies and companies engaged in Power Sector, Banking, Insurance are exempt from filing financial statements with Form AOC in XBRL

- For Non-Banking Financial Companies AOC-4 NBFC is required to be filed which has been introduced on 20.02.2020

- Companies which falls under XBRL Amendment Rules, 2017 need to file financial statements into XBRL

Q.5 – What is form AOC 4 and MGT 7?

Form AOC 4 and MGT 7, both the Forms are mandatory to be filed by every Company registered under the Companies Act, 2013 of the Companies Act, 1956. However, e-Form AOC-4 is used to file the Financial Statements of the company along with Directors Report and other required attachments including Annual Return. e-Form MGT-7 is used to file the Annual Return of the company. e-Form AOC-4 and MGT-7 should be filed within the period of 30 and 60 days, respectively from the date when the Annual General Meeting (AGM) is held.

Q.6 – What is the Penalty for Late Filing and non-filing of Form AOC 4?

Form AOC-4 should be filed before the stipulated deadlines otherwise the penalty INR 100/day from the due date is levied. However, the highest limit of penalty is INR 10 lakhs. It may also result in disqualification of Director of a Defaulting Company if this form has not been filed for 3 consecutive years. Moreover, it may also lead to imprisonment of company’s Chief Financial Officer, Managing Director and Directors for a period which may last up to 6 months or with fine of 1 to 5 lakhs or more.

Delayed filing of this Form also results in higher government fee for filing Form AOC-4.

The government fee extends in the following manner:

- Around 30 Days – 2 x normal filing fees

- Higher than 30 days & > 60 Days – 4 x normal filing fees

- Higher than 60 days & > 90 Days – 6 x normal filing fees

- Higher than 90 days & > 120 Days – 8 x normal filing fees

- Higher than 120 days & > 180 Days – 10 x normal filing fees

- Higher than 180 days & > 270 Days – 4 x normal filing fees

As per Company fresh start scheme 2020 Aoc-4 for previous years can be filed without paying late dees till 30th September 2020

Q.7 – Does Form AOC 4 need to be certified? If yes, by whom?

Yes, Form AOC 4 needs to be certified in case of other than small companies or OPC. It should be certified by a full time practising Chartered Accountant/Cost Accountant/ Company Secretary.

Q.8 – What is the meaning of certification of Form AOC 4?

Certification of Form AOC 4 refers to the declaration by the full CA, CS or cost accountant practitioner that all the given information and attached documents are true, complete, verified and compliant with the law. The same certification by Manager/Director/Secretary/CFO/CEO is also needed wherein they declare that the information furnished in the Form is true, correct and complete as per their knowledge.

Q.9 – What are the details to be filed with Form AOC-4?

Company’s general details such as Corporate Identity Number (CIN); Details about its director/s, manager, CEO, CFO and all who signature company’s financial statements and Board Report; Details about Auditor and SRN of ADT-1 etc should be filed with Form AOC-4 along with company’s financial parameter, P&L account, Balance sheet, share capital, Corporate Social Responsibility (CSR) reporting and Acknowledgement of related party transaction.

Q.10 – What is the government fee for filing AOC-4?

The Government fee for the submission of Form AOC-4 on or before the deadline is mentioned here:

| Company’s Nominal Share Capital | Government Fee |

|---|---|

| Upto INR 1 lakh or no nominal share capital | INR 200 |

| Between INR 1 lakh & INR 5 lakhs | INR 300 |

| Between INR 5 lakhs to INR 25 lakhs | INR 400 |

| Between INR 25 lakhs to INR 1 crore | INR 500 |

| More than INR 1 crore | INR 600 |

How to File AOC 4 Form Return By Gen Complaw Software

MCA AOC-4 Form in PDF Format

Gen Complaw Software Features

Please confirm digital signatures of CA, Company Secretary etc are not required on Forms- AOC-4 and MGT-7A in case of small pvt Ltd companies.

Dear sir my last AGM completed please calculate my future complete Penalty and ROC filling

Kindly calculate fees from MCA fee calculator

Thank you for the nice article.

I have a related question for you.

As I was unaware that there was KYC-3-DIR to be filed for Company Directors for the year 2019, the MCA site is asking for Rs 5000/- penalty.

I have my mobile / email with MCA, however, no intimation or notice has been sent by them.

Is there a way we can request MCA for a Late Fee Waiver.

Regards

Arabinda

There is no provision for waiver of fees. For further clarification please contact the MCA department.

Hi,

Please check your DIN now, your disqualification must be removed by now,