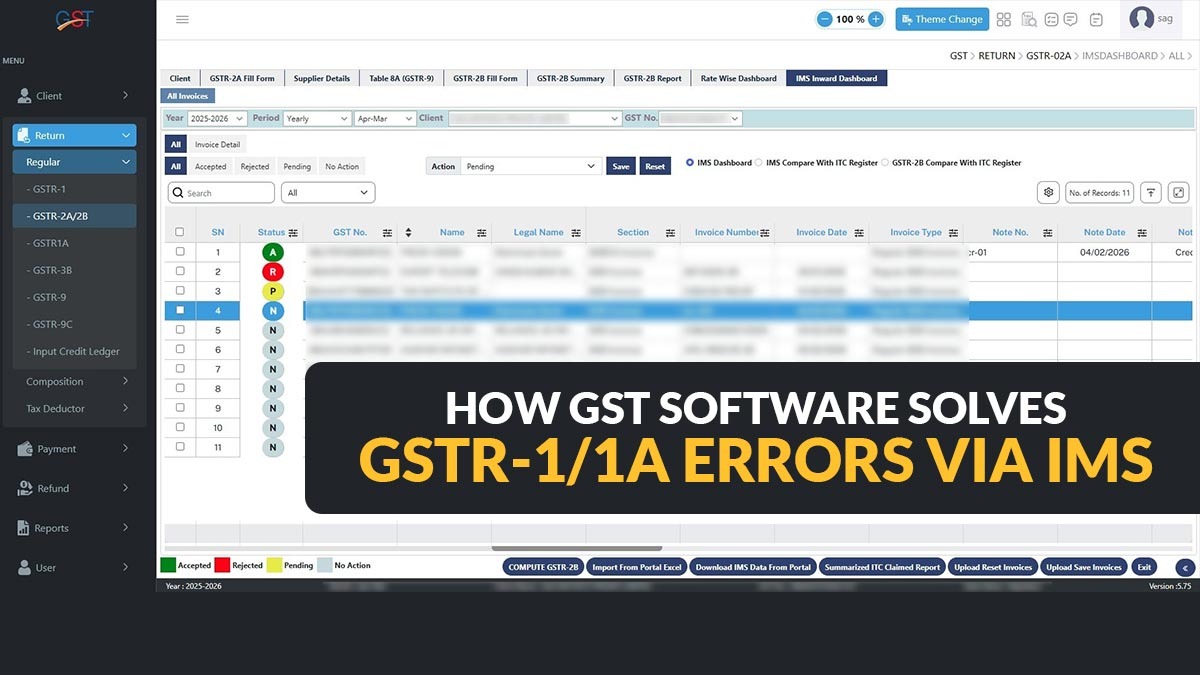

In India, filing appropriate GST returns is crucial for businesses. However, issues may arise with the GSTR-1 and GSTR-1A forms. These forms support the reporting of sales of goods and services and affect the amount of tax credit that customers can claim. Small mistakes, such as errors in invoice numbers or incorrect buyer information, can cause problems that may result in notices from tax authorities and disputes over tax credits.

The GST portal, to address such problems, rolled out the Invoice Management System (IMS), which provides an appropriate way to determine and fix errors. An advanced GST software secures an important role in utilising IMS to rectify mistakes in GSTR-1 and GSTR-1A perfectly.

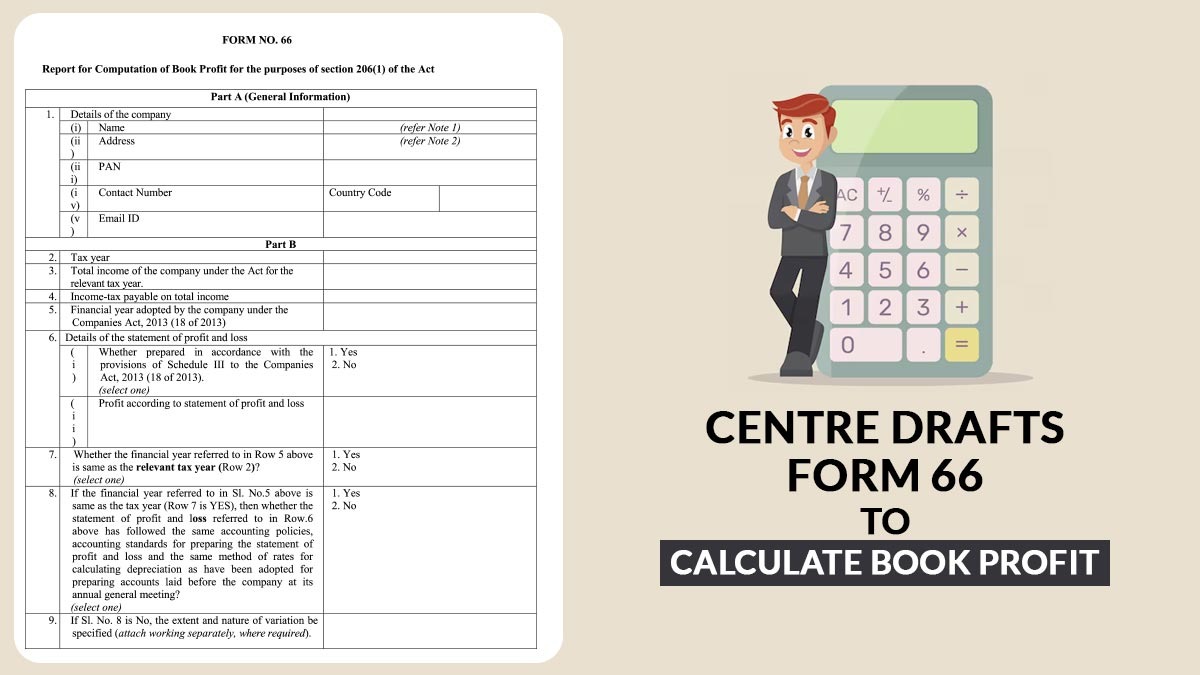

Understanding GSTR-1, GSTR-1A, and IMS

GSTR-1 is a form that businesses fill out monthly or quarterly to report their sales. If any error occurs in this return, then it can impact the way tax credits are processed for the buyers. Sellers under GSTR-1A are permitted to make corrections on invoices shown by buyers.

The Invoice Management System is a tool made to rectify communication between sellers and buyers for invoices. It assists buyers in accepting, rejecting, or requesting changes on invoices, making the process transparent.

Common Errors in GSTR-1 and GSTR-1A

It is crucial to understand the types of errors businesses encounter, along with:

- Incorrect GST Identification Number (GSTIN) for the buyer

- Wrong dates or numbers on invoices

- Mismatched tax values

- Duplicate or missing invoices

- Incorrect place of supply

- Wrong tax rates

Much time is consumed when errors are determined and fixed manually, which can cause mistakes for businesses that manage many invoices.

How GST Software Supports Fixing Errors

GST software facilitates the process of rectifying GSTR-1 and GSTR-1A errors by automating tasks and integrating IMS actions directly into the filing process.

Automated Invoice Reconciliation

The software verifies sales invoices against data on the GST portal. If an invoice is shown as rejected or pending by the buyer, then it shows the problem, streamlining the process for businesses to determine the main problem.

Real-Time Error Identification

Advanced GST software validates the information of invoices as it is entered, assuring that everything is appropriate. When an invoice has a problem, the software determines what needs to be fixed.

Easy Amendments with GSTR-1A

After finding the errors, the software permits users to make rectifications in GSTR-1A. Any revisions incurred are synced with the GST portal to ensure everything is compliant.

Bulk Rectifications

For businesses that deal with multiple invoices, software can support correcting multiple invoices at once with the use of Excel or JSON files. The same features save much time and effort.

Tracking Changes

The software maintains a record of all the revisions incurred, making it simpler for businesses to track what has been revised. The same is valuable for audits or reviews by tax authorities.

Lowering Disputes

By promptly addressing invoices shown via IMS and rectifying the errors in GSTR-1/1A, the suppliers can help ensure that buyers obtain precise invoice data. The same decreases the risk of tax disputes and supports clients in getting their tax credits seamlessly.

Saving Time and Costs

Manually fixing errors can result in missed due dates and additional compliance costs. GST software automates such repetitive chores, ensuring timely submissions and reducing the overall compliance costs for businesses.

Staying Compliant with Updates

Because of frequent revisions in the GST norms, it is difficult for businesses to align with them. The GST software gets updated regularly to match the changes, supporting the businesses to keep compliance without requiring them to track everything.

Closure: The Invoice Management System has rectified the way businesses resolve invoice discrepancies under GST. Businesses require more powerful GST software to benefit from this system. With the automation of procedures, software eases the rectification of errors and makes compliance simpler and more efficient.