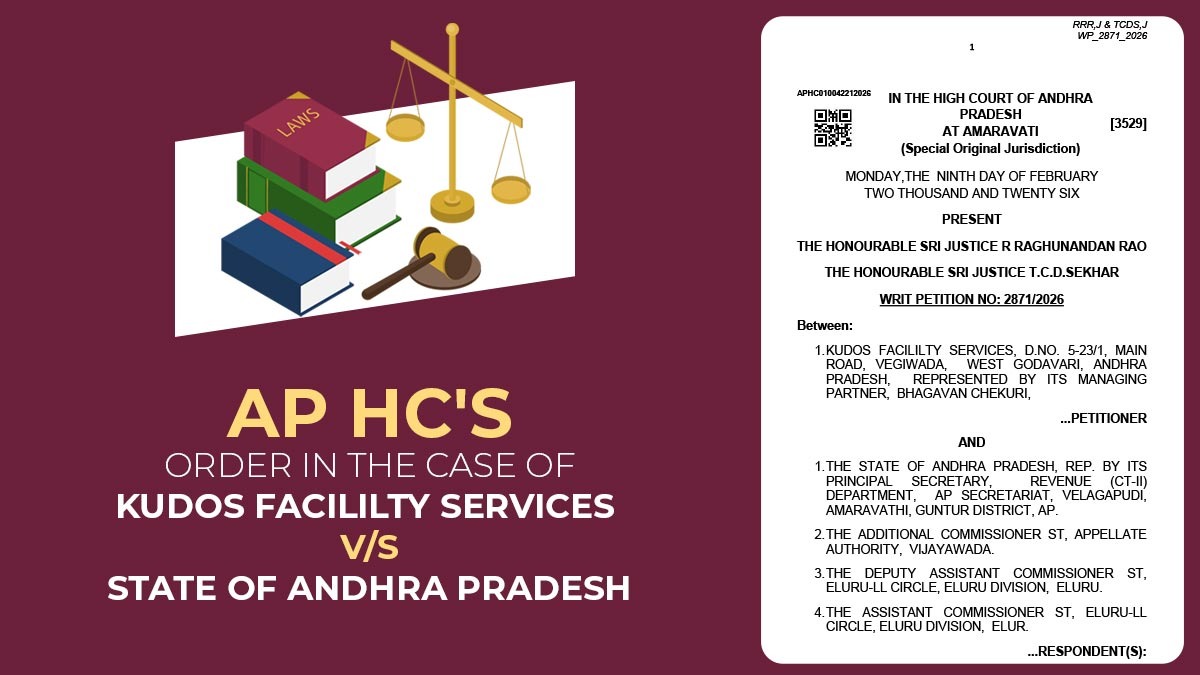

The Gujarat High Court stated that courts cannot condone delays in filing GST appeals after the statutory period, even while exercising writ jurisdiction under Article 226 of the Constitution.

A writ petition filed by a partnership firm has been dismissed by the bench of Justice A.S. Supehia and Justice Pranav Trivedi after finding that the delay surpassed the condonable limit quoted under law.

On March 21, 2024, a demand order was issued u/s 74(5) of the CGST/SGST Act, before the applicant, who is a partnership firm registered under GST, requiring payment of 1,98,720 towards tax, including interest and penalty, taking the total demand to 5,03,768.

Applicant cited that notices for personal hearings were uploaded on the GST portal with scheduled dates in September 2025, but no separate communication was sent through email or post, resulting in their absence from the hearings.

The firm specified that the appellate authority denied the appeal, noting that it does not have the authority to condone delays after the regulatory period. HC said that the applicant submitted the appeal u/s 107 of the GST Act post a delay of 284 days.

The applicant gave a reason for the delay, in which it cited that it does not have much computer knowledge and it relied on a part-time accountant whose role was limited to keeping accounts and filing GST returns, and thus was clueless about the tax determination order (DRC-07) that had been issued.

The Court discovered the explanation provided is not convincing, noting that in the present digital era, it is hard to acknowledge that the taxpayer and their accountant were unaware of how to verify orders on the GST portal.

The bench, referring to Section 107(4) of the GST Act, suggested that an appeal must be filed within 90 days, with an additional condonable period of only 30 days if an adequate reason is shown. Once this extended period has passed, neither the appellate authority nor the High Court can extend the limitation further.

The Court stressed that tax statutes function under stringent timelines, and any relaxation of these timelines could have serious consequences for revenue administration. The bench referenced the decision of the Apex Court in Assistant Commissioner (CT) LTU, Kakinada v. Glaxo Smith Kline Consumer Health Care Ltd., which established that High Courts should not overlook legislative intent by accepting cases filed outside the maximum limitation period.

Read Also: Gujarat HC Dismisses Plea Against GST Registration Cancellation and Appeal Rejection Due to Delay

The Court repeated that although writ jurisdiction is wide, it cannot be exercised incorrectly with statutory provisions governing limitation. It specified earlier judgments highlighting that when a special statute specifies a definite limitation period, courts should respect that mandate as a matter of public policy.

HC quoted that the taxpayers are expected to stay alert for proceedings and regularly validate the orders uploaded on the GST portal. Even if a correct explanation were available, the Court cannot condone delay after 120 days in total, because it would dilute legislative intent.

As the applicant had earlier taken the regulatory remedy of appeal, the Court refused to analyse the legality of the original demand order. It said that the dispute engaged factual problems instead of jurisdictional errors or breaches of natural justice.

The Court concluded that it does not have the power to condone the delay; therefore, it dismissed the writ petition, confirming that the remedy of appeal is a creature of statute and should be exercised within the said timelines.

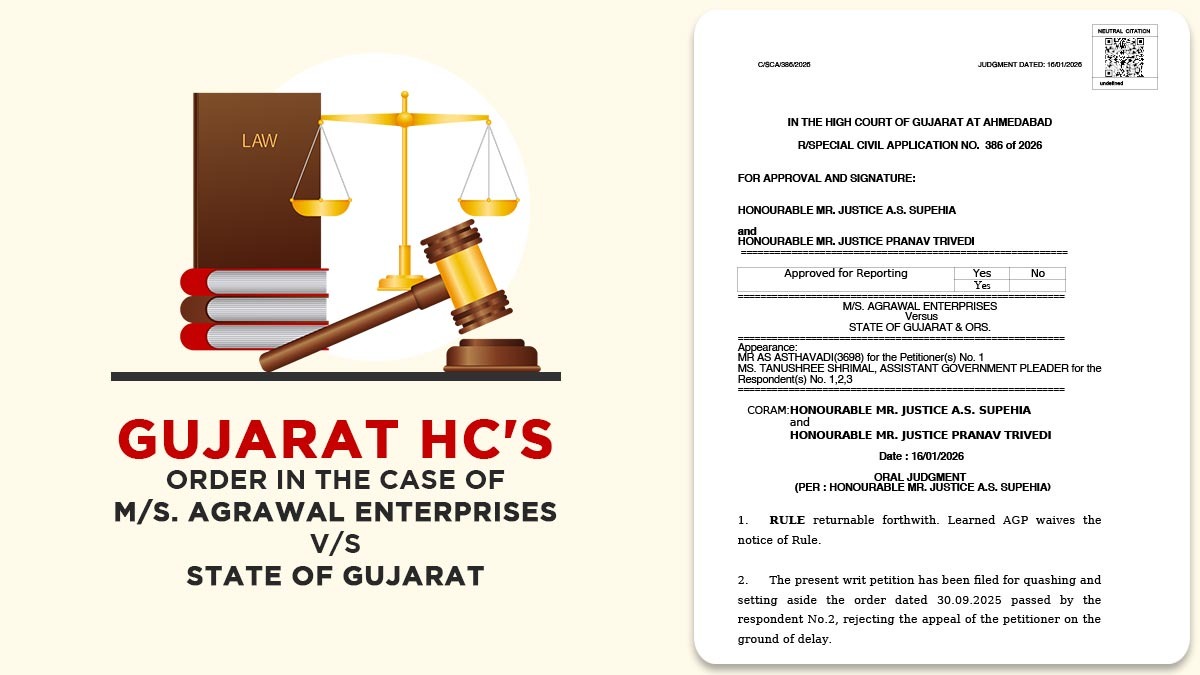

| Case Title | M/S. Agrawal Enterprises vs. State of Gujarat |

| Case No. | R/Special Civil Application No. 386 Of 2026 |

| Counsel for the Petitioner | As Asthavadi |

| Counsel for the Respondent | Tanushree Shrimal |

| Gujarat High Court | Read Order |