The legal proceedings began when authorities examined the business practices of M/s C.G. Foods. The investigation was triggered by a complaint alleging that the company failed to reduce prices following a GST rate cut intended to benefit consumers purchasing instant noodles.”

The GST rate for these goods was lowered from 18% to 12%, from November 15, 2017, as per Notification No. 41/2017–Central Tax (Rate). The Director General of Anti-Profiteering (DGAP) conducted an investigation covering the period from November 15, 2017, to December 31, 2018.

As per the company, the reason for the increase in cost is due to higher input, packaging, fuel, and freight costs; MRPs were not revised due to market competition.

Important: What are Anti-Profiteering Rules in GST India?

Even after a decrease in GST rate, it surged the base prices of various SKUs, neutralising the tax benefit to consumers. The DGAP specified total profiteering of Rs. 90,90,310 across multiple States.

The issue was whether C.G. Foods violated Section 171 of the CGST Act, 2017, by increasing base prices after the GST rate reduction and thereby failing to pass on the commensurate benefit to consumers.

The DGAP’s findings have been kept by the GST Appellate Tribunal and validated the profiteering of Rs. 90,90,310 for the period from 15.11.2017 to 31.12.2018.

The Tribunal ruled that although the respondent provided proof of increasing costs, like increases largely associated with periods before the GST rate reduction, and did not justify the contemporaneous increase in base prices. The statutory presumption of profiteering u/s 171 remained unrebutted.

The Tribunal asked the respondent to deposit the profiteered amount into the Consumer Welfare Fund of the Centre and the States in equal proportion. And no levying of interest or penalty was charged, as the pertinent provisions for the charge of interest and penalty were rolled out after the period under investigation. Therefore, the appeal was disposed of.

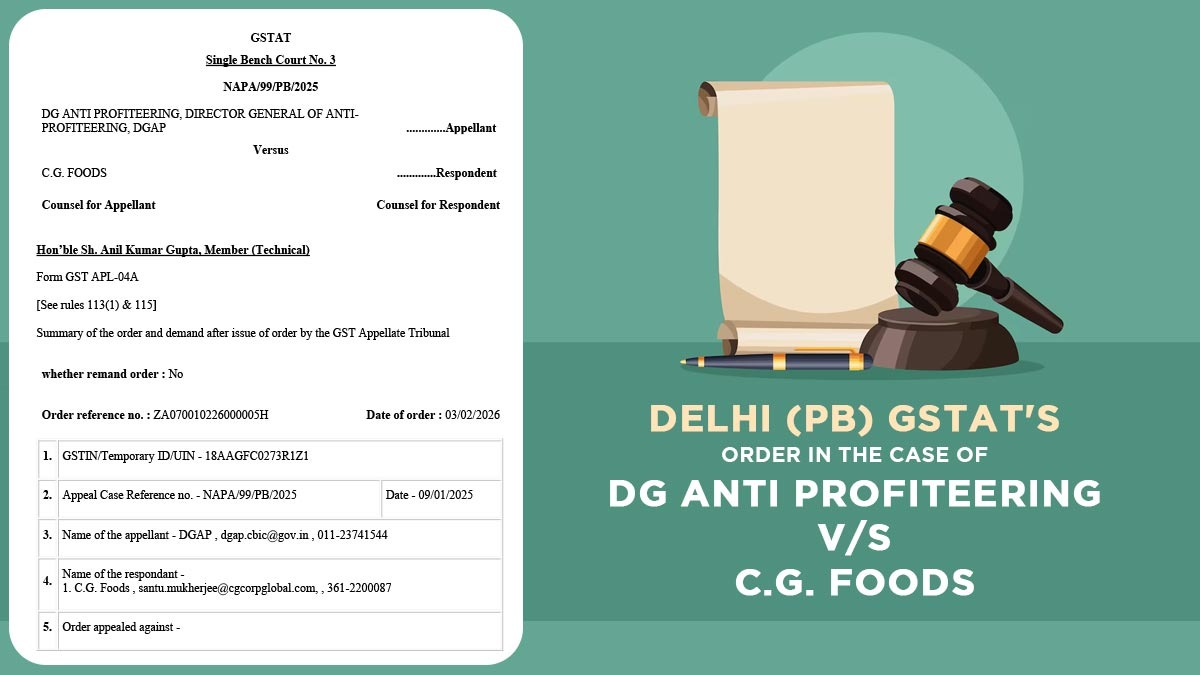

| Case Title | DG Anti Profiteering vs. C.G. Foods |

| Order No. | NAPA/99/PB/2025 |

| Delhi (PB) GSTAT | Read Order |