The Andhra Pradesh High Court has ruled against a lawful challenge to a GST assessment and the procedure to recover outstanding taxes. The petition argued that the official assessment did not contain a Document Identification Number (DIN), and that earlier notices sent to the assessee were not signed. However, the court decided to dismiss the petition.

The Division Bench, comprising Justice R. Raghunandan Rao and Justice T.C.D. Sekhar held that a unique Reference Number (RFN) generated by the GST portal upon electronic issuance serves as sufficient authentication. Consequently, the absence of a separately recorded Document Identification Number (DIN) does not render the proceedings invalid. The appeal has been rejected by the bench and upheld the actions of the tax authorities, quoting unexplained delay and delay on the applicant’s end.

The applicant, a registered GST dealer involved in furnishing manpower services to APSRTC, was liable for assessment proceedings for the tax duration 2019. The department, after noticing discrepancies in the return furnsihed a pre-show cause notice in Form GST DRC-01A, followed by an SCN in Form GST DRC-01, proposing tax, interest, and penalty.

Since no objections were filed, the Assessing Authority issued an assessment order on 12 June 2024 using Form GST DRC-07. The petitioners’ statutory appeal was subsequently rejected in July 2025, after which recovery proceedings were initiated through an attachment notice issued in Form GST DRC-16 under Section 79 of the CGST Act.

Dissatisfied applicant approached the HC under Article 226 of the Constitution. The main issue before the Court was that the assessment order does not secure a Document Identification Number (DIN) as needed under CBIC Circular No. 122/41/2019- GST dated 5 November 2019. As pre-show cause and show cause notices did not have physical or digital signatures, therefore, it was allegedly not valid.

The Bench rejected the argument that the assessment and recovery proceedings were arbitrary and void, noting that the assessment order clearly included a system-generated Reference Number (RFN), which is automatically assigned by the GST portal when an order is digitally signed and uploaded.

The Court repeated its earlier rulings, keeping that GST notices and orders are issued electronically via the portal and cannot be kept unless digitally signed by the issuing authority. RFN presence establishes that a digital signature has been affixed. DIN and RFN are portal-generated identifiers, and the absence of the term in the printed order does not invalidate the proceedings.

On the earlier rulings of the same HC, the Bench relied, which specified that procedural amendments in the GST portal and standardisation of digital signatures should be acknowledged while analysing these challenges.

Beyond denying the technical objections, the Court determined that the writ petition was obligated to be dismissed based on the fact of unexplained delay. In June 2024, the assessment order was passed and uploaded on the portal on the exact day.

Read Also: AP HC Dismisses Plea Against GST Assessment Order, Holds Portal Notices as Valid Service

Previously, the applicant had participated in proceedings by filing objections to an earlier notice, showing complete awareness of the assessment procedure. No effective explanation was proposed for the late filing of the statutory appeal or for approaching the High Court only after attachment proceedings were initiated in December 2025.

The Court said that the applicant’s actions fell under the doctrine of laches, which denied them discretionary relief under Article 226. The Andhra Pradesh High Court found no merit in any of the arguments presented and dismissed the writ petition.

It upheld the validity of the assessment and recovery proceedings and chose not to interfere. No order was passed as to costs, and all due applications were closed.

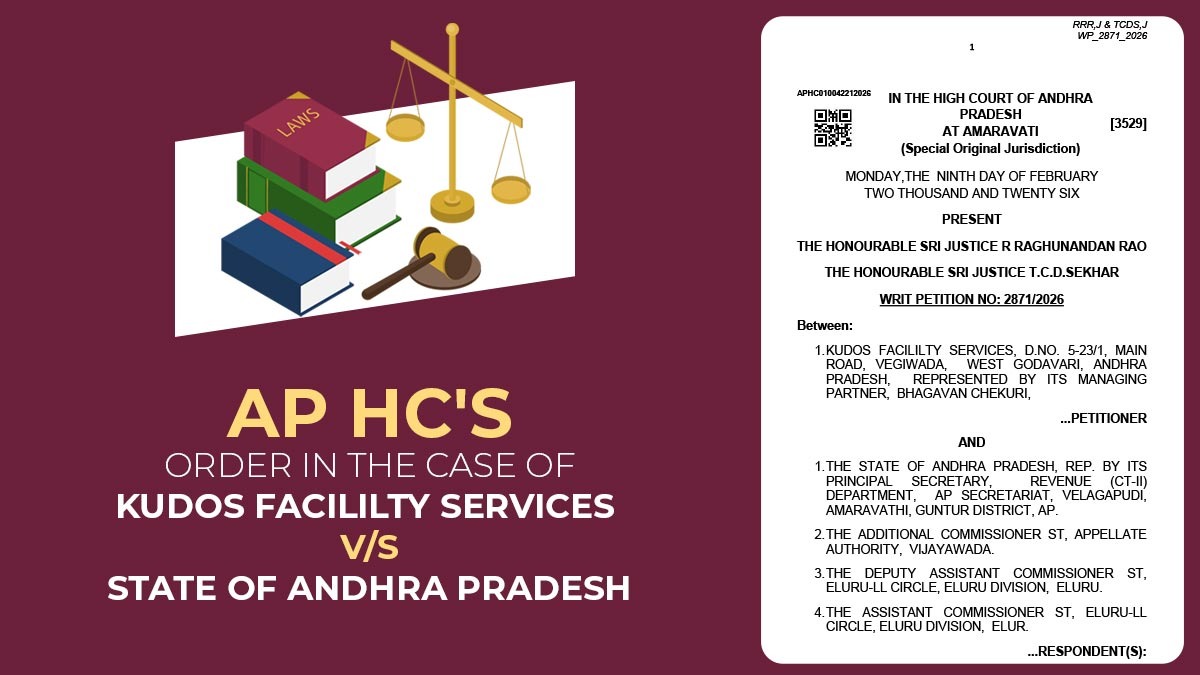

| Case Title | Kudos Facililty Services vs. State of Andhra Pradesh |

| Case No. | Writ Petition No: 2871/2026 |

| Counsel for the Petitioner | M Ravindra |

| Counsel for the Respondent | GP for Commercial Tax |

| Andhra Pradesh High Court | Read Order |