The Madurai Bench of the Madras High Court has determined that a best judgment assessment issued to a non-filer under Section 62 of the Tamil Nadu Goods and Services Tax Act, 2017, is automatically withdrawn upon the submission of a valid return by the registered taxpayer, regardless of whether this submission occurs beyond the stipulated 30-day timeframe.

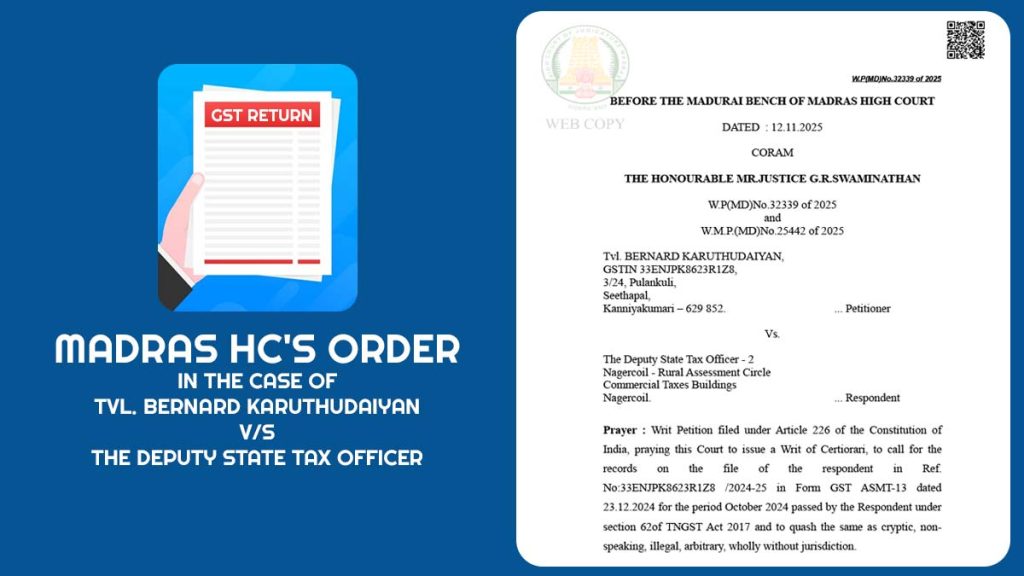

The decision has arrived in a petition submitted via Tvl. Bernard Karuthudaiyan, who contested an assessment order dated 16 October 2024, passed by the Deputy State Tax Officer, Nagercoil Rural Assessment Circle, for the tax period of August 2024.

The applicant has been unable to submit the monthly GST return for August 2024. The same makes the issuance of a GSTR-3A notice concerning non-filing, followed by a best judgment assessment order in Form GST ASMT-13 under Section 62.

Therefore, the applicant submitted the overdue dated 21 November 2024 and approached the HC asking to quash the assessment order based on the fact that the order was cryptic, arbitrary, and without jurisdiction.

Concerning the case, Justice G.R. Swaminathan reproduced Section 62 of the Tamil Nadu Goods and Services Tax Act, 2017, which deals with the assessment of non-filers. Sub-section (2) establishes that if a registered person provides a valid return within 30 days of the assessment order issued u/s 62(1), the assessment “shall be deemed to have been withdrawn.

Multiple judicial precedents have held the 30-day timeline to be directory, not mandatory, the court stated. Thus, despite the late return filing by the applicant after the specified duration, the statutory results still operated.

The court stated that the tax department can validate the returns submitted by the applicant, and if there are discrepancies or short payments determined, then a fresh show-cause notice may be issued.

Also, any amount collected earlier from the applicant needs to be adjusted toward future tax liabilities. Thereafter, the attachment placed on the bank account of the applicant stands lifted.

As per that, the writ petition was permitted.

| Case Title | Tvl. Bernard Karuthudaiyan vs. The Deputy State Tax Officer |

| Case No. | W.P(MD)No.32339 of 2025 and W.M.P.(MD)No.25442 of 2025 |

| For Petitioner | Mr.N.Sudalai Muthu |

| For Respondent | Mr.J.K.Jeyaselan, Government Advocate |

| Madras High Court | Read Order |

The Madurai Bench of the Madras High Court has determined that a best judgment assessment issued under Section 62 of the Tamil Nadu Goods and Services Tax Act, 2017, is automatically nullified upon the submission of a valid return by the registered taxpayer. This holds true even if the return is filed after the stipulated 30-day period.