The Kerala High Court ruled that Section 263 of the Income Tax Act, 1961, can be invoked where the Assessing Officer (AO) is not able to address the main issue in the assessment order.

The bench stated that the problem does not appear to have been addressed by the assessing authority when issuing an order under Section 143(3) of the Act. As the assessment order does not appear to have addressed the problem in relation to the competing norms, the authority’s practice under section 263 of the Act was justified.

Section 263 of the Income Tax Act, 1961, allots the Principal Commissioner or Commissioner of Income Tax the authority to revise an order passed by the Assessing Officer.

Justices A. Muhamed Mustaque and Harisankar V. Menon were addressing the problem where the taxpayer, under the provisions of the Income Tax Act, 1961, questions the suo motu revisional measures u/s 263 of the Act as validated via the order of the Income Tax Appellate Tribunal.

In the same case, the taxpayer had two units/divisions – ‘Fertiliser Division’ and ‘Test House Division’, out of which, the Test House Division was sold as a case of ‘slump sale’ with reference to the provisions of Section 50B of the Income Tax Act, 1961.

A return was presented in that manner. Steps were taken under section 143(3) of the Act, and an order dated 20.12.2018, the same was finalised.

Thereafter, a notice u/s 263 of the Act dated 15.10.2020 was issued asking to set aside the assessment order referred to above, to which the taxpayer was asked to submit the objections, placing reliance on the above observations, in support of its claim that proper adjudication has been performed in the case via the assessing authority.

The Commissioner found that the Assessing Officer had not fully investigated all aspects of the case and had only completed the assessment by accepting the position taken by the taxpayer, which was a wrong assumption of facts.

The Tribunal in the impugned order has rejected the appeal against the above-mentioned order. It is in such cases that the captioned appeal is submitted by the taxpayer under section 260A of the Act.

The taxpayer’s contention is with reference to the very invocation of the authority u/s 263 of the Act with reference to the inquiry performed by the assessing authority.

As per the bench the question as to whether the transaction sale is to be regarded as a case of slup sale u/s 50B of the Act qua the provisions of Section 50 of the Act as per which the it is to be deemed as a case of short term capital gain; does not seem to have been addressed by the assessing authority while issuing order u/s 143(3) of the Act.

The bench said that the Assessment Order (AO) refers to specific documents/materials produced by the taxpayer. However, no adjudication is there with reference to the provisions of the regulation in the assessment order.

As the assessment order does not seem to have addressed the problem with reference to the competing norms, exercise of the authority u/s 263 of the Act was justified, the bench said.

The bench in the above has dismissed the appeal.

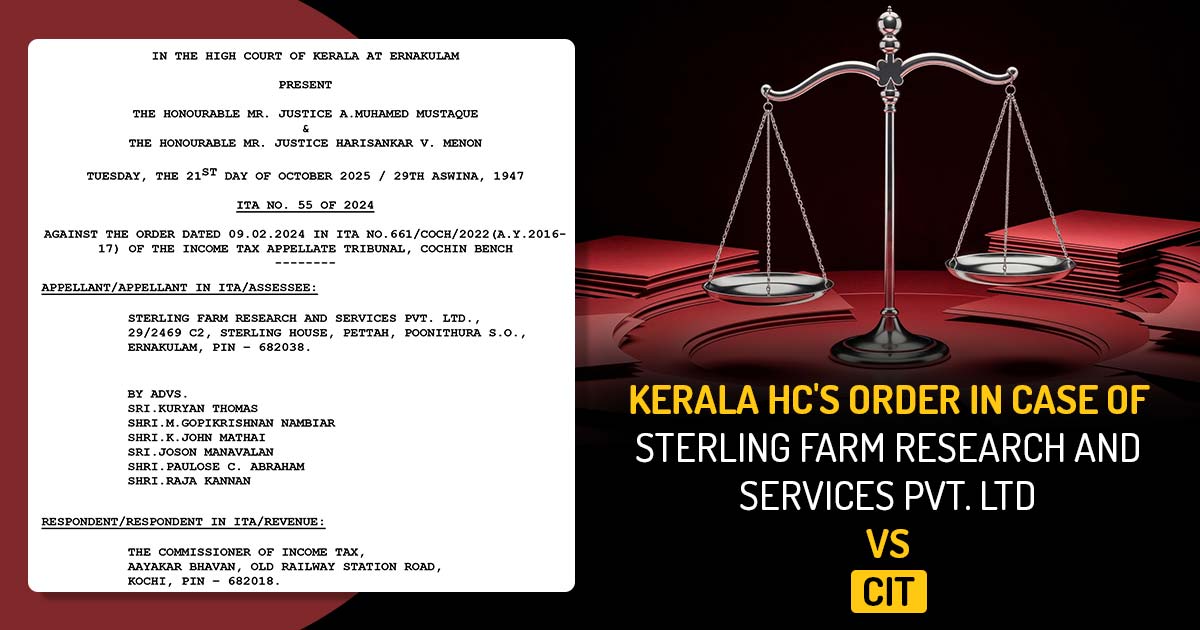

| Case Title | Sterling Farm Research and Services Pvt. Ltd vs. CIT |

| Case No. | ITA NO. 55 OF 2024 |

| For Petitioner | Sri Kuryan Thomas, Shri m.gopikrishnan Nambiar, Shri k.john Mathai, Sri Joson Manavalan, Shri Paulose C. Abraham, Shri Raja Kannan |

| For Respondent | Sri Jose Joseph |

| Kerala High Court | Read Order |