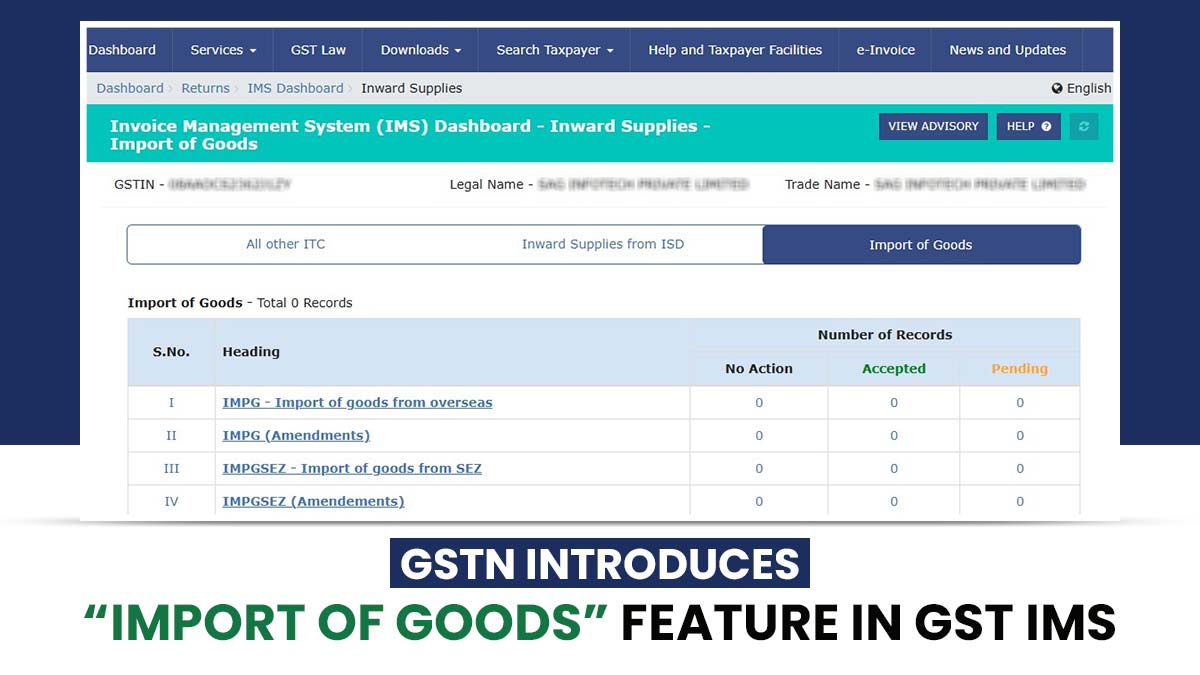

The GST portal has introduced a new section, “Import of Goods,” in its IMS system. Moving forward, when a taxpayer files a Bill of Entry (BoE) for imported items, including those from Special Economic Zones (SEZs), the relevant information will be available in the system.

This upgrade facilitates enhanced management and monitoring of all imported goods from October 2025.

GST, or Goods and Services Tax, is a system where businesses calculate and report the tax they owe. The taxpayer must show the ITC eligibility under the provisions of the law and rules made thereunder.

In cases where the GSTIN in a Bill of Entry has been revised and the previous GSTIN (G1) had taken Input Tax Credit (ITC) earlier on that Bill of Entry, the previous GSTIN must reverse the ITC amount taken on such BoE. Therefore, the entry for reversal of ITC due to the revision in GSTIN in BoE will be exhibited to the earlier GSTIN (G1).

Read Also: How to Compare IMS Data with the ITC Register via Gen GST

Under advisory for addressing the situation where the ITC has already been reversed either partially or fully by the previous GSTIN, an option has been furnished to the previous GSTIN to declare the ITC that ought to be reversed, based on the ITC taken earlier (not surpassing the original value as per the Bill of Entry).

It should be noted that if no action is taken on an individual BoE, then the same shall be considered as deemed accepted and grounded on the measure taken, the GST portal shall generate the draft GSTR 2B for the receiver on the 14th of the subsequent month.

From the October 2024 tax period, IMS was rolled out on the GST portal. It allows the receiver taxpayer to accept, reject, or keep pending individual records uploaded by suppliers through GSTR-1/1A/IFF.

The same operation provides authority to the receiver taxpayers to handle their inward supplies via opting measures on the individual records on the GST portal itself.

According to the GST Network, which serves as the IT backbone of the indirect tax system, the Invoice Matching System (IMS) is an optional feature. Recipients are not required to take any action regarding it. If no action is taken, all transactions within the IMS will be deemed accepted.

It’s important to note that reverse charge entries and import-related entries (which come from the ICEGATE and DGFT portals) will flow directly to Form GSTR-2B and will not be included in the IMS.

This system is designed to help taxpayers match their records or invoices with those issued by their suppliers, ensuring they can avail the correct Input Tax Credit (ITC). Taxpayers can use this feature to easily accept, reject, or hold invoices in the system for later processing, as needed.