The Kerala High Court has issued an important interim order allowing retired Union Bank employees to renew their group health insurance policies without being required to pay the 18% Goods and Services Tax (GST) on the premium amount. This provides significant immediate relief to the pensioners.

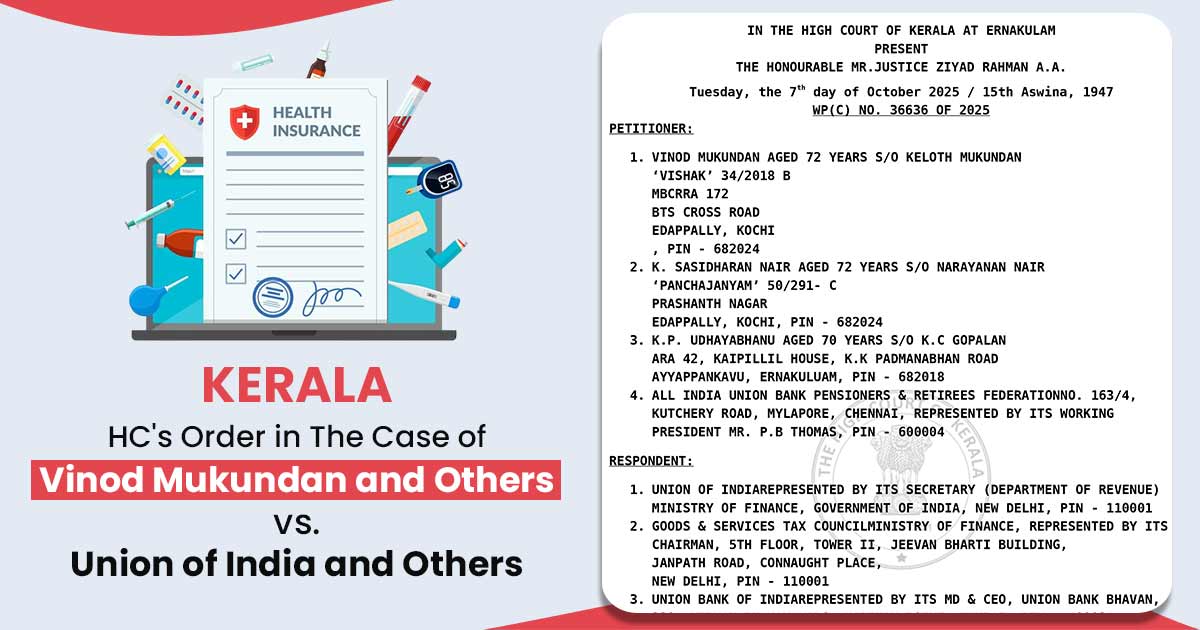

The Court issued the interim order in response to a writ petition filed by Vinod Mukundan and others, including the All India Union Bank Pensioners & Retirees Federation, challenging the 18% GST imposed on group health insurance policies.

While the GST on individual health insurance policies has been fully waived with effect from September 22, group health insurance policies remain taxable. The petitioners have contended that this distinction is arbitrary and discriminatory.

While asking for the reply of the Union Government and the GST Council, Justice Ziyad Rahman A.A ordered:

“In the meantime, the petitioners shall be permitted to renew the insurance policies for the current year, by making the actual premium without the GST amount.”

The Court, this interim arrangement will be subject to the further orders to be passed by this Court.

The National Insurance Company Ltd was also impleaded as a respondent. The case will be heard next on November 17.

Description of Group Health Insurance Policies

Group health insurance policies are health insurance plans provided to a group of people under a single contract, by an employer to their employees or by an organisation to its members. These policies deliver medical coverage for hospitalisation, surgeries, and other healthcare expenses.

As the risk is spread across many individuals, the premium cost is often lower compared to individual health insurance plans. Most cases specified that members are not required to undergo medical tests to be included, and coverage commences upon joining the group.

Group health insurance for employees provides financial protection in medical emergencies with zero or no cost to them, depending on whether the employer fully or partially pays the premium. Employers also benefit by offering health insurance helps in employee retention, improved morale, and a positive workplace environment.

Read Also: GST Impact on the Insurance Sector with Slab Rates

Also, group policies can comprise benefits like maternity coverage, coverage for pre-existing illnesses without a waiting period, and options to extend coverage to family members, making them a worthwhile and inexpensive healthcare solution.

| Case Title | Vinod Mukundan and Others vs. Union of India and Others |

| Case No. | WP(C) NO. 36636 OF 2025 |

| For Petitioner | V.K.Prasad |

| Kerala High Court | Read Order |