A cash credit account cannot be treated as the property of the account holder, which can be considered u/s 83 of the GST Act, the Bombay High Court mentioned.

The Division Bench of High Court Justices Jitendra Jain and M.S. Sonak noted that the phrase ‘including bank account’ follows the phrase “any property” shall be directed to a non-cash-credit bank account. Thus, Section 83 of the MGST Act shall not govern “cash credit account”.

Applicant submitted the petition contesting the action of the department/Respondent No.1, u/s 83 of the Maharashtra Goods and Service Tax (MGST Act), whereby the cash credit account of the applicant with ICICI Bank has been attached provisionally.

Similar: GST Guide of Electronic Cash, Credit, Liability & Negative Liability Register

As per the bench, Section 83 of the MGST Act is for the provisional attachment of ‘any property, including a bank account of the taxable person’. The account holder has the liability of the cash credit account towards the bank to take the loan, and hence, no stretch of imagination cash credit account can be considered as a property of the account holder/Petitioner.

The bench cited that “cash credit account” cannot be deemed as “property” of the account holder, which can be considered u/s 83 of the Act.

While permitting the petition, the bench asked the department to withdraw the letter addressed to the ICICI Bank, Malad (E), Mumbai 97, for provisionally attaching the cash credit account of the taxpayer.

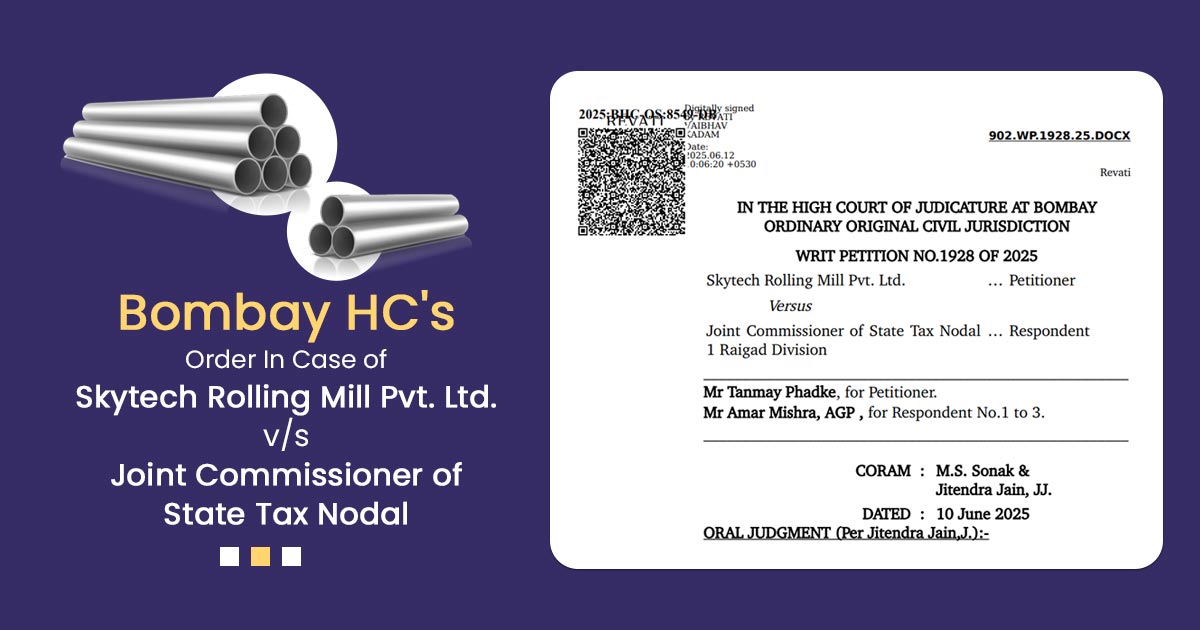

| Case Title | Skytech Rolling Mill Pvt. Ltd. vs Joint Commissioner of State Tax Nodal |

| Case No. | WRIT PETITION NO.1928 OF 2025 |

| For Petitioner | Mr Tanmay Phadke |

| For Respondent | Mr Amar Mishra, AGP |

| Delhi High Court | Read Order |