The Delhi Bench of Income Tax Appellate Tribunal (ITAT) has removed the INR 26.35 lakh addition made to cash deposits during the demonetization period, marking that the Revenue Department had accepted the sales and purchases without rejecting the books of accounts.

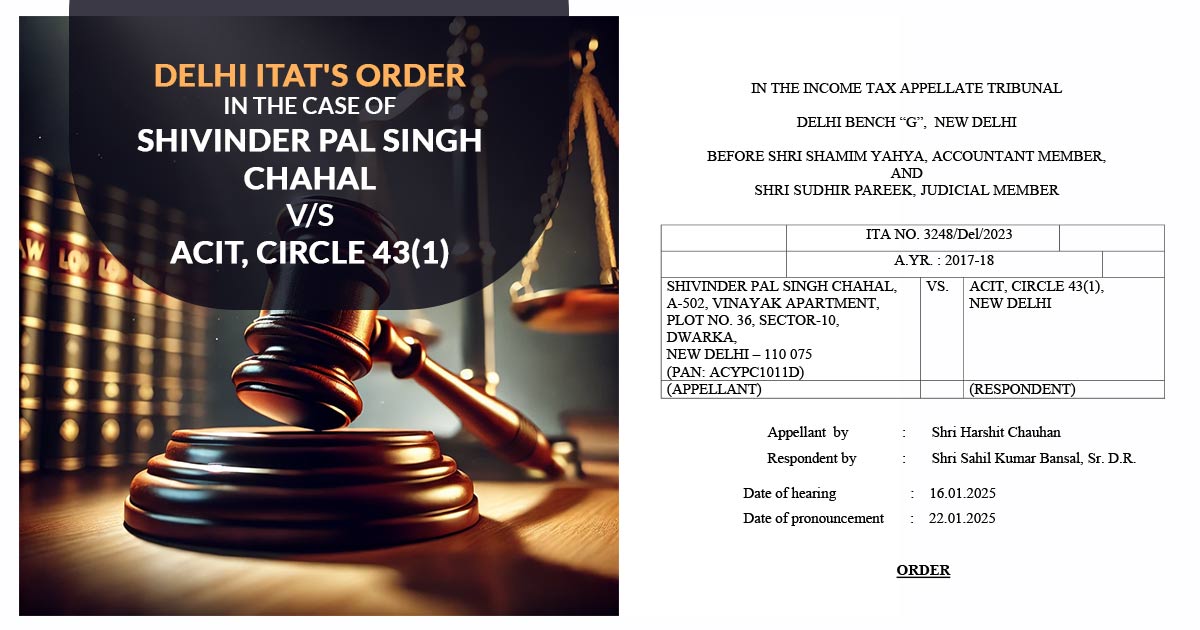

The taxpayer/applicant, Shivinder Pal Singh, appealed against the order on 26.10.2023 for the Assessment Year(AY) 2017-18 passed by the Commissioner of Income Tax (Appeals)[CIT(A)].

The issues involved adding Rs 26,35,000 to the cash deposits made during the demonetization period. The assessing officer discovered that such sales were much higher than in the other periods and added the taxable amount.

The addition was kept by the CIT(A), and the taxpayer appealed to the tribunal, dissatisfied with the CIT(A) order.

Rewrite Title: ITAT Delhi Upholds Deletion of INR 6.80 Crore Addition U/S 69C for Alleged Bogus Purchases

The records are been reviewed by the two-member bench comprising Sudhir Pareek (Judicial Member) and Shamim Yahya (Accountant Member), and marked that the revenue department has accepted the sales and purchases without rejecting the books. As the disallowance was unexplained, it asked for its deletion and permitted the plea on the same issue.

The additional problem engaged in the addition of Rs 7,52,667 because of the distinction in he reported purchases in the ITR and the import export data from the Central Board of Excise and Customs(CBEC). The explanation was been rejected by the AO and incurred an addition, which has been kept by the CIT(A). The taxpayer appealed to the tribunal.

The records are been reviewed by the tribunal, and it was discovered that the difference of Rs. 7,52,667/- in purchases stayed unreconciled because of the absence of a credible elaboration. As the addition was explained, therefore, it kept the order of CIT(A) and dismissed the plea on the same issue.

The filed plea of the taxpayer was partly permitted.

| Case Title | Shivinder Pal Singh Chahal vs. ACIT, Circle 43(1) |

| Citation | ITA NO. 3248/Del/2023 |

| Date | 22.01.2025 |

| Appellant by | Shri Harshit Chauhan |

| Represented by | Shri Sahil Kumar Bansal |

| Delhi ITAT | Read Order |