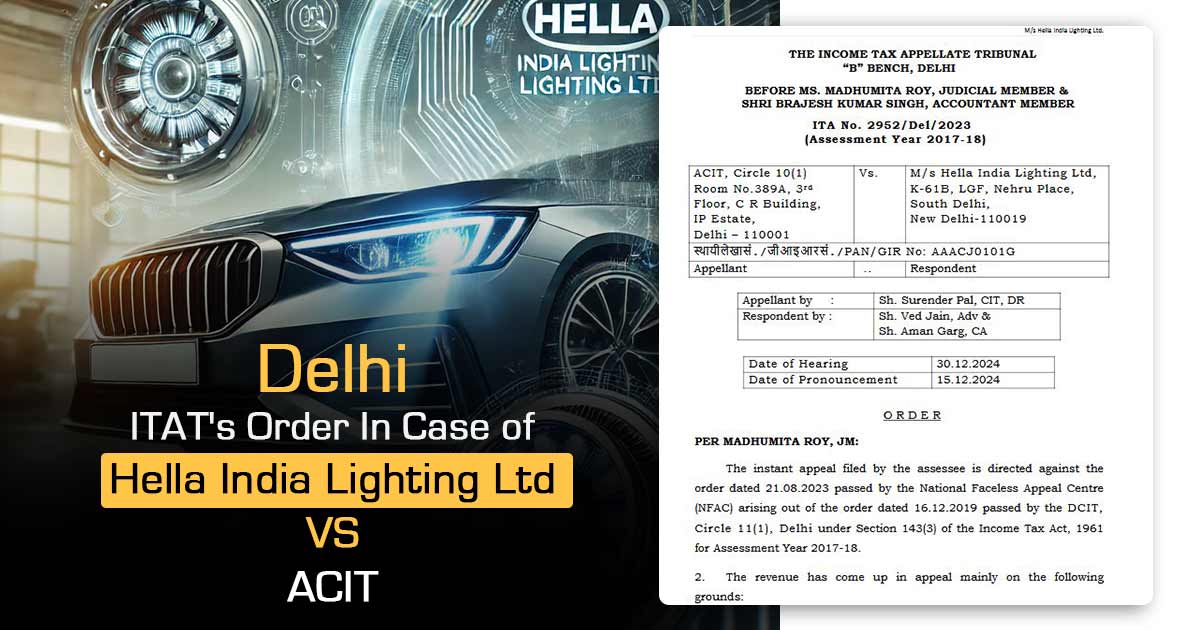

The Income Tax Appellate Tribunal (ITAT), Delhi, dismissed the appeal of the revenue in the case of ACIT Vs Hella India Lighting Ltd., addressing 3 issues for the assessment year 2017-18.

The revenue contested the deletion of an addition u/s 69C amounting to ₹6.80 crore, disallowance of expenses of ₹3.15 crore, and disallowance of a foreign exchange loss of ₹96.71 lakh. The tribunal carried the findings of the Commissioner of Income Tax (Appeals) [CIT(A)], favouring the taxpayer.

For the section 69C addition, the AO considered the purchase of fixed assets worth ₹6.80 crore as bogus due to insufficient documentary evidence. But in the appellate proceedings, the taxpayer furnished the invoices and evidence of the purchases which were corroborated via the AO in a remand report.

The addition of the CIT(A) has been removed and the ITAT concurred, dismissing the claims of the revenue as worthless. under Section 37(1), the disallowance of 10% of other expenses was overruled after the taxpayer gave detailed invoices and related documents. ITAT discovered the remand report validated the genuineness of the expenses, directing the disallowance as unjustified.

Therefore it was ruled by the tribunal that the claim for foreign exchange loss relied on judicial precedents and accounting standards. It was marked that these losses being integral to business transactions, were permissible under Sections 43AA and AS-11, dismissing the claim of the revenue for the absence of hedging.

Read Also: ITAT Chennai Deletes INR 12.14 Lakh Addition Under Section 69 of the IT Act

The taxpayer’s documentation validity and its compliance with the statutory provisions have been outlined by the ITAT concluding that the plea of the revenue does not have merit. The same ruling supports the norm that authentic business expenses and losses could not be arbitrarily disallowed without effective grounds.

| Case Title | Hella India Lighting Ltd vs. ACIT |

| Citation | ITA No. 2952/Del/2023 |

| Date | 15.12.2024 |

| Appellant by | Sh. Surender Pal, CIT, DR |

| Respondent by | Sh. Ved Jain, Adv, Sh. Aman Garg, CA |

| Delhi ITAT | Read Order |