The Madras High Court, in the case of Chetna Steel Tubes Private Limited v. Goods and Service Tax Network, has dismissed the petitions contesting a 2018 circular for the tax obligation u/s 129 of the CGST Act.

The applicant argued that filing the tax at both the detention phase and in regular GST returns amounted to double taxation. The court noted that before January 1, 2022, businesses had to file both the tax and penalties when the goods were seized.

However, after the change, a 200% tax penalty is imposed. It was held by the court that while the tax is collected at the phase of detention to ensure compliance, any excess amount filed in return could be claimed as a refund. The same ruling specifies that taxpayers are not within the double taxation as the surplus GST paid in GSTR-3B can be refunded.

It was kept by the court that the objective of section 129 was to legislate tax compliance in transit and the impugned circular does not make an automatic tax obligation above what is needed within law. Therefore the petitions were dismissed confirming the right of the taxpayer to claim the refunds for any excess tax filed as of the detention.

Check Facts:

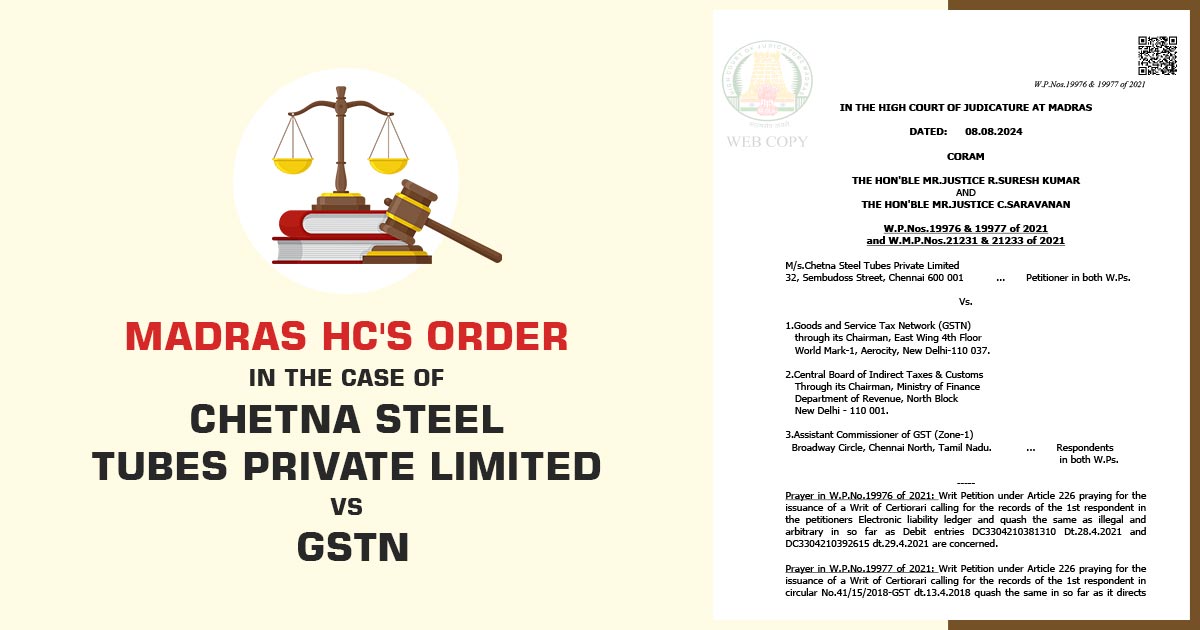

M/s Chetna Steel Tubes (P.) Ltd. (“the Petitioner”) has submitted the present writ petitions contesting the Circular No. 41/15/2018 GST on April 13, 2018 (“the Impugned Circular”).

It was ruled by the applicant that they could not be loaded with the tax obligation twice once at the phase of detention to obtain their detained goods released u/s 129 of the CGST Act and other at the phase of tax payment in the regular returns in Form GSTR-3B.

Hence, no question is there of making an automatic tax obligation and therefore the applicant has also contested the demand notices on April 28, 2021, and April 29, 2021 (“the Impugned Notices”) in the existing petition.

Main Problem

Whether tax collected at the phase of detention can be claimed as a refund if excess tax is filed in regular returns?

Held

The Hon’ble Madras High Court in Writ Petition Nos. 19976 & 19977 of 2021, held as under:

- It is marked that as far as the duration before January 1, 2022, is regarded it is specific that the applicant whose goods are seized u/s 129 of the respective GST legislation needs to file the subject tax and penalty. The law has been revised after January 1, 2022, whereby merely the penalty is leviable at 200% of the tax.

- It is noted that the tax is being imposed twice under the impugned circular and is opposite to section 129 of the respective GST legislation could not be countenanced. Section 129 of the CGST Act has the objective of recovering the tax on these goods in transit where the removal of these goods does not fulfil any of the legal compliance needed for the removal of goods. Hence the tax was required to be collected to the scope of tax that was liable to get filed in the returns at the phase of the detention of these detained goods. The tax would need to be debited from the applicant’s electronic credit account kept under the respective GST acts.

- It was ruled that if the goods of the supplier were detained and subjected to tax and the penalty u/s 129 of the CGST act as it stood before the change then the supplier is qualified to claim the excess tax refund, if any paid in the returns submitted in Form GSTR-3B. Hence the specified apprehension in the writ petitions is misplaced and unwarranted. Therefore such writ petitions were dismissed. Consequently, such writ petitions were dismissed.

| Case Title | Chetna Steel Tubes Private Limited Vs GSTN |

| Citation | W.P.Nos.19976 & 19977 of 2021 and W.M.P.Nos.21231 & 21233 of 2021 |

| Date | 08.08.2024 |

| For Petitioner | Mr.R.Vijayakumar |

| For Respondents | Mr.A.P.Srinivas |

| Madras High Court | Read Order |