If an order is passed under section 148A(d) of the Income Tax Act in the lack of an appropriate sanction as per the provisions of Section 151 of the Income Tax Act, the order and the resulting notice u/s 148 shall need to be declared illegal, the Bombay High court ruled.

The bench of Justice G. S. Kulkarni and Justice Somasekhar Sundaresan has marked that a sanction for passing an order u/s 148A(d) was directed to be obtained under clause (ii) of Section 151 as more than 3 years had elapsed from the end of the relevant assessment year for the proceedings to be adopted u/s 148A and subsequently under section 148 of the Act. However, the sanction was obtained under clause (i) of Section 151.

Section 151 is related to sanctions for the issue of notice. Section 151(1) expresses that no reassessment notice would be issued after the expiry of 8 years from the end of the pertinent assessment year until the Board is satisfied on the reasons recorded via the income-tax officer that it is a suitable matter for the issue of such notice. Section 151(2) remarks that no reassessment notice would be issued after the expiry of 4 years from the finish of the pertinent assessment year, unless the Commissioner is pleased, based on the recorded reasons by the Income-tax Officer, that it is a fit case for the issue of such notice.

The notice issued by the respondent department u/s 148 of the Income Tax Act, 1961 has been contested by the taxpayer. The assessment year was 2016–17. Applicant indeed contested the notice that is on the stage of the notice issued under Section 148A(b) and an order passed by the respondent department on notice under the provisions of Section 148A(d).

It was argued by the taxpayer that the order passed through the assessing officer u/s 148A(d), which sets the required approval to pass the order u/s 148A(d) was granted by the Principal CIT, Mumbai, via a letter or order sheet entry dated August 29, 2022, by the provisions of Section 151(i) read with paragraph 6.2(ii) of Instruction 01 of 2022 issued by the CBDT.

The sanction is required to have been received under clause (ii) of Section 151, which can be through the authorities set out in the provision, and if the Chief Commissioner or Director General has passed more than 3 years from the termination of the relevant assessment year, which is assessment year 2016–17.

Read Also: Madras HC New SCN Shall be Issues U/S 148 of the IT Act That Have not Been Raised Earlier

While permitting the petition, the court under Section 148A(d) as well as the consequent notice under Section 148 quashed the order.

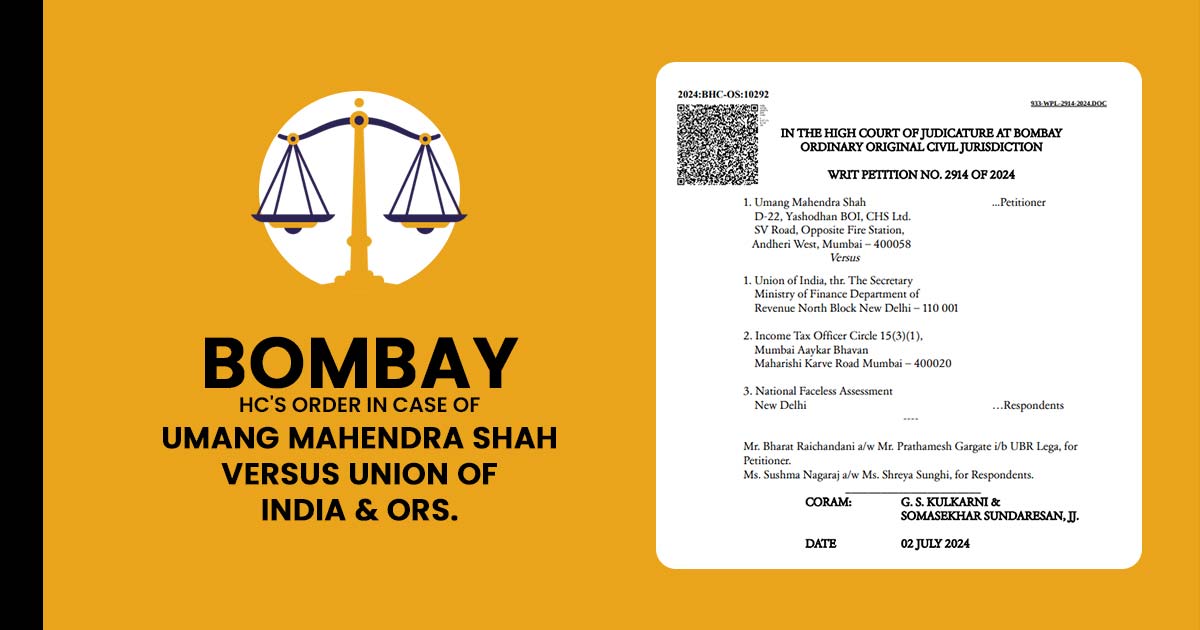

| Case Title | Umang Mahendra Shah Versus Union of India & Ors. |

| Case No.: | Writ Petition No. 2914 of 2024 |

| Date | 02.07.2024 |

| For petitioner | Mr. Bharat Raichandani, Mr. Prathamesh Gargate |

| For respondent | Ms. Sushma Nagaraj, Ms. Shreya Sunghi |

| Bombay High Court | Read Order |