The matter of Laxmi Meena Vs Union of India & Ors. before the Rajasthan High Court is concerned with the legality of proceedings initiated u/s 148A(d) of the Income Tax Act, 1961, established on facts proposing differences in reported income from a property transaction. Below is a detailed case summary:

A Summary of the Arguments and Background

Proceedings are Commenced: The proceedings initiated by the income tax officer u/s 148A(d) and u/s 148 of the Income Tax Act have been challenged by the applicant. Such sections provide authority to reopen the assessments when there is reason to acknowledge the income has escaped assessment.

This is the Contention of the Applicant: It was contended by the applicant that the proceedings were without jurisdiction as the mentioned income from the sale of the land was precisely noticed as 13 lakhs. No income has escaped the assessment established on the available information, they argued.

Defending Revenue: It was opposed by the revenue that the proceeding initiation was on the grounds of the data proposing the sale act undervalued the property, directing to the underreported income. They contended that the validity of such claims must be investigated at the time of the following phases of assessment instead of at the nascent phase of the issuance of the notice.

Read Also:- PB & HR High Court Deletes the Order U/S 148a(b) and INR 10K Penalty on the Tax Dept

In this case, the Court has found and Ruled Based on Two Precedents

Observance of Procedures: It was remarked by the court, that no allegations of procedural impropriety or the refusal of the change in the execution of the proceedings were there. The procedural factors do not get contested by the applicant and instead the jurisdiction of the tax council to reopen the assessment.

The Jurisdictional Issue: The court while directing the statutory precedents along with the matter of Anshul Jain Vs. Principal Commissioner of Income Tax, stressed that at the initial phase of the notice under section 148, it is before the time for the court to delve into the merits of the controversy. The major findings of the facts and law counted within the ambit of the income tax officer.

An Overview of Judicial Intervention: The Rajasthan High Court quoting the Supreme Court’s ruling and various High courts, repeated that the writ jurisdiction under Article 226 must not be interrupted prematurely in the cases of tax in which the legal remedies are available for the taxpayer.

It was highlighted by the court that factual disputes for the valuation and the income assessment must be addressed via the legal petition procedures instead of via writ petitions.

The Dismissal of a Case and Subsequent Appeal: The writ petition has been dismissed by the court keeping the validity of the notice under section 148A (d) and section 148. On the petition this decision was also upheld by the Apex court, supporting that any grievance on the merits must be addressed at the time of the reassessment proceedings to the tax council.

Conclusion

In the case of Laxmi Meena Vs Union of India & Ors. the decision of the Rajasthan High Court emphasized the principle that contest to the income tax reassessment notices must be addressed via the lawful avenues furnished under the Income Tax Act. It was refused by the Court at the starting phase of the issuance of the notice, leaving the applicant to seek the available remedies at the time of the next assessment proceedings.

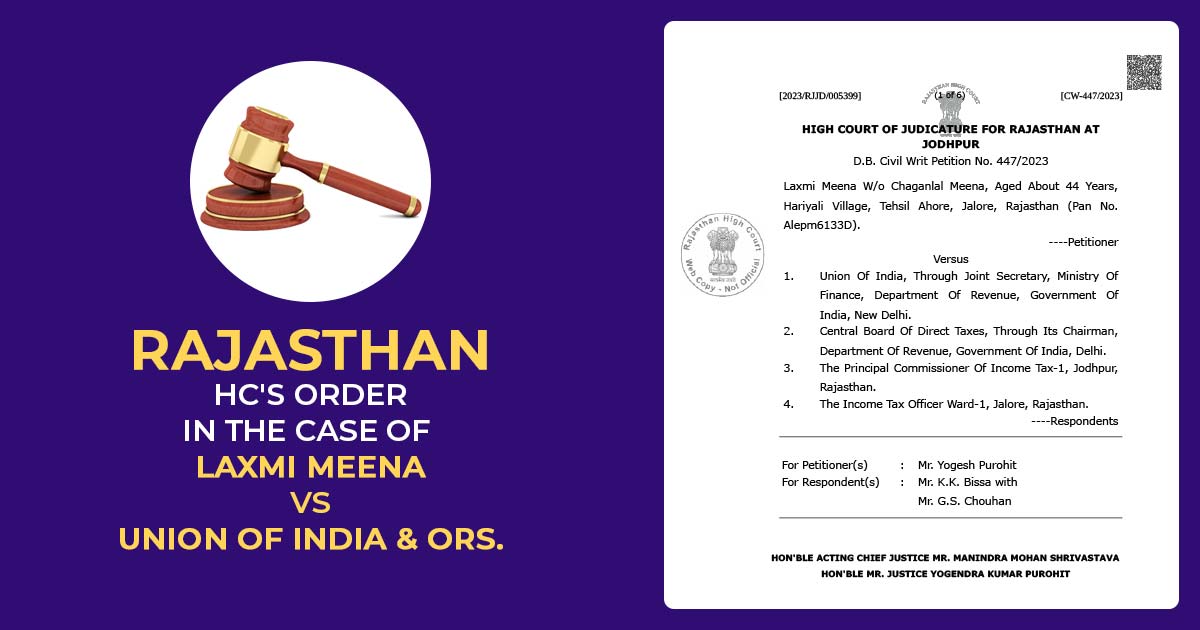

| Case Title | Laxmi Meena Vs Union of India & Ors. |

| Case No. | Civil Writ Petition No. 447/2023 |

| Date | 15.02.2023 |

| Counsel For Petitioner(s) | Mr. Yogesh Purohit |

| Counsel For Respondent | Mr. K.K. Bissa with Mr. G.S. Chouhan |

| Rajasthan High Court | Read Order |