The GST Law and Procedures handbook for departmental officers provides a complete overview of GST law and simplifies its various aspects in an easy-to-understand manner. It is organized into 14 helpful chapters, each explaining the legal and procedural requirements of GST as a simple guide for government officers.

The government departmental officers felt the need for a GST Handbook to help them understand the various procedures of GST. After receiving feedback from different offices under CBIC, DGGST has now released the GST Handbook for the departmental officers.

- Overview and Achievements of GST: On 1st July 2017, GST was introduced and secured unified India’s indirect tax system, doubling the number of taxpayers to 1.4 crore and recently achieving collections exceeding Rs 2 lakh crore.

- Objective and Development of GST Handbook: The GST Handbook, made by a dedicated team, strives to assist departmental officers in comprehending the CGST Act, 2017, and corresponding rules, assuring constant undertaking of GST statutes and procedures.

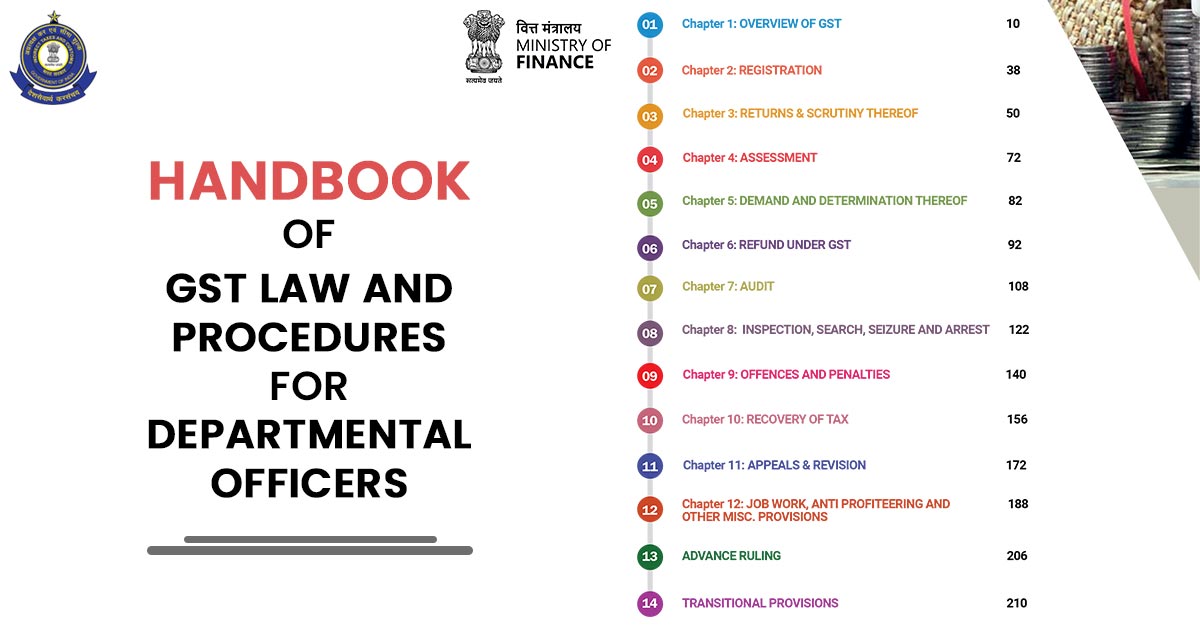

- Handbook Content and Structure: It has been organized into 14 chapters, the Handbook furnishes a simple ‘how to’ guide on GST’s legal and procedural aspects, covering significant aspects of the CGST Act, 2017, and IGST Act, 2017.

- Usefulness and Non-binding Character: The same Handbook acts as a guide to improve the efficiency of the officers in operating their chores, however, it is advisory and not statutorily bound. It seeks to propose the most updated data on GST statutory and functionality.

- Recognition and Upcoming Updates: The same initiative regards the contributions of distinct committees and officers. The same Handbook has been made to adapt the future GST amendment, and feedback is motivated to rectify future editions.