The GST has created the confusion between publishers and authors and the question is that who is liable to pay 12% of Goods and Services Tax (GST) on royalties. The Meerut Publishers’ Association on the issue of GST liability on royalty filed the writ petition seeking clarity on the subject matter. The petition was initiated in Delhi high court on September 11 against the centre on the confusion created by India’s biggest indirect tax reform

The fiction and subjects authors are regulating the court case with proximity. The famous fiction writers like Ashwin Sanghi and Ravi Subramanian have become more serious about the discussions on the topic with the publishers.

The hot discussion is that “Who is liable to furnish 12% GST on royalty?”

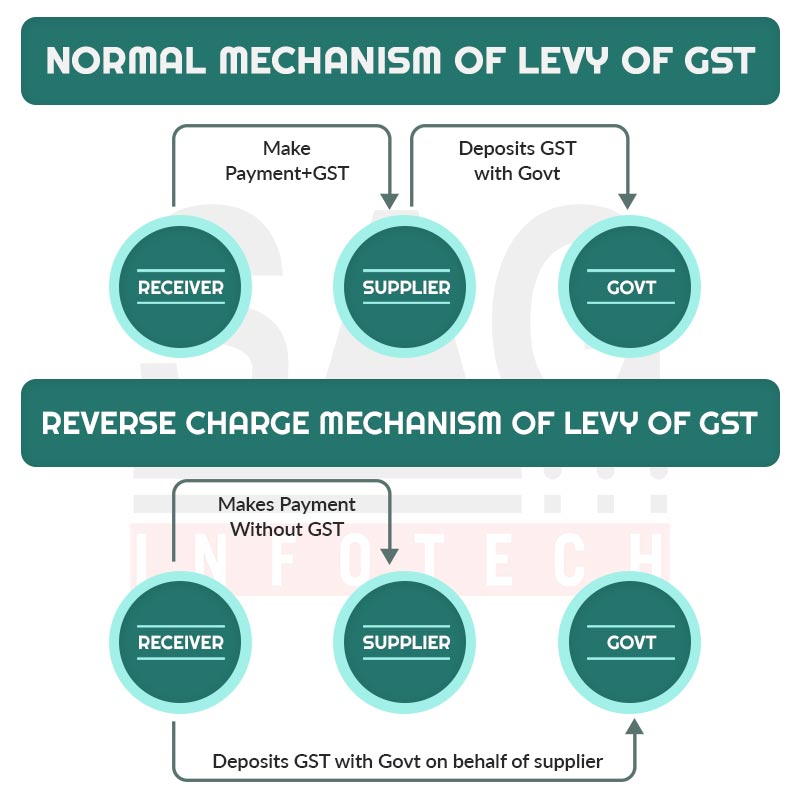

On the matter, Ashwin Sanghi said, “The problem lies in the fact that 12% GST is applicable on author royalties. Publishers must pay GST on the reverse charge mechanism basis

Lately, there was no significant tax on royalty under sales tax and it was the subject of the exempted list. In addition, the royalty was also not the part of VAT as when the author transfer his/her own work the right of publishing it is not considered absolute.

MS Mani, a partner at Deloitte India said, “The reverse charge applicable on the copyrights of authors under GST requires the publishers to pay the tax, and if these are passed on to the authors, it would amount to an effective reduction in the royalties payable.”

Another discussion among authors is that the famous fiction writer like Ashwin Sanghi and Ravi Subramanian are able to propel the publishers to pay royalties but the neophyte in the field will not be able to establish their remark on the subject matter.

Ravi Subramanian, the established fiction author said, “While the well-known authors would be able to convince the publishers to absorb the GST on royalty, the lesser known and new writers would be squeezed. The larger problem, however, is that the publishers operate on about 5% margins and that they are facing the squeeze.”

Read Also: One Nation One Tax: Why GST is Still Away From This Agenda

Industry experts concerned on the topic say that however, the books are put out of the GST net, still, the cost of the structure is not forgiving the publishers.

Abhishek A Rastogi, a partner at Khaitan & Co said on regarding the matter, “While books are largely out of the GST gamut, various input supplies are taxable. The royalties paid to authors or writers are taxed at 12% and that too under the reverse charge mechanism. The cost of books may go up due to the cascading tax effect on publishers.”

Ashwin Sanghi, Author of well-known books like The Krishna Key, The Rozabal Line, and Chanakya’s Chant commented on the matter in a humorous way and said we may do opposite of other industries and put hurdles for the inclusion of books under GST.

According to tax experts, refund mechanism is not available against input taxes if the supply Goods such as books are exempted under GST. The revert of refund scheme profits is limited to only taxable goods mentioned under GST taxable items list. This is the reason why publishers are not able to compensate royalties against tax liabilities.

Abhishek A Rastogi said, “The matter for a refund of inverted duty structure in case of exempted supplies for publishers is pending before the Delhi High Court. The legislature and judiciary should take a pragmatic view on this subject to keep costs under control for these essential supplies.”

The norms under GST will also shade their effects over freelancers and authors of school and college books. The situation can increase the cost of books in colleges and schools.

I will get one time royalty for my book. Do I need to register for gst?

No. You do not have to register for GST. They ask for your personal India tax info NOT GST. You fill a form and relax.

I am an author. My publisher has deducted 9% GST from my ROYALTY. Is it correct? What’s the legal position? kindly clarify

“please consult this with the GST practitioner”

i purchase the paper and job work for printing and binding the book.

Sale to private educational institute

What is rate of GST and HSN code ?

please reply

Please go to this link for reference https://cbic-gst.gov.in/gst-goods-services-rates.html

Please let me know whether the petition is before the High Court or the Supreme Court?

GST service code of royalty to authors by publishers

Royalty is not a supply under the GST and is not liable to GST

We have client paying GST under reverse charge and passing following entry

Royalty A/c Dr 10

IGST (Reverse Charge) Dr 1.2

To IGST Cr. 1.2

To TDS u/s 194J 1

To Party 9

Now confirm me is this ok or not and what will we do IGST (Reverse Charge) it will continue or on place of IGST (reverse charge) include it in value of Royalty.

Here IGST is our liability paid from bank.

Please contact to GST practitioner

Is there any notification for GST rate @ 12% for SAC 998911?

No

I am a simple author. I have received a one-time lump sum amount for writing books. I want to know whether the GST will be applied to the lump sum amount achieve by the publisher. Please acknowledge me and give me the proper information that 12% GST is applicable to the authors one-time lump sum amount or not.

“Please Contact to GST Practitioner”

If GST is payable on royalty, it is going to discourage new writers which may ultimately be a loss to the students community. I think if GST has already been charged on all the items connected with publishing, there is no reason to charge it again on royalty, which is otherwise is not a permanent income and income tax is already being paid.

what is the SAC code for Royalty on the sale of books?

998911

Can GST applicable on my royalty income?

Yes, GST is applicable on royalty.

If I am an unregistered publisher and taking services from authors, then do I have to get registered under GST mandatory for RCM.

Can I impose GST on royalty?

Yes, GST is applicable on royalty.

Sir, I supply sand and stone. kya mujhe sand amount me gst 5% lagana hai ki sand amount and royalti dono me

kya royalti amount me gst lagana hai kya

We are paying royalty amount to our foreign client, we deduct TDS u/s 195 @ 20%, Can we pay RCM under GST?

If yes then at what rate and under which SAC Code?

We booked monthly bill but not paid RCM on monthly basis, can we pay previous months RCM along with interest in March or not?

Yes, you need to pay tax under RCM, the rate would be 18% and you can pay to govt with interest in the next month.

IF BOOKS ARE NOT COVERED UNDER GST, WHAT TYPE OF PRINTED BOOKS ARE COVERED UNDER TARIFF ITEM 4901 10 10. PRINTED BOOKS ARE TAXABLE @5% UNDER THIS ITEM TARIFF.

iF BOOKS ARE TAXED @5%,I.E. Rs.5 ON SALE OF Rs.100/-, THE PUBLISHERS NORMALLY PAY ROYALTY @10% ON 75% OF THE SALE VALUE, I.E. Rs 7.5. THEN 12% OF 7.5, WILL BE Rs 0.90. THIS CAN BE ADJUSTED AGAINST Rs. 5/- COLLECTED ON SALE OF BOOKS.

I’m an English Language Teaching expert and going to write a series of five English Language Teaching books for Primary school students. The publisher who is going to publish this series is not very clear about applicable GST. Can anyone guide me? Who will pay GST? The publisher or me? How much?

GST @ 12% is levied on royalty paid to authors by publishers and that too has to be deposited by the publisher under RCM.