The West Bengal Authority for Advance Ruling (AAR) in a case before it carried that the Residential Welfare Association (RWA) operating within an Apartment facility would not be responsible for paying Goods and Service Tax (GST) when the membership fees charged on their members are less than Rs.7,500 per month

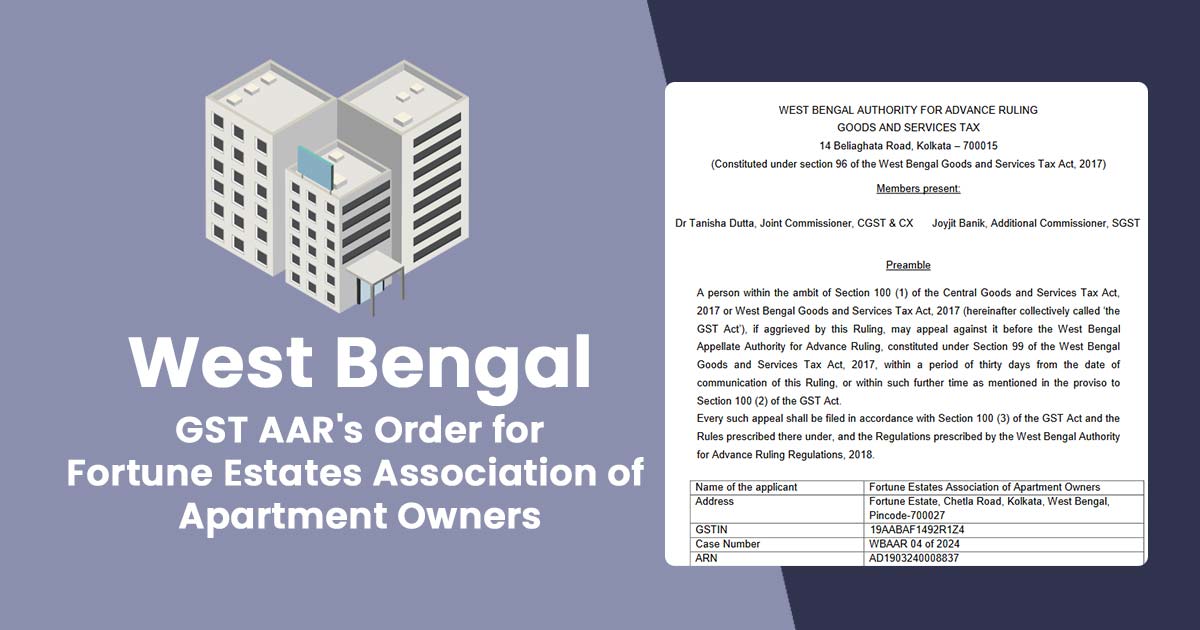

Fortune Estates Association of Apartment Owners (Fortune Estates) RWA registered under the West Bengal Apartment Ownership Act, 1972 asked for an Advance Ruling under the provisions of Section 97(2)(b) of the GST Act about the applicability of a notification given under the provisions of the Act.

Fortune Estates is in the business of furnishing the services obtained via third parties to its members. Charges for the rendering of these services are reimbursed via a mode of charges or share of contribution repeated by the members every month.

The asked query to West Bengal AAR was that if Serial No.77 of Notification No.12/2017-CT(R) comprise of “Service by an unincorporated body or a non-profit entity registered under any law for the time being in force, to its members by way of reimbursement of charges or share of contribution” shall be applied in the matter of applicant where the monthly maintenance amount obtained via members are less than Rs.7,500.

Fortune Estates opined that the above-said provisions of Notification No. 12/2017-CT(R) are muted on the GST chargeability in the case that the payment generated via the constituent members are distinct, ranging between being lesser or higher than Rs.7,500.

Read Also: UP AAR: GST Applies to Sale of Residential Units, Classified as Services Not Immovable Property

The multiple questions raised via the Applicant before AAR all relate to the same problem and may be replied to in summarization, the two-member Bench of AAR including Dr Tanisha Dutta, Joint Commissioner, CGST & CX, and Joyjit Banik, Additional Commissioner, SGST observed.

AAR referred to Circular No. 109/28/2019-GST on 22.07.2019 issued via the Tax Research Unit, Department of Revenue, Ministry of Finance. It explained that the GST exemption under Notification No.12/2017-CT(R) is specific to individual members. This means that if one member pays charges less than Rs. 7,500 per month, that payment may be GST exempted.

Similarly, if a member files an amount of more than Rs 7500, the RWA will be obligated to file the GST on the mentioned amount filed via the member.

In conclusion, AAR carried that the applicant RWA will not be obligated to file tax on the amount which is gathered via its members through the way of reimbursement of charges or share of contribution in which this amount does not surpass Rs 7,500 per month per member.

| Case Title | Fortune Estates Association of Apartment Owners |

| GSTIN | 19AABAF1492R1Z4 |

| Case Number | WBAAR 04 of 2024 |

| Date | 29.07.2024 |

| Applicant | Mr. Mohit Kabra |

| West Bengal (AAR) | Read Order |