It was carried by the West Bengal Authority For Advance Ruling (AAR) that the supply of baby carriers with hip seats cost less than Rs.1000 per piece would draw a Goods and Services Tax (GST) of 5% while these carriers cost more than Rs.1000 per piece shall draw GST at 12%.

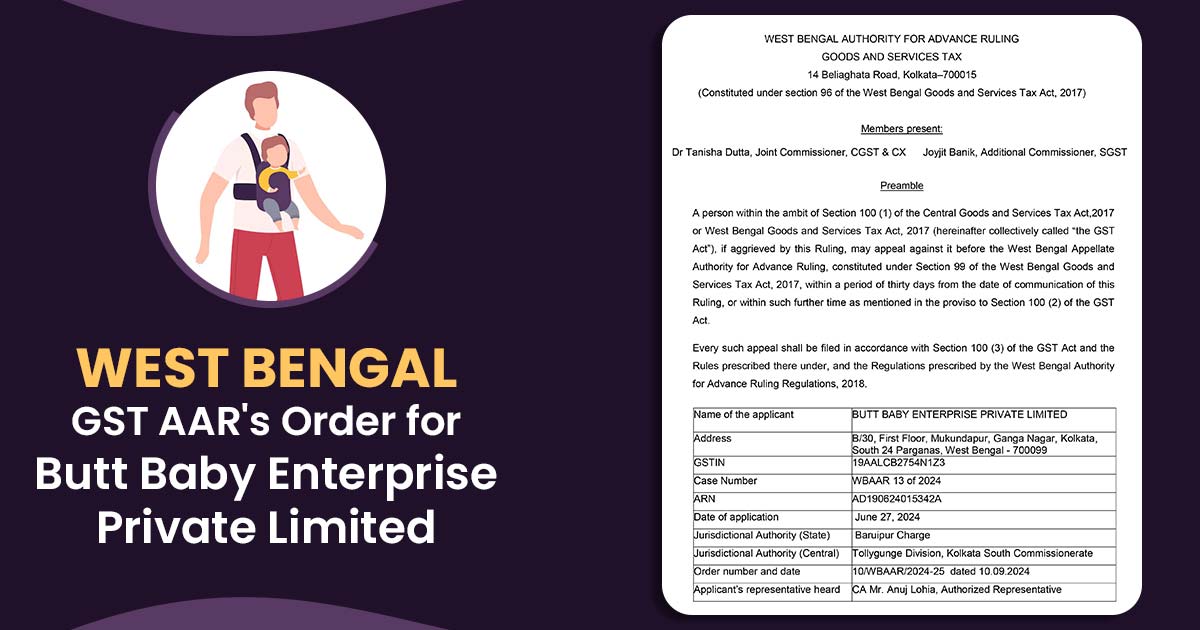

The Application for Advance Ruling u/s 97(1) of the CGST Act, 2017 was furnished via Butt Baby Enterprise Private Limited, a West Bengal-based enterprise concerned in the business of manufacture and trading of “Baby Carriers with Hip Seat”.

Read Also:- WB AAR: Comprehensive Water Supply Planning Services Are Exempt from GST

The petitioner queried the AAR if “Baby Carriers with Hip Seat” can be counted under Harmonized System of Nomenclature (HSN) Code 63079099 about “Other made up textile articles; sets; worn clothing and worn textile articles”; alternatively which HSN Code shall be applied to the products manufactured by the petitioner if not Chapter 63.

The same was considered by the applicant that products made via them were counted under HSN Code 87; precise information about the manufacturing process of the applicant and the category of product under HSN Code 87 was proposed as part of the Application, including the GST break-up developed by the Applicant calculated at 18%.

Also Read:- WB AAR: Applicant is Eligible to Claim GST ITC on Demo Cars

The petitioner, on meeting with e-commerce retailers, admitted that Chapter Heading 87 associates with “Vehicles other than railway or tramway rolling-stock and parts and accessories thereof” and does not cover any sort of normal fabric or narrow woven fabric, foam or mould being the dominating raw materials in the Baby Carriers.

Following these findings, the petitioner said that the raw materials utilised and the derived final product are precisely categorised under Chapter 63, established on which the query before AAR was raised.

The two-member Bench of Dr Tanisha Dutta, Joint Commissioner, CGST & CX and Joyjit Banik, Additional Commissioner, SGST marked the lack of any explicit remark of “Baby Carriage with hip seat” under Subheading No.6307 but characterized that the scope of “other made up articles, including dress pattern” under Chapter No. 6307 is wide adequately to contain Baby carriage with hip seat.

After reviewing the submissions and available materials, Authority For Advance Ruling determined that the GST applicable to the goods manufactured by the Applicant can be differentiated based on their pricing and ruled that:

Sale of Baby Carriers with hip seats cost less than Rs.1000 per unit shall be categorized under Entry No.224 of Schedule-I of Notification No: 01/2017-Central Tax (Rate) and draw a 5% GST and the identical carriers when cost more than Rs.1000 per unit shall be counted under Entry No.171 of Schedule-I of Notification No: 01/2017-Central Tax (Rate) and be responsible for 12% GST.

| Applicant Name | Butt Baby Enterprise Private Limited |

| GSTIN of the applicant | 19AALCB2754N1Z3 |

| Date | 27.06.2024 |

| Applicant | CA Mr. Anuj Lohia |

| West Bengal GST AAR | Read Order |