Visakhapatnam ITAT on finding that there is no shortfall of TDS and the taxpayer is eligible to obtain credit of the entire amount, rendered the AO to allot the credit of the whole amount deducted as tax at source under section 194Q of the Income Tax Act.

The Bench of Duvvuru Rl Reddy (Judicial Member) witnessed while referring the CBDT Circular No. 452 that “Kaccha Arahtias are concerned, the turnover does not include the sales effected on behalf of the principals and only the gross commission has to be considered for the purpose of 44AB.”(Para 5)

According to the facts of the case, the taxpayer has furnished its income return which was processed and accepted. But, the AO while processing the return furnished via the taxpayer noted that the taxpayer had claimed TDS of Rs. 72,218. The AO acknowledging the facts and circumstances of the matter applied Rule 37BA of the Income Tax Rules, 1962, and limited the claim of the taxpayer to an extent of Rs. 9,583 only and passed Intimation.

Post acknowledging the taxpayer submission the CIT(A) partly permitted the petition of the taxpayer.

Kaccha Arahtias turnover contains only the gross commission and not the sales effected on behalf of their principals, Bench observed.

The taxpayer is just a licensed commission agent in Agricultural Market Committee Yard, which is formed under the rules and regulations of the Government of Andhra Pradesh, bench witnessed.

The Bench observed that the Circular issued via the CBDT squarely applies to the taxpayer and therefore the taxpayer is serving only as an agent (kaccha arahtia).

On discovering that the taxpayer is eligible to get a credit of the whole amount deducted as tax, ITAT permitted the appeal of the taxpayer.

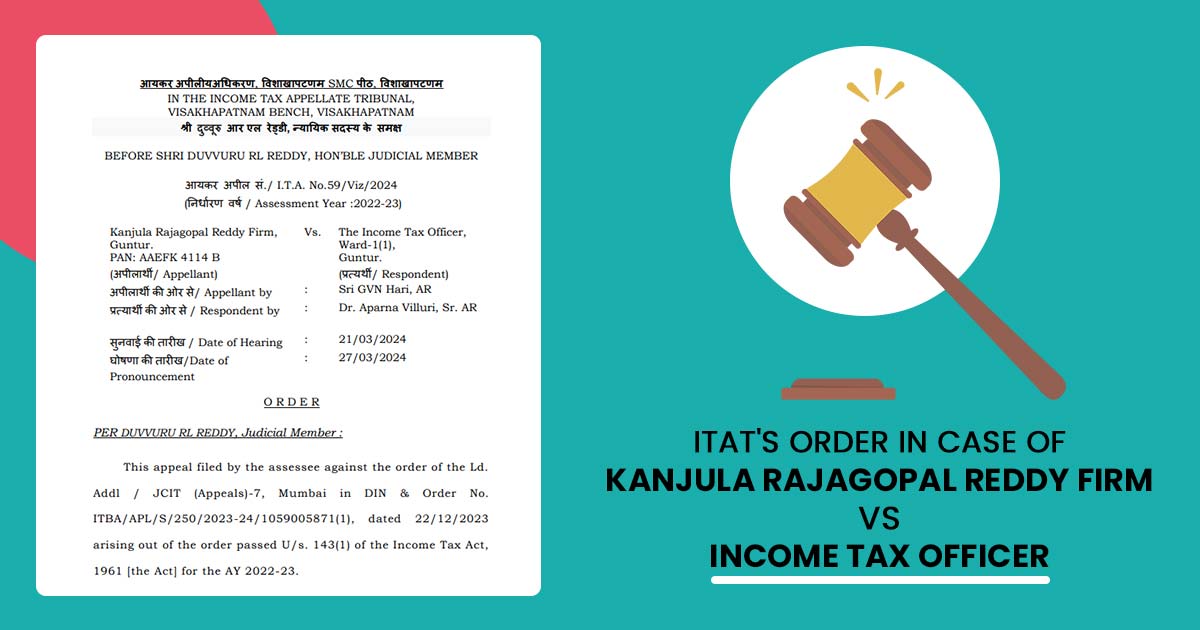

| Case Title | Kanjula Rajagopal Reddy Firm VS Income Tax Officer |

| Citation | I.T.A. No.59/Viz/2024 |

| Date | 27.03.2024 |

| Appellant by | Sri GVN Hari, AR |

| Respondent by | Dr. Aparna Villuri, Sr. AR |

| Vishakhapatnam ITAT | Read Order |