For any taxpayer, it is essential to find out that all your personal information on the tax filing portal is updated. There might have done a revision in your name, address, mobile number, etc. An assessee is urged to update/ modify the profile information on the new ITR portal to ensure that the essential communication concerned to the tax will be performed within time.

As per the upgraded website of the income tax all enrolled users of the e-filing site are enabled to access their account post logging in to view and edit their profile details.

Taxpayers Can Easy Update & See Profile Information on New Portal

- Information of Demat Account & Bank Account

- Register DSC under Income tax

- Higher Security of income tax e-Filing Vault

- Information of PAN – AO Jurisdiction

- Information of Representative Assessee & Authorized signatories for ITR & forms

- Information of Income Source

- Certificates & Registrations

- Rewards & Appreciations

- Applicability of Portuguese Civil Code

Step to Update the Personal Information on New ITR Website

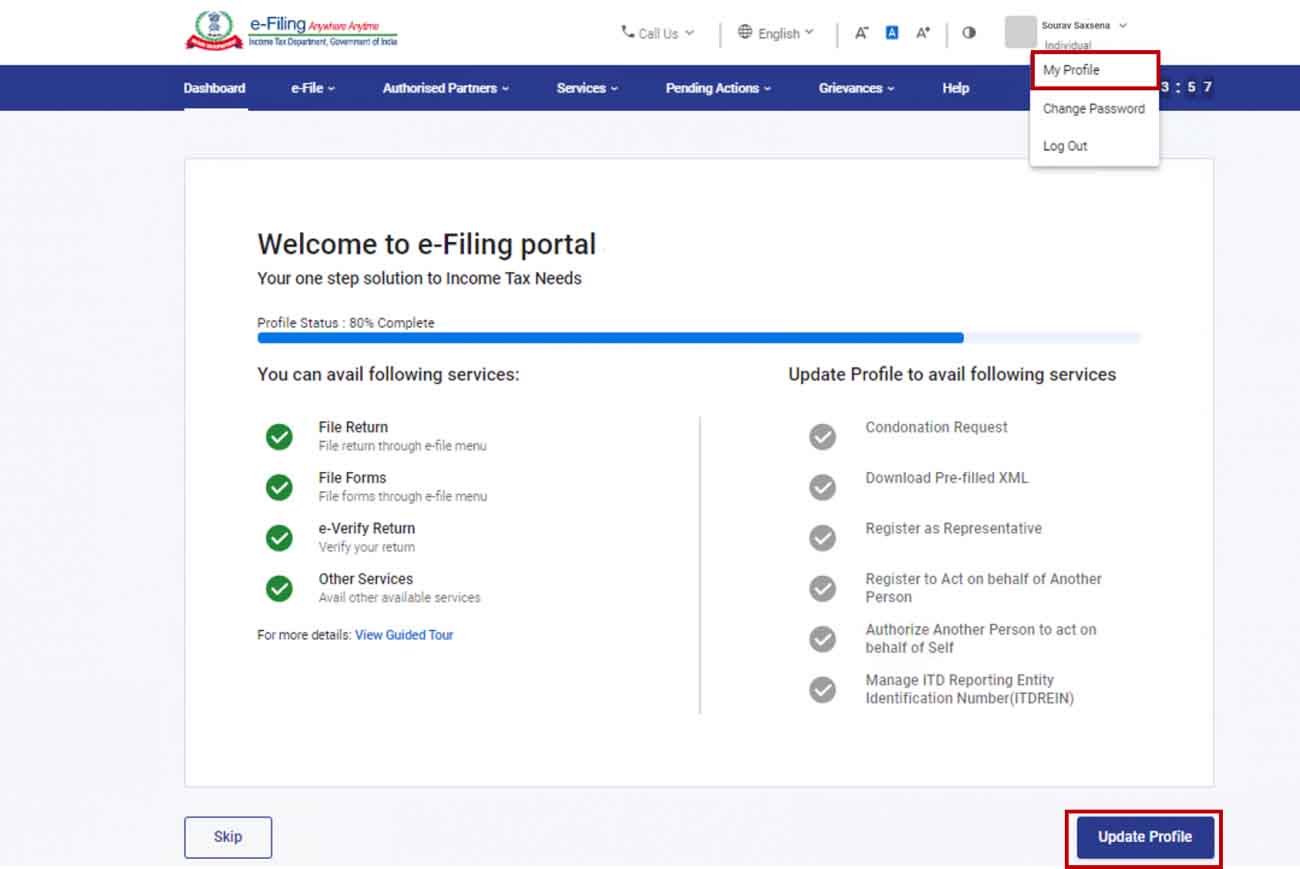

Step 1: Log in to the e-filing portal using your user ID and password.

Step 2: Upon the welcome page Tap on your name and then My profile in the top right corner of your dashboard. Then the taxpayer could tap on the update profile.

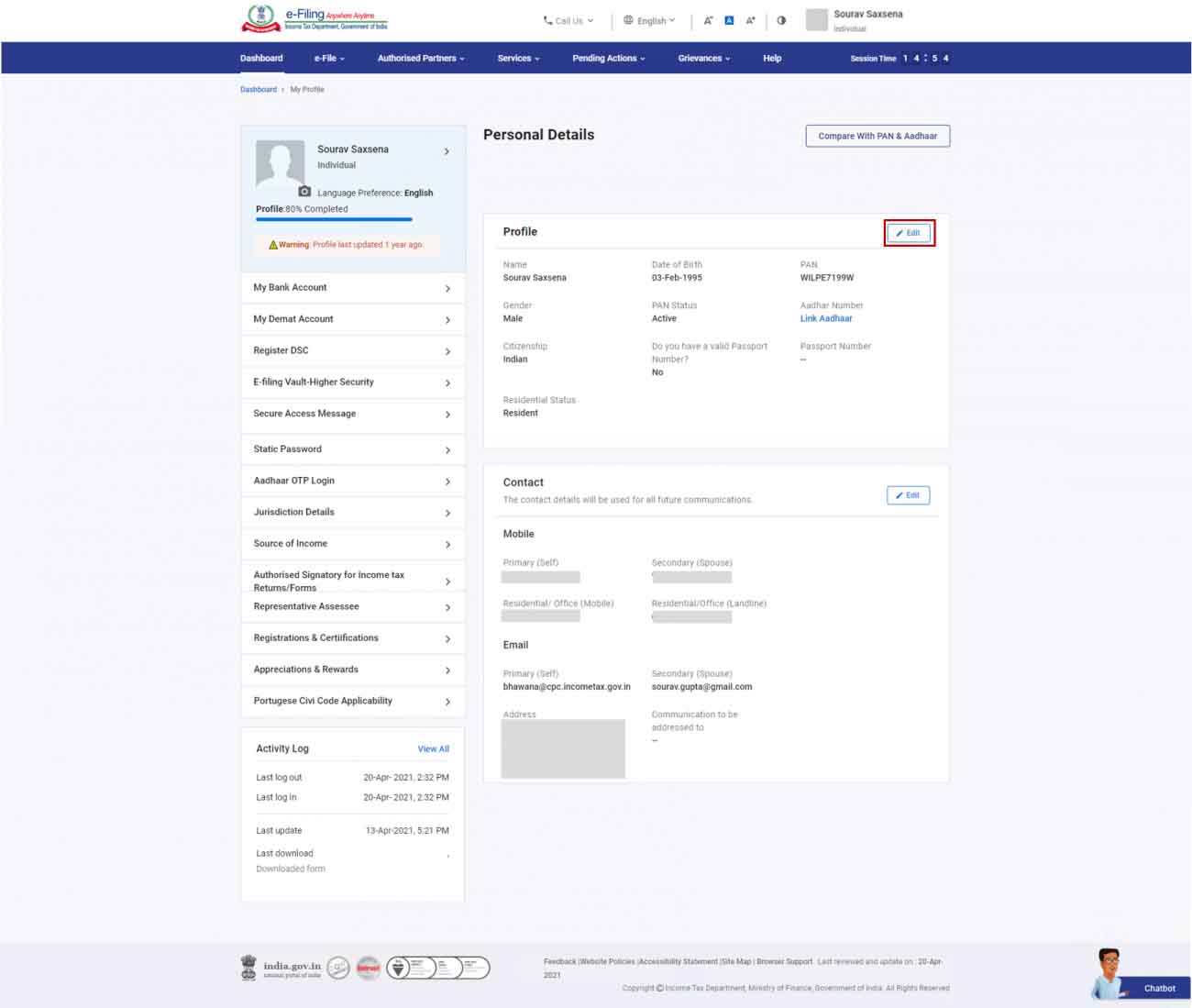

Step 3: Tap on Edit to update personal details.

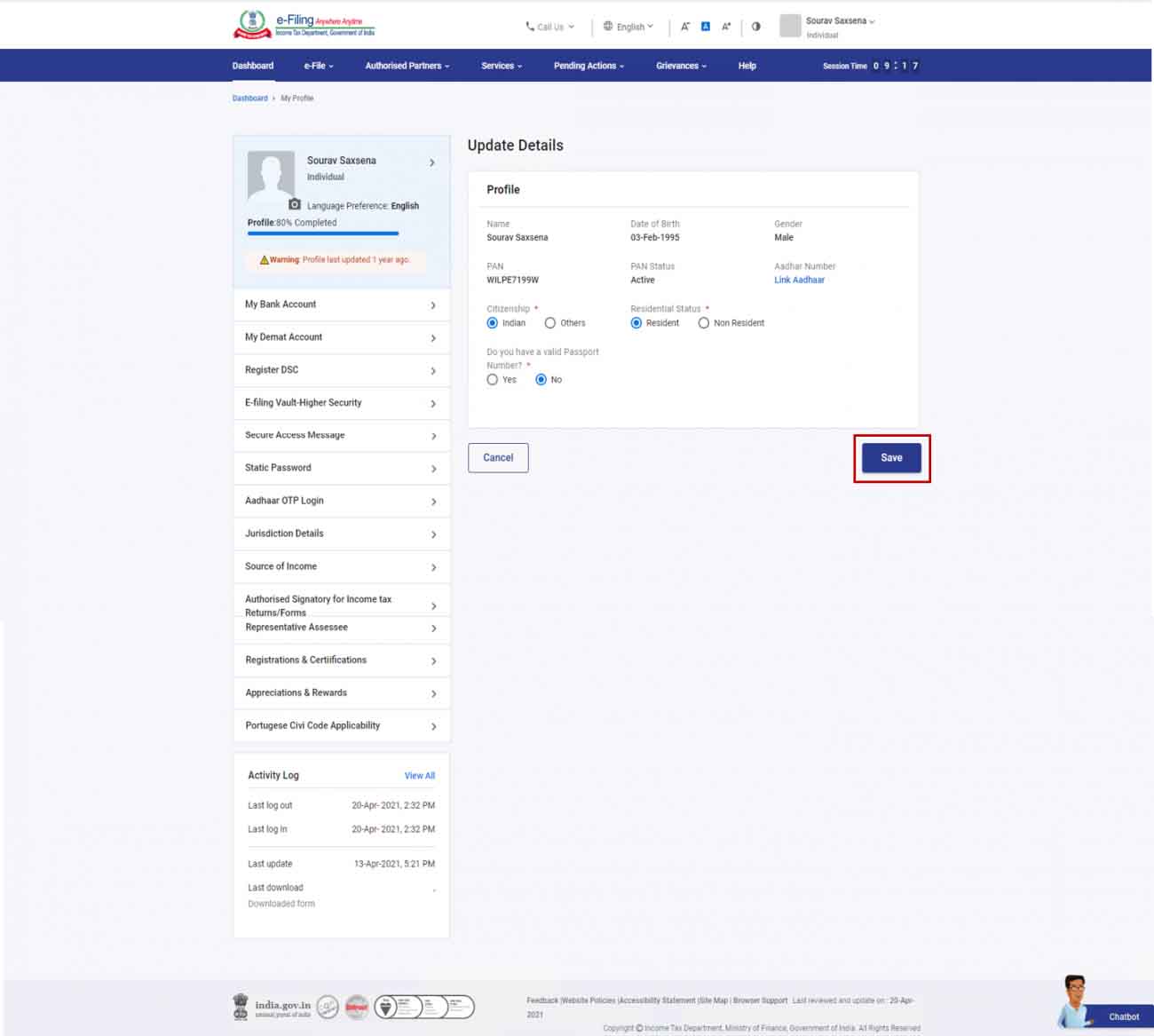

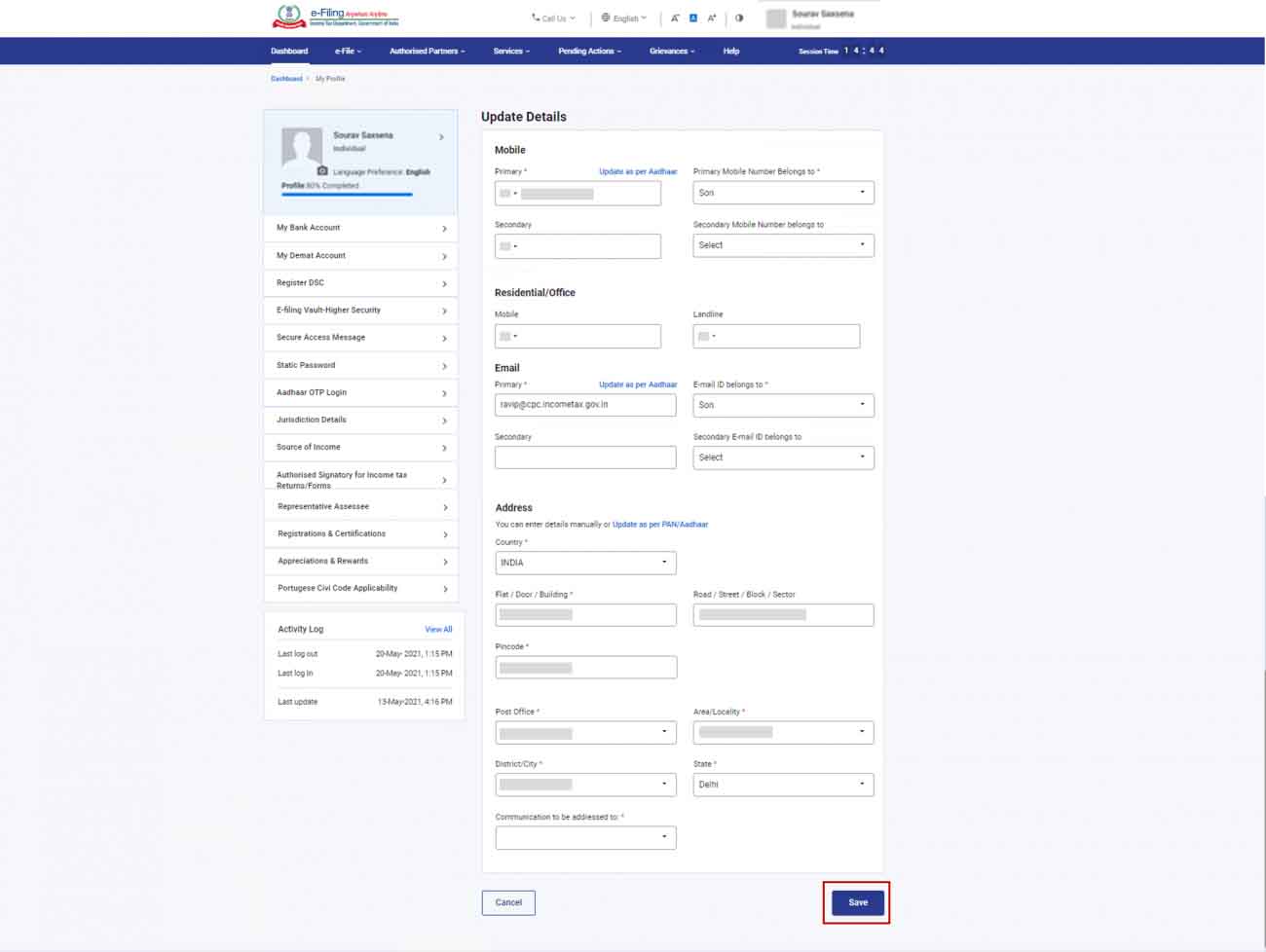

Step 4: Once the needed information is edited then tap Save.

Simple Step to Update Contact Information According to Aadhaar, PAN, or Bank

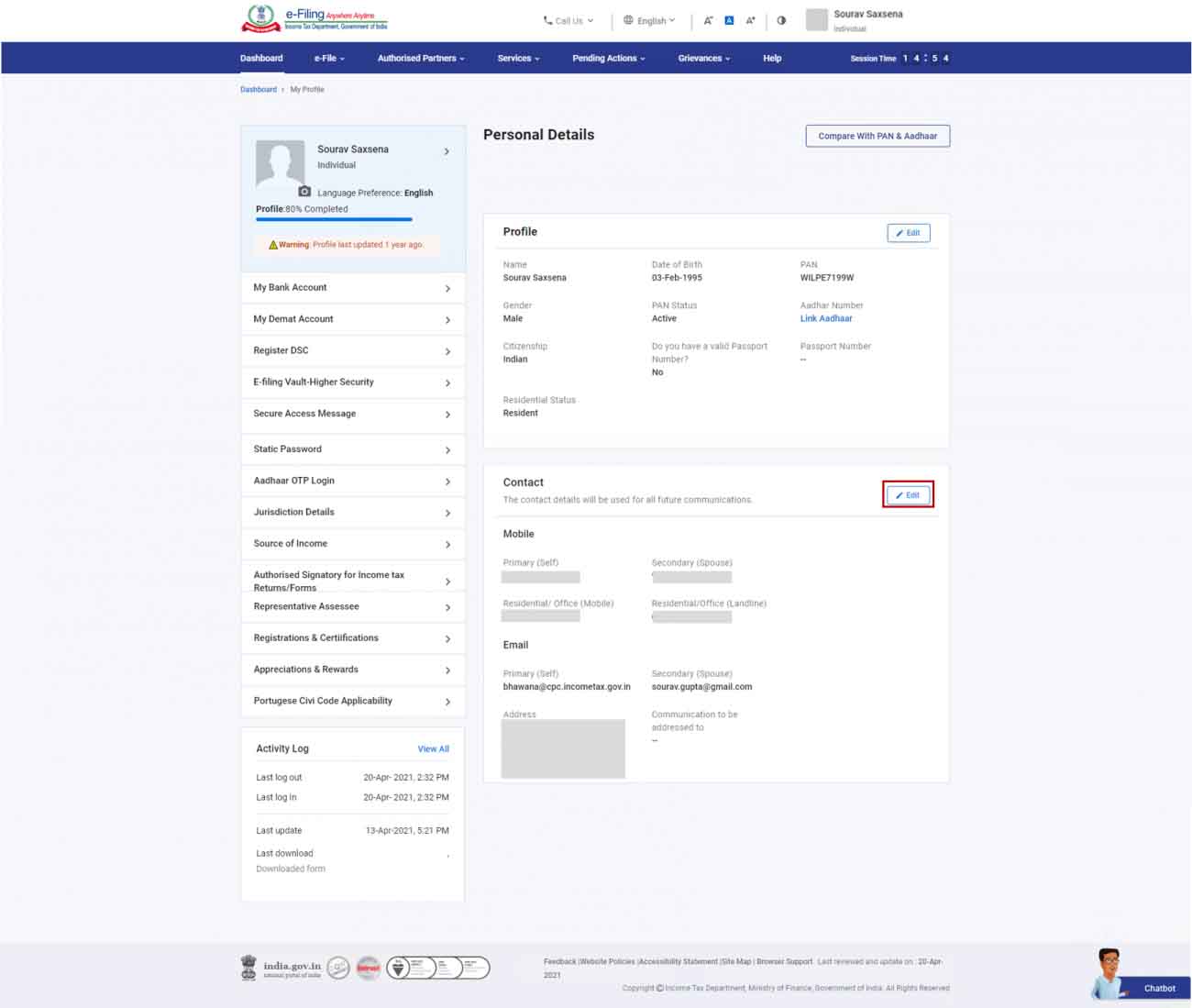

Step 1: Upon My Profile page, tap ‘Edit’ to update contact details.

Step 2: Insert the Mobile Number as per Bank/Aadhaar/PAN details and then tap Save.

Note: A pop-up message shall appear if you tap on the update under PAN/Aadhaar link. Tap update after choosing as per PAN or as per Aadhaar.

If your PAN or Aadhaar details have formerly been amended then hover on the “!” sign and choose tap here to update your bank details.

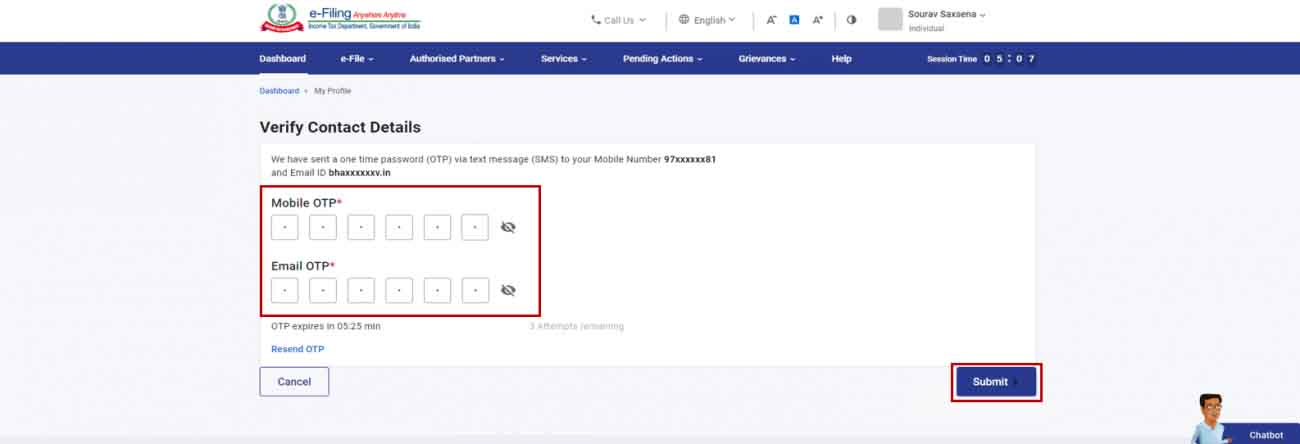

Step 3a: Upon verifying your contact information insert the two 6 digit OTP which has been received at the taxpayer’s primary mobile number and on the primary email then tap submit.

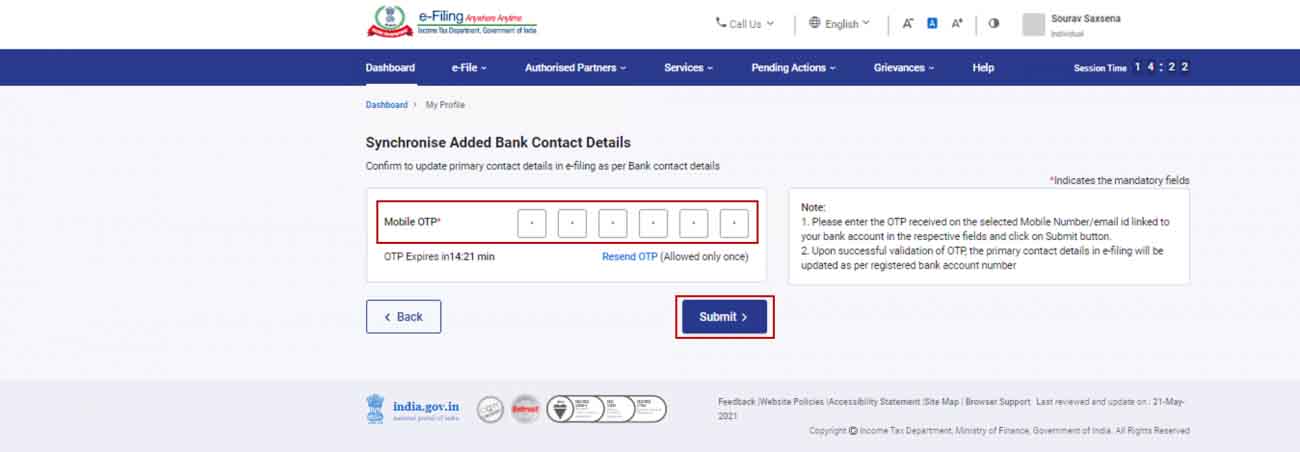

If you opted for the contact information according to the bank information:

Step 3b: On the synchronized added bank contact information page insert a 6 digit OTP that has been sent to the primary mobile number and then tap submit.

Note: The OTP shall only get valid for 15 minutes.

- Only 3 chances shall be given to insert the correct OTP.

- The OTP countdown will be shown on the screen which states the expiry time of OTP.

- Resend the OTP timer that revealed what time is being left to regenerate the OTP. Post to the successful Update a success message will prompt.

Essential Things to Remember on Editing the Contact Information

- Mobile Number and Email ID: Taxpayer shall receive the OTP on the primary mobile number along with the primary email ID which he inserts on the e-filing website if you update the email and the mobile number according to the bank information.

- If you update the email address and mobile number as per the Aadhaar and do no additional amendments then the taxpayer will not get urged to validate the mobile number but he shall be needed to verify his email address.

- There shall be no OTP authentication required when you only update the address according to the PAN or Aadhaar. Once the address has been successfully updated upon your primary email ID an email shall be furnished to you.

- The OTP will be sent to the primary email address if in case the taxpayer is a non-resident with an international phone number.