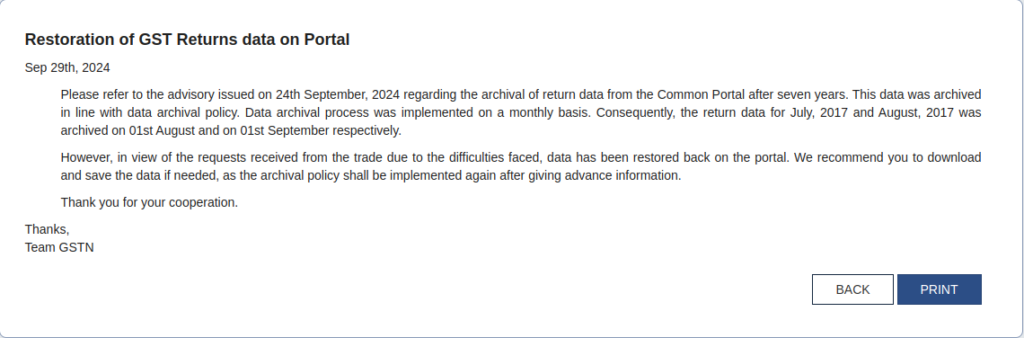

GST Network mentioned the monthly returns data for July and August 2017, the start of the Goods and Services tax incorporation has been restored on the portal.

The GSTN mentioned that it is executing its data policy, under which the data for the assessments would be retained for 7 years. Therefore the GST returns data would not be present beyond seven years for assessments and shall be archived.

As per that on 1st August 2024, the returns furnished for July 2017 were archived and data for August 2017 on 1st September 2024 was archived.

The trade and industry asked for more time to execute the same policy, they can download their pertinent information from the GST portal for any forthcoming reference.

GSTN in an advisory to the assessees mentioned the GST returns for 17-18 were available on the feedback obtained via the trade and industry.

“…in view of the requests received from the trade due to the difficulties faced, data has been restored back on the portal. We recommend you to download and save the data if needed, as the archival policy shall be implemented again after giving advance information,” GSTN cited.

Under the norms of GST, taxpayers are not permitted to furnish their GST returns after the lapse of 3 years from the last date of filing the mentioned return.

The taxpayer’s information would be retained just for 7 years under the GST portal data policy.

On July 1, 2017, GST was implemented.