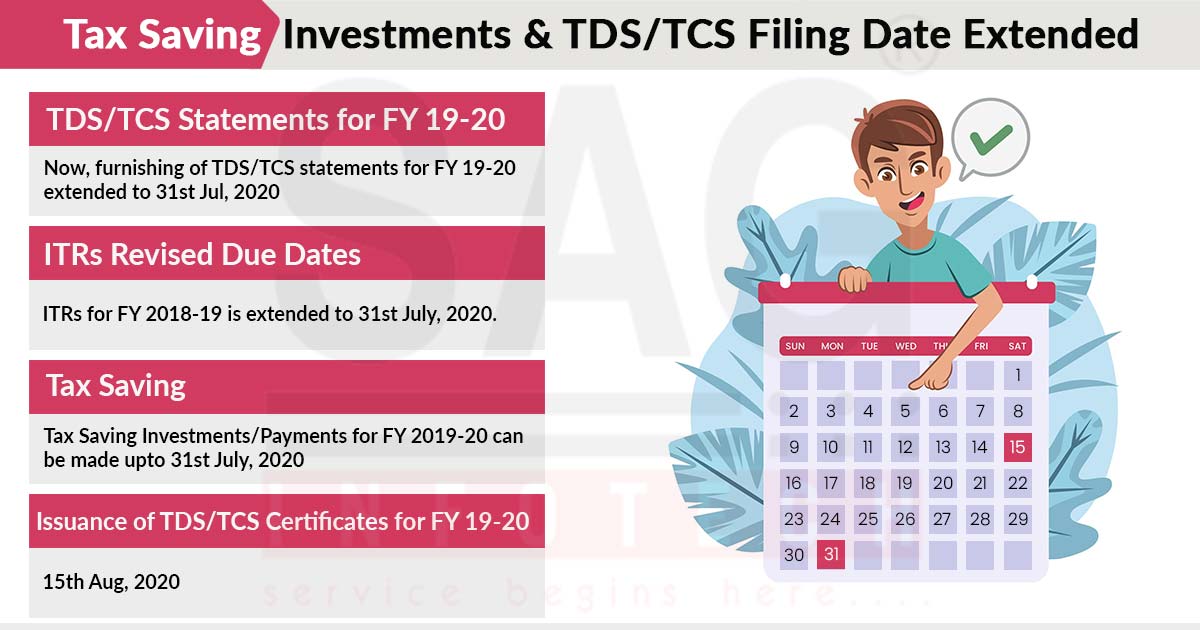

The Income Tax Department has extended the last date for tax-saving investments and payments for the previous year 2019-20, till 31st July 2020 for all the assessees. The decision will be very beneficial for the assessees amid the Coronavirus outbreak. The extension was announced by the department through a tweet saying that the payments and investments in tax saving activities can now be completed by 31st July 2020. The last date for furnishing TDS and TCS

The tweet read, “Understanding & keeping in mind the times that we are in, we have further extended deadlines. Now, Tax Saving Investments/Payments for FY 2019-20 can be made up to 31st July, 2020. We do hope this helps you plan things better.”

The department said that the move has been taken considering the situation the people are in. The department has made the announcement hoping that the move will be very beneficial for the people. All the assessees can now make the payments and invest in tax saving activities till 31st July 2020 to claim a tax deduction while filing the returns. Some investments, like life insurance policies, public provident fund (PPF), equity-linked saving scheme (ELSS), national savings certificate (NSC) and others, help in claiming deductions under Section 80C. The central government had previously announced that the last date for filing regular as well as revised returns for the previous year 2019-20 has been extended till 31st July 2020.

Under a statement issued by the Central Board of Direct Tax (CBDT), the board said that the last date for filing Income Tax Returns

Under the new tax regime, the department has also allowed the assessees to claim an exemption of Income Tax on the conveyance allowance provided to the employees by the employer. The department also announced that the employers can now issue the TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) certificates by 15th August 2020.

Various changes have been made by the CBDT under the new tax regime to make the tax filing compliance better and easier. All the assessees opt between the new and old tax regime freely.

Other Major Relief by IT Dept. for Taxpayers

Pan-Aadhaar Link till 31st March 2021

- The government has decided to extend the last date for linking PAN and Adhaar from 30th June till 31st March 2020. All the assessees can now link their PAN with Adharr till 31st March 2020.

Last Date to file Form 16 and Form 16A extended

- The Income Tax Department has extended the last date to file Form 16 and Form 16A till 30th November 2020.

Last Date for Self-Assessment Extended

- The government has provided some relief for the taxpayers by extending the last date of self-assessment till 30th November 2020. The assessees having a tax liability of less than Rs 1 Lakh can now submit the self-assessment till 30th November 2020.

LAST DATE TO SUBMIT ETDS FOR 1ST QR QR FY 2000-21 ?

31st March 2021