The approach behind the Employee Provident Fund (EPF) scheme is to provide significant benefit to the employees at the time of their retirement. The scheme specifies that a nominal amount is deducted from the salary of an employee as a contribution towards the fund. According to the latest circular, which has got affected from June 1, 2015, changes have been made regarding the Income-tax rules on the EPF withdrawal by one of the biggest retirement funding associations worldwide, Employee Provident Fund Organization (EPFO).

(Update: Budget-2016)

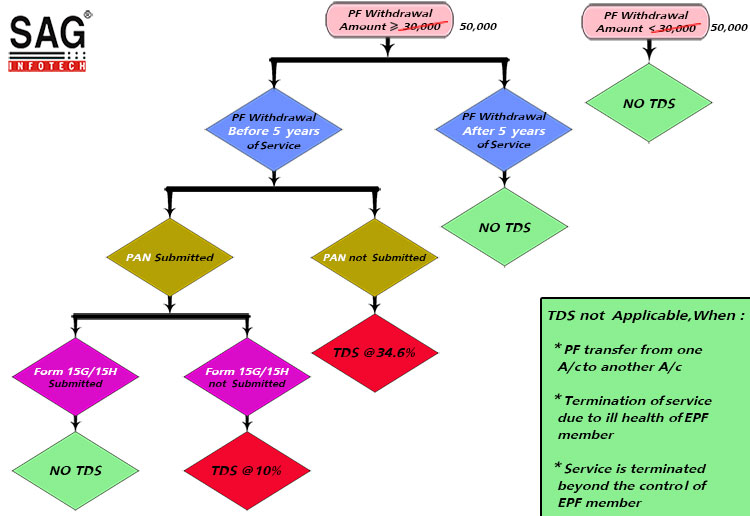

Payment of an accumulated balance to pay an employee from PF, the threshold limit increased from Rs. 30,000 to limit Rs. 50,000. So, TDS is not applicable if PF withdrawal amount is less than Rs 50,000.

PF Withdrawal Rules associated with TDS

Cases where TDS is not applicable

- If the amount, which is to be withdrawn as PF is less than

Rs. 30000Rs. 50,000. - No tax on pf Withdrawal after 5 years or more of continuous service.

- If an employee withdraws an amount of more than or equal to

Rs. 30000Rs. 50,000 before 5 years but submits Form 15G /15H along with his / her PAN. - When a transfer of PF is from one A/c to another A/c.

- Being an EPF member, if the service has been terminated due to ill-health and he withdraws his accumulation (balance).

- If the employer discontinues the business or any cause beyond the control of EPF Scheme’s member (Employee).

Cases where TDS is applicable

When accumulation is more than Rs. 30000 Rs. 50,000 and the employee i.e. the EPF member has worked less than 5 years, then two cases are there:

- Deduction of TDS will be at 10% if PAN is submitted, but 15G/15H Forms are not.

- Deduction of TDS will be at maximum marginal rate i.e., 34.608% if PAN is not submitted.

Flowchart: TDS on EPF Withdrawal

Some other important key points:

- If the subscriber has submitted all the required forms, then he/she will get an exemption from TDS with no taxable income.

- TDS will be deducted under Section 192A of Income Tax Act, 1961 and it is deductible at the time of payment.

- Form 15G and 15H are self-declarations and may be accepted in duplicate.

- If the amount of withdrawal is beyond 2,50,000 or 3,00,000 respectively, then Forms 15G and 15H cannot be accepted.