The approach behind the Employee Provident Fund (EPF) scheme is to provide significant benefit to the employees at the time of their retirement. The scheme specifies that a nominal amount is deducted from the salary of an employee as a contribution towards the fund. According to the latest circular, which has got affected from June 1, 2015, changes have been made regarding the Income-tax rules on the EPF withdrawal by one of the biggest retirement funding associations worldwide, Employee Provident Fund Organization (EPFO).

(Update: Budget-2016)

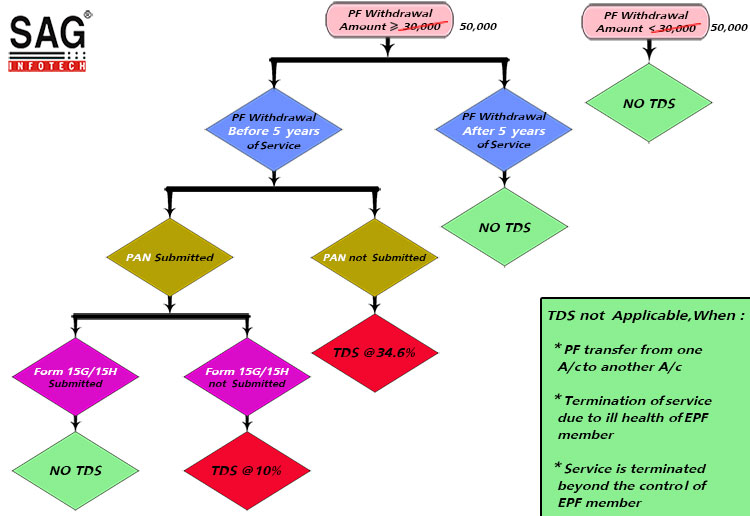

Payment of an accumulated balance to pay an employee from PF, the threshold limit increased from Rs. 30,000 to limit Rs. 50,000. So, TDS is not applicable if PF withdrawal amount is less than Rs 50,000.

PF Withdrawal Rules associated with TDS

Cases where TDS is not applicable

- If the amount, which is to be withdrawn as PF is less than

Rs. 30000Rs. 50,000. - No tax on pf Withdrawal after 5 years or more of continuous service.

- If an employee withdraws an amount of more than or equal to

Rs. 30000Rs. 50,000 before 5 years but submits Form 15G /15H along with his / her PAN. - When a transfer of PF is from one A/c to another A/c.

- Being an EPF member, if the service has been terminated due to ill-health and he withdraws his accumulation (balance).

- If the employer discontinues the business or any cause beyond the control of EPF Scheme’s member (Employee).

Cases where TDS is applicable

When accumulation is more than Rs. 30000 Rs. 50,000 and the employee i.e. the EPF member has worked less than 5 years, then two cases are there:

- Deduction of TDS will be at 10% if PAN is submitted, but 15G/15H Forms are not.

- Deduction of TDS will be at maximum marginal rate i.e., 34.608% if PAN is not submitted.

Flowchart: TDS on EPF Withdrawal

Some other important key points:

- If the subscriber has submitted all the required forms, then he/she will get an exemption from TDS with no taxable income.

- TDS will be deducted under Section 192A of Income Tax Act, 1961 and it is deductible at the time of payment.

- Form 15G and 15H are self-declarations and may be accepted in duplicate.

- If the amount of withdrawal is beyond 2,50,000 or 3,00,000 respectively, then Forms 15G and 15H cannot be accepted.

I left my company in India in Feb’24 and moved abroad. I worked for my last company in India for around 8 years and now I would like to withdraw my PF. Please let me know the procedure to Withdraw the PF and will this amount tax exempted?

“Contact to income tax department”

Hi sir my father is working in a factory for 40 years and 4 years of working period is left and he wanted to withdraw his pf amount( excluding pension) for house construction. so if he withdraws the complete amount at once( having left his working period left) any tax or TDS is applicable for it and for such purpose which form should be filled, how much tax it would be please kindly knowledge me in this regard.

Any PF Amount withdraw before 5 years is taxable and any amount withdraw after 5 years of continuous service is exempt.

I had been employed with a firm and got UAN(1), when I left I withdrew my PF too and that UAN(1) closed[Duration of working – 2 years] if the 2nd company I got UAN(2) when I left and joined 3rd company that UAN(2) was carried forward [Duration of working in 2nd and 3rd company combined is 3.5 years]. Under my PAN, only UAN(2) is showing. So:

1. do I fall under Less than 5 years of service and hence have to fill Form 15G (as every time I applied they are asking me to fill from 15G).

2. If Yes, then the total estimated Income for PY should be PF amount + Approx Salary?

Need help with these 2 questions.

Is TDS applicable on the whole amount of Employers share, Employees Share & even Pension amount if it reaches 50000/-

Or it is applicable only when the employer & Employees share is more than 50,000/-

Please clarify this doubt.

Please clarify Question

I worked for a company for 4 years (Jyly 2011 – June 2015) and I have one UAN(1) for this. Currently, I am working with another company for the last 4 yrs and 7 months(July 2015 – current) and here I have new UAN(2). Also, the account/EPF transfer of the previous company was not done yet.

Now I want to withdraw my full EPF from the previous company – UAN(1). The reason for leaving service is mentioned as “CESSATION (SHORT SERVICE)” for UAN(1). The combined EPF amount is more than 4 lacks. My question is here if TDS will be applicable for the withdrawal. if yes, then is it on the total amount or just on interest received.

Withdrawals of PF before completion of 5 years of continuous service are subject to tax. Withdrawals after completion of 5 years of continuous service in the EPF are tax-free. So if you withdraw the PF amount before the completion of 5 continuous years of service, the principal amount, as well as the interest accrued, is subject to tax.

Sir, I worked for an MNC company for the period of 14 years and during this period PF contributions were contributed continuously. Then I resigned the job and remained jobless for the period of six months (No PF contributions). Then, I re-joined the same company as a consultant (contractor) and a fixed PF amount is contributed every month after creating a new account. Employer is suggesting to transfer old PF amount to new account (of course same UAN ). But this contract is only for 24 months! So my questions:

1. Is it good to transfer old PF amount to new account? If yes, when I withdraw after 24 months, is there any TDS? ( please note 6 months gap between two jobs).

2. I am 49 years old and can I withdraw all components of PF (my share+Employer share+pension amount)?

Please advice,

Thanks

Legally an employee should transfer his PF account to a new company when he changes his job. Yes, You can transfer Old PF account to new one simply through online process.

If you want to withdraw PF amount and if you have completed 5 years of continuous service in single or multiple companies, you are eligible to withdraw PF amount and the return are tax-free. As you completed 14 years service so you can withdraw PF amount and it will be tax-free.

If you withdraw PF amount after 24 months, treatment will be the same and withdrawn PF amount will be tax-free because you have completed 14 years of continuous service.

Sir,

I have the following Queries-

1) can UAN number be generated for Old In-operative Account for year 2007-2008 ?

2) How can I get Date of Joining and Date of Leaving details if my Ex-employer is lost.

3)If I Physically Visit Regional EPFO , The process of My Name correction if required may resolve in one day?

4) How can I follow up for above process and check the progress?

Hi,

I have left an organisation after 6 years and joined another organisation, but due to some situation I have left the same after 5 month, but I have transferred my pf amount old organisation to new organisation, currently, I am not working, can TDS applicable when I withdraw my pf amount please suggest.

No TDS will be deducted if the PF amount is withdrawn after a continuous service of 5 years.

Hi,

I applied for pf advance under form 31, they approved Rs. 7500 and received that amount. Now I am terminated and unemployed and applied pf amount only under form 19 for total amount Rs .47000, my UAN not attached with PAN due to an error in my father name. I have 2 years of experience.

For this transaction tax would be applicable?

Please advice.

If the amount has been withdrawn before completion of 5 years underemployment and reasons other than termination by reason of the employee’s ill-health, or by the contraction or discontinuance of the employer’s business or other cause beyond the control of the employee, the withdrawn amount will be taxable.

I have served in my previous organization for less than 5 years from May 2010 to April 2015. And I have withdrawn PF after 7 years in Nov 2017. My question is whether this PF amount is taxable?

It will be taxable since word “continuous employment for 5 years” have been specified to be eligible for exemption.

I have served in my previous organization for less than 5 years from May 2010 to April 2015. And I have withdrawn PF after 7 years in Nov 2017. My question is whether this PF amount is taxable?

Thanks,

I was asked to resign after serving for 4.5 years i.e June 2016. After 5 months of unemployment in November, I applied for PF transfer in UAN no. Being Pvt PF Trust they denied and asked me to file for the refund along with Form 15-G/15-H and assured it will not be taxable. Due to the difference of name in Bank A/C and PF, a/C refund was not made in FY 2016-17. subsequent to corrections and resubmit of documents refund was made in October 2017. They deducted TDS on the EPF Refund. In Dec 2016 I got employed and got the refund of 100 % tax deducted for being low in income. Whereas with this additional income of EPF taxable income falls in 30 % slab. This way there is double penalization. Please clarify a. is the EPF withdrawal is taxable since refund has been made after 5 years through years of service is < 5 years. (b) If it is taxable why not this income be considered in the FY 2016-17 in place of 2017-18.

Your suggestion is important and where and how the case be presented in the taxation department.

Thanks and regards,

I HAVE WORKED IN A COMPANY FOR 5.5 YEARS. EMPLOYER HAS DEDUCTED PF FOR LAST 3.5 YEARS, I HAVE RESIGNED ON COMPLETION OF 5.5 YEARS. AND JOINED OTHER COMPANY WHERE NO PF DEDUCTION. I HAVE WITHDRAWN PF AMOUNTING RS. 251608.00 AFTER 6 MONTHS OF LEAVING PREVIOUS COMPANY.

PF DEPARTMENT HAD DEDUCTED 10% TDS REFLECTING IN 26AS. PLEASE ADVICE THE AMOUNT WITHDRAWN WILL BE ADDED TO MY INCOME OR NOT. CAN I CLAIM FOR REFUND?

REGARDS

KM GANGWAR

I am retired in the month of April 2018. I want to retain the P.F. amount hoping to fetch interest another 3 years even TDS is deducted on interest. I have so far not withdrawn my P.F .at any time. I understand the current P.F.rules does not permit and if I do not withdraw the total amount no interest is paid and it goes to inoperative account.

Please clarify the above is correct. Request for immediate advise.

Regards

I have worked in the company for 2 Years and they terminated my contract because of their poor business. I have PF account and UAN with them. After 6 months I joined another company where I have another UAN. I have not transferred my PF to the new company. Now please let me know

1) Can I have final settlement / withdraw total PF from previous company ? is it taxable since I was terminated and there is a gap of 6 months between these 2 jobs

2) If I resign present company as well and leave both PFs with not joining any other company and withdraw after 58 years what is the Income tax and interest on my pf with both companies.

1) Yes, you can withdraw the PF amount. It will be taxable since the amount is withdrawn before 5 years.

2) In the second case, if you withdraw the amount after 5 years, then no tax liability will occur.

Hi Sir,

I would like to know that my company payroll has been changed, I mean to say that company is still same but payroll changes, in my previous payroll

Pf amount has already been deducted for 4 years my last relieving date is 31oct 2018 and new pf is not merge because of data mismatch problem with the previous pf, and my total pf is 64000 and before this company I had worked for different company for more than 1 year 8 months and I had withdrawn the pf amount ,so my question is my previous 18 month will be add in 4 years or not because previous pf amount I had already withdraw, and many of my friends had withdrawn pf in same company ,they merge both previous and current pay roll but their service are less than me but no amount is taxed, they all get the full amount ,but they had done online, for me please suggest for offline pf withdrawal

I am unable to update my PAN card and my Pf balance amount is around 60k, I already apply online once and was rejected as amount crossed 50k, do I claim it?

Online PF withdrawal is not possible unless KYC (PAN, Aadhar no.) has been done. Contact Department’s helpdesk for issues in updation of PAN.