The approach behind the Employee Provident Fund (EPF) scheme is to provide significant benefit to the employees at the time of their retirement. The scheme specifies that a nominal amount is deducted from the salary of an employee as a contribution towards the fund. According to the latest circular, which has got affected from June 1, 2015, changes have been made regarding the Income-tax rules on the EPF withdrawal by one of the biggest retirement funding associations worldwide, Employee Provident Fund Organization (EPFO).

(Update: Budget-2016)

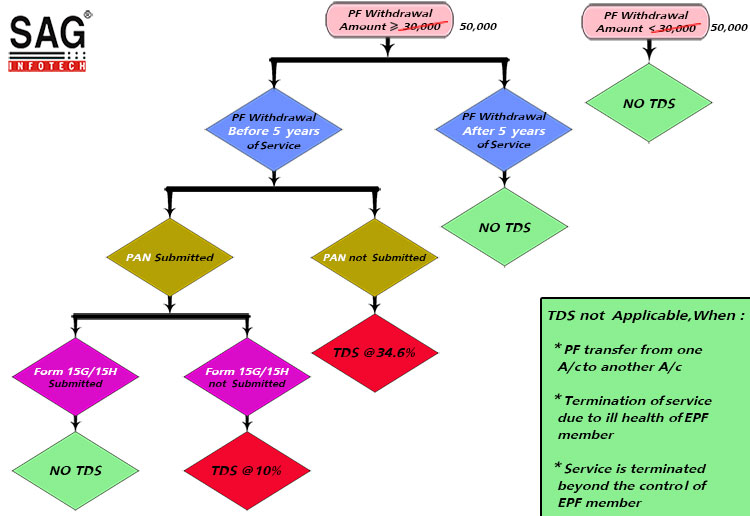

Payment of an accumulated balance to pay an employee from PF, the threshold limit increased from Rs. 30,000 to limit Rs. 50,000. So, TDS is not applicable if PF withdrawal amount is less than Rs 50,000.

PF Withdrawal Rules associated with TDS

Cases where TDS is not applicable

- If the amount, which is to be withdrawn as PF is less than

Rs. 30000Rs. 50,000. - No tax on pf Withdrawal after 5 years or more of continuous service.

- If an employee withdraws an amount of more than or equal to

Rs. 30000Rs. 50,000 before 5 years but submits Form 15G /15H along with his / her PAN. - When a transfer of PF is from one A/c to another A/c.

- Being an EPF member, if the service has been terminated due to ill-health and he withdraws his accumulation (balance).

- If the employer discontinues the business or any cause beyond the control of EPF Scheme’s member (Employee).

Cases where TDS is applicable

When accumulation is more than Rs. 30000 Rs. 50,000 and the employee i.e. the EPF member has worked less than 5 years, then two cases are there:

- Deduction of TDS will be at 10% if PAN is submitted, but 15G/15H Forms are not.

- Deduction of TDS will be at maximum marginal rate i.e., 34.608% if PAN is not submitted.

Flowchart: TDS on EPF Withdrawal

Some other important key points:

- If the subscriber has submitted all the required forms, then he/she will get an exemption from TDS with no taxable income.

- TDS will be deducted under Section 192A of Income Tax Act, 1961 and it is deductible at the time of payment.

- Form 15G and 15H are self-declarations and may be accepted in duplicate.

- If the amount of withdrawal is beyond 2,50,000 or 3,00,000 respectively, then Forms 15G and 15H cannot be accepted.

how many times withdraw from pf advance amount?

Please clarify your query.

I have claimed PF online but my pan is not verified. Is there any chance to stop the PF Claim. Bcz I have not worked for 5years.

Contact to PF dept helpdesk.

Contacted through the mail. Not able to cancel. Can have any contact details or mail id to cancel…

Can I Do tax return if not attached the PAN card later or nowhere to get money back?

Already one time I have withdrawn some amount in my pf. (Pf advance). So how many times I can take the remaining amount. If there are any limits. Example (2 or 3 times) or more than. Please clarify.

No there are no such limits for frequency of withdrawal.

I had applied for Partial withdrawal of EPF. But I had not completed 5 years of service. Then what will be the percentage of TDS deducted from my withdrawal? When the TDS will be deducted. Can the Deducted TDS claim back? If so what is the procedure to claim the TDS Back? How long will it take to claim the TDS back? Please give me in brief.

TDS will be deducted @ 10% and you can claim the TDS deducted by filing ITR for the concerned financial year.

I have completed 5 years and still in the same job, Is it taxable if I withdraw more than 50,000?

If you withdraw after completion of 5 years, then the tax would not be levied.

Hi,

I am currently working in the same office for last two years. Now I am eligible for pf to withdraw? My employee share is 20000 and employee share is 19500. so how much amount is eligible for withdrawing. And also I am uploading my PAN number is shown error “pan verification failed(name against UAN does not match with the name in income tax department)”. So how to resolve the issue. without PAN number I have withdrawn the PF amount is taxable or not. Please guide me.

An Employee cannot withdraw Employer contribution to EPF before 58 years. An Employee can withdraw 90% of EPF balance once he reaches the age of 57 years. EPF membership does not end with leaving the job. Also if employee withdraws an amount of pf before 5 years of service then, the entire amount received is taxable. in case of name mismatch, please check details in your pan and name against UAN.

Thanks for your information. If below 5 years of service and also continuing the current job, withdrawing the amount of below 30000 is taxable or not. Because you mentioned the above chart below 50000 is not taxable. Please clarify.

If you withdraw below than Rs. 50000/- then TDS will not be deductible.

Thanks for your information…

MY PF AMOUNT BELOW 5OK. I NEED TO SUBMIT PAN OR NOT FOR WITH DRAWL OF AMOUNT PLEASE REPLY.

As per new KYC rules under PF, PAN number is mandatory to be linked with PF a/c.

I worked in two organization 1st Org 7 Years and 2nd org 6 Months. I transferred my pf account but system showing “CESSATION (SHORT SERVICE)”.So my PF is taxable or not.

Hi,

I have worked for 2.5 years and I would like to claim the PF via online mode. My PF amount withdrawal will be >50000 and hence I have to submit the 15G form for tax exemption. Is there a way to submit 15G form online?

You just have to submit Form 15G declaration in a hard copy to the TDS deductor. The deductor would file consolidated Form 15G online.

There is no such method to file Form 15G online.

Hi,

On UAN name is Rajesh

Pan name is Rajesh Mehta (verified on UAN)

PF amount less than 50k.

Then can I withdrawal PF.

Yes, you can withdraw the amount.

If PF amount 77k then withdraw the amount or not with same above issue.

Yes, you can withdraw the same.

I have transferred the amount from my old pf account to the new pf account through online.Now the employee share and employer share amount are reflecting in my new pf account but the pension contribution amount is not added from the old pf account to the new pf account. Why it is so?and how can I get that pension amount?

It will get transferred within 20-25 days but if still, it doesn’t work, contact to EPFO helpdesk.

I have worked with ICiCI bank for about 4 years, left the job in 2010; now I am working in a company from 2 years, got UAN from current employer after checking the epfo portal, I can see only last 2 years of deposit to my pf account, as I want to withdraw money for PF this is attracting TDS as it is only showing 2 years of service, how to add up that period when no UAN service was available.

I have completed 3 years of service before leaving my last company. However, I had transferred my PF from my previous employer where I had worked for 7 years. Will my PF withdrawal be taxable? The online portal shows the DOJ of PF as the date when I joined the last company.

please help!

As you have completed 5 years of continuous service (in total), no withdrawal will be taxable.

Sir, I have been working for 3.5 years in the same organisation just I want to avail the pf amount for medical emergency due to this reason can I get pf amount without tax. I have medical reports also available

As per new rules of withdrawal, for medical treatment purpose, you can withdraw the amount up to 6 times of your monthly salary or available fund in pf a/c (whichever is lower). But TDS on that amount will be deducted and you can claim the refund of TDS while filing the return of concerned FY.

Sir, I want to online claim EPF Amount but whenever I click on claim form tab it shows under maintenance. I am suffering from the last 10 days. EPFO is the highly reputed organisation and such a loose point?

Contact to department.

I had worked in a company for 43 months and I left that in last year in April – 17, since then doing business and had not withdrawn PF money, will this 12 months period add to earlier 43 months and can i withdraw PF after another 5 months without tax liability when total 60 months period of PF account is completed, although 17 months are such when no PF contribution happened in my account

As per rules continuous employment of 5 years will be counted and also if you remained unemployed for more than 2 months, you can withdraw the amount and that too will be taxable. It doesn’t matter if you withdraw it after completion of 5 years as you are not employed now.

I have worked 2.5 years in the old organisation but now I am working in the new organisation. My old pf account has RS 1 lac amount. I want to withdraw that amount. Because I have two UAN number one for old and second one for the new organisation.

So let me know does TDS deduction applicable on this amount or not.

I am right now working in a company with 4.4 years of experience. Right the amount share in my account is as follows: i) Employee share: 66,612 ii) Employer Share: 21,459 iii) Pension Contribution: 43,502

So I am planning to withdraw the above amount after 5 years. So will it be taxable? What are all the components that I can withdraw (only Employee & Employer share or all including Pension fund)? If I plan to switch a company in between do I need to transfer the amount or do I need to open a new account for withdrawal? If I do it will that be taxable? Confused with all these questions please do clarify the same

If you withdraw after completion of 5 years, then no amount will be taxable and if you switch your job then you not need to open a new pf account, you can continue with the same account and can withdraw after completion of 5 years (in total). But if you withdraw the amount and open a new a/c, the withdrawal will be taxable.

With reference to your statement that I can continue with the same account and can withdraw after completion of 5 years (in total), will it be possible to withdraw all the amount from my current pf account while I am working for a company in present? Do I need to provide a valid reason for doing so or else I can withdraw my amount just like that as I have completed 5 years of service including my previous company experience?

You can withdraw pf amount while on the job only for the defined reasons as are stated by EPFO and also the eligible amount and requirement of minimum service period are provided by EPFO, so you have to look after for these before withdrawal.

Dear Sir,

I have completed my 3.5 years service, so now want to withdraw the pf amount without any deductions, request you to suggest, what should I do.

IF pf amount is withdrawn before 5 years, TDS @ 10% will be deducted.

Hi,

I have worked for 3.9 years in 1 organization, Is 10% TDS applicable in cessation (SHORT SERVICE) case? if yes, then how can I remove this deduction. Can I apply form 15/H online?

PF withdrawal before 5 years will attract TDS @ 10% and form 15H is for no TDS deduction on interest paid by the bank, so this form is not applied in your case.

Sir,

As I have resigned 3 months ago and I have 9.7 Years of Aggregate service. 10% TDS is applied to my online claim of Rs. 70000. Please explain why and what can I do now?

As per rules, TDS would not be deducted but as TDS has been deducted, you can claim the refund for the same by filing ITR for the concerned period.

I have completed 1.6 years of service in the same company and my current PF balance lying as Rs. 39,000 including all employee, employer and pension contributions. So now I want to withdraw the money. So is there any TDS or tax deductible for this amount???. So please advice.

As you are withdrawing amount before 5year and as your withdrawal amount is more than Rs.50000, so TDS @ 10% will be applicable.

I am jobless from last 4 months, I have 9.8 years of aggregate service (in 2 companies).

I have two queries –

1) Can i withdraw full PF balance ( employee+ employer share) or only employee share + interest ?

2) can i withdraw partial/full EPS amount using offline procedure in some emergency conditions?

As you have completed 5 years of service, you can withdrew full amount i.e. employees ‘s share/ employer’s share with interest.

You have informed that we can withdraw the entire amount of PF (Employee share+Employers share + interest on both) subject to completion of 5 years of service. However, the new PF rule says that Employers contribution can be withdrawn only after attaining the retirement age. i.e., 58 years. Hence, despite our new rule, can we withdraw the entire amount of PF (Employee portion + Employer portion)

Hi,

I worked in the first organisation for 6 yrs 7 months and 4.5 months in second organisation, together nearly 7 yrs, under the same UAN. At what % TDS will be deducted??

My PAN is not verified, though.

Please advise.

Thanks

Hi,

I have worked in my previous org 3 yrs and left 3 yrs ago so the total of 6 years.

Below is the statement received in my E passbook for PF.

Employee Share 86,789.00

Employer Share 45,967.00

What amount will I receive if I withdraw?

Hi,

I received less amount for my pf withdrawal, when I called pf office, the person from pf office told me that some amount got deducted for TDS as I did not submit the 15g form. This was my last organisations’ responsibility to submit the required form or ask me to submit the same before submitting the pf withdrawal forms.

Can I now ask for the refund of the deducted TDS? What is the procedure?

You can only claim the refund by filing income tax return for the concerned period.

SIR

I was employed with a company for a continuous period of 3 years and then changed my job with a new employer where also I am continuing for last three years. Balance in my PF account of the previous employer is lying in old account whereas the balance of new employer is a new account.

MY query is:

1. can I withdraw from Both accounts, if yes then what shall be a tax liability

2. If I withdraw from old account than what shall be the position

Sourabh

You can withdraw from both accounts but as you have not transferred pf amount from old account to new account and also not have completed continuous 5 years of service, the tax will be charged on withdrawals and as well as if your withdrawal amount exceeds 50000/- EPF dept. will also deduct TDS @ 10%.

Hi,

I had worked 2 years 6 months service with my previous employment and then transferred the PF amount to current employment. Now, 2 years 5 months services are completed in the current employment and I am still working in the current company.

My question is, Shall I withdraw the PF amount (employee’s share) from current company PF account as 5 (2.6+2.5) yrs are completed?

If is it possible, any TDS will be deducted and what %?

Kindly advice.

Thanks,

Selvam

As you have not yet completed 5 years of service, so if you withdraw any amount from PF a/c exceeding Rs. 50000 will attract TDS @ 10%.

I had completed 5 years 5 months service with my previous employment and changed my job in May 2017. Previous employment PF balances not transferred to new employment PF account.

I would like to know:

-whether TDS applicable on previous employment (5+ years) PF balance withdrawal? or

-is it advisable to transfer previous employment PF balances to new PF account and then withdraw?

-any other suggestion is appreciated.

Thanks

TDS will not be applicable if you continuously serve for 5 years.

I have completed 10 years of service in the same company. Now I have quit the job and not joined any other company. Now I want to withdraw PF, Can I withdraw entire PF amount? Is TDS applicable even working more than 5 years? kindly advice

If PF amount is withdrawal after 5 years, then TDS will be deducted.

I have 18 lacs pf accumulated (employee + employer portion). I have completed more than 5 years of service.

If I withdraw PF will I have to pay

1) Pay TDS during withdrawal and/or

2) At the time of filing return (being treated as an Income)?

I am in financial crisis and needs the fund very badly.

Request a kind response from a fellow member here on site

I shall be grateful to get a response.

Regards

I have withdrawn my PF and pension amount online after 5 years of service (starting from May 2012) recently. In this 5 years, I have worked in 2 companies with a gap of just 5 days in joining the next company. I have received my pension amount in full as specified in the PF passbook i.e Rs.1,38,000 but when I applied for pension withdrawal there was a reduction in an amount by Rs. 6,937 (I received Rs. 42,575) where the actual amount in PF passbook was Rs. 49,512. Is there a TDS? Do I need to raise a complaint? Please comment.

As per sec 192A, TDS will be deducted from the withdrawal of PF amount exceeding Rs. 50000/-

I was withdrawn 200000 from my pf account, but an amount of 184000 only debited in my account, Is there any tax liability on me. My annual income in tax slab

Generally on withdrawal of amount from PF exceeding Rs. 50000/- attract 10% TDS.

My pf amount was 150000 on Apr-2017 and when I withdraw my pf amount then pf department 10% deducted TDS from my pf amount, so I want to know how I can withdraw my TDS amount?

If your amount of PF was not liable for TDS deduction then either you can claim the amount of TDS as a refund after filing the ITR for the period 2017-18 or you can ask the Pf department to rectify their mistake.

I have 3.4 lakh PF amount and I left my job in Feb 2017 and started working a small startup from July 2018 ( No PF there). Now I wanted to take out my PF through the online system only as my last employer has shut shop in India (it was a Singapore based organization). The online UAN profile shows my AAdhar number and PAN Numbers.

1. Can I assume that my Aadhar and PAN KYC has been already done by my previous employer?

2. what is the post Tax PF? I will get into my account? 3.06 (after deducting 10%)? or are there any other deductions?

3. I stay in Mumbai and there are like 10+ EPF offices? So can I submit my forms directly to any PF office? Also, can we submit everything online or we have to physically submit the documents to the offices?

I have withdrawn the PF in Aug 2017 i.e. before 5 years of continuous due to personal reasons. The PF amount is say Rs.4,00,000/ and TDS deducted Rs.40,000/- (at 10% along with form 15G/H). Now I got the Job and my Income from salary would be Rs.7,00,000/- in this FY.

My question is, PF withdrawn amount will be added to my income, in this case, i.e. Income from Salary 7,00,000/+ PF withdrawal amount 4,00,00/- = 11,00,000/-?. OR I need to pay the tax towards my salaried income i.e. 7,00,000/- only?

Please advice.

In case of withdrawal before 5 years of continuous service, the whole amount shall be chargeable to tax. thus tax will be levied on Rs. 11,00,000 in your case.

Once you left the service and completed 2 months without job then you are eligible to withdraw both portions (Employer’s and your) by submitting forms either through your employer or applying directly to UAN website (in case applying on UAN portal you need approved KYC ..aadhaar card and Bank account)

I have 84k Pf amount I submitted all documents through online. PF withdrawal also requested through online but my pan says not verified. may I know the how much TDS will deduct and it is credited to My TDS account or not?

As per the provisions of the TDS Act, the rate of deduction is 10 percent on the submission of the Permanent Account Number (PAN). Deduction of TDS will be at maximum marginal rate i.e., 34.608% if PAN is not submitted. Yes, it will be reflected in 26AS.

I have worked in a private company for 4 years where my pf was getting deducted and i have another 3 lakh rs of accumulated pf balance. Now I have taken up another job where the employer is not deducting pf. When can i withdraw my accumulated pf balance and will it be taxable ? Should I leave it with the PF organisation for 1 year so that 5 years is completed and then apply for withdrawal? Please advice

After how many days of resignation full amount of pf can be withdrawn?

Kindly help for same

The EPF members cannot withdraw full PF amount before attaining the age of retirement. The maximum withdrawal on cessation of employment cannot exceed an amount aggregating employee’s own contribution and interest accrued thereon. You can withdraw your contributions + interest portion only. The employer’s portion can be withdrawn after attaining the retirement age

I have worked in a private company for 2yrs. Where pf was cpf. After that I join a state govt firm which is under gpf scheme. So it is mandatory to withdraw my cpf from the last company. Now I want to know whether this money is taxable or not.

I have completed 12 years of service in the same company. Now, if I have plans either to quit job permanently or shift to other job, can I withdraw entire PF amount per latest tax rules. Heard that Employer PF and interest cannot be withdrawn. Please advice