The GST law would pose the major purpose of the tax which is to get collected merely on the value-added. A method is there in India via which the tax suffered at the before time would be permitted to get lessened from the tax subjected to get paid on the supplies.

The same prevents the tax on tax and at every stage, the load of the net tax would get reduces. The statement of the purpose during the GST bill introduced in the year 2014 furnished that the goal was to eliminate the cascading effect of tax. The same would be in line with the CENVAT law instead of the VAT laws of the States.

Discussing the GST Input Tax Credit impact on the yearly returns and the discussion of the method for the same in which the disclosures related to ITC are required to be incurred in the annual return of the GSTR-9.

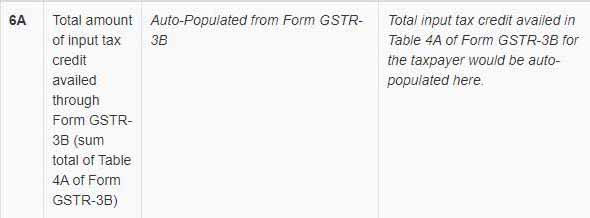

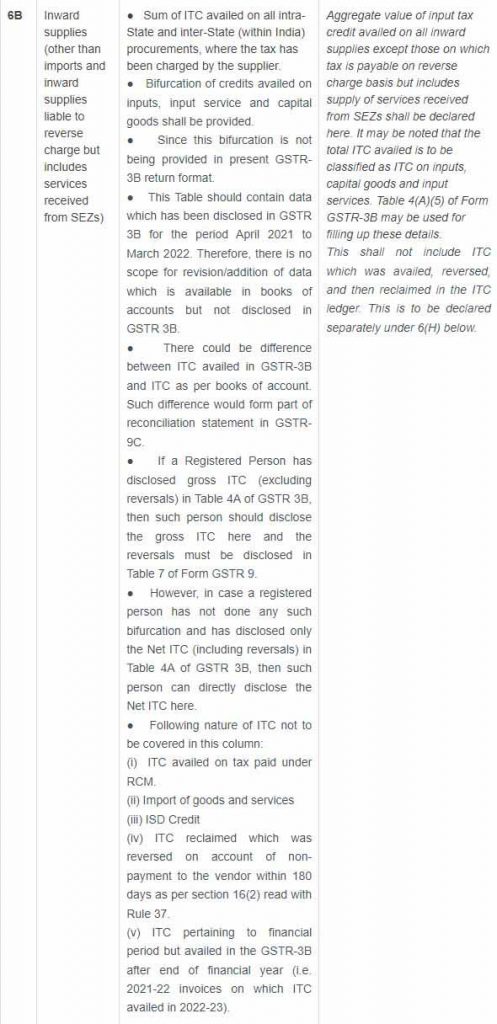

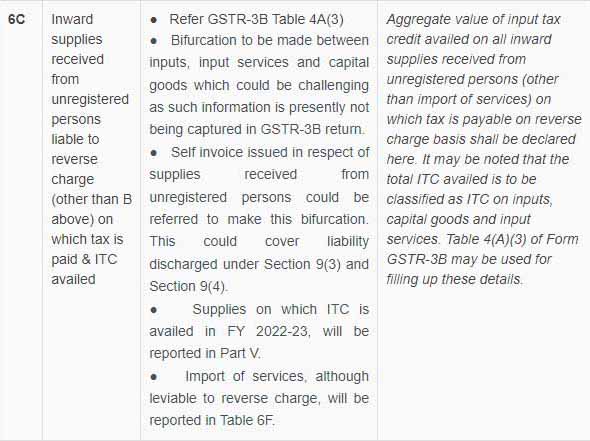

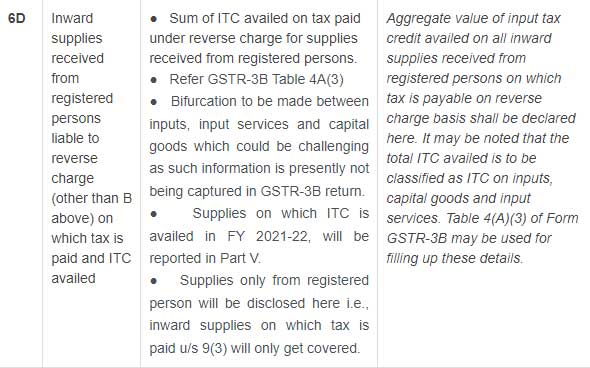

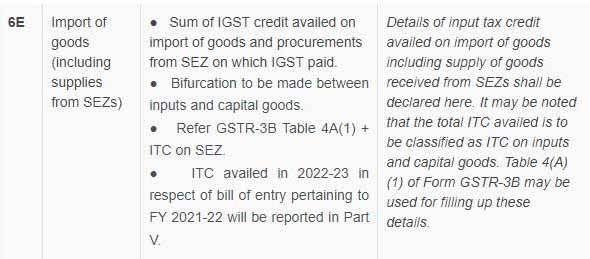

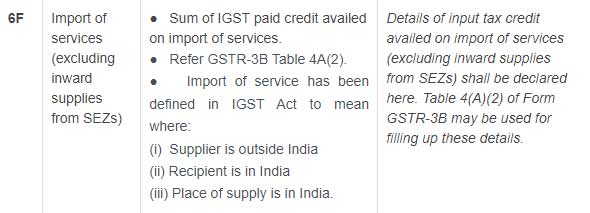

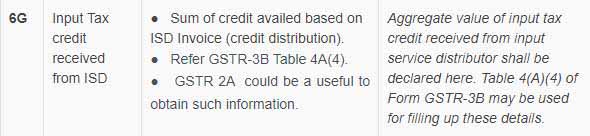

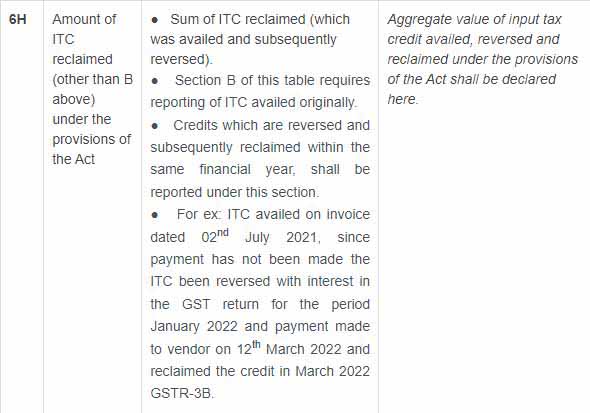

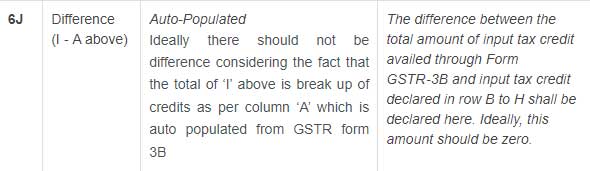

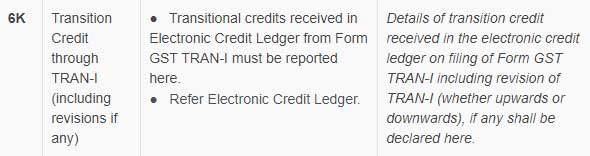

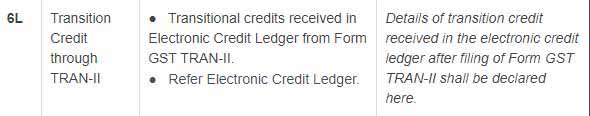

Table 6 furnishes for reporting of gross input tax credit (ITC) claimed via the registered person in the financial year:

The mentioned below table should be filled as per the ITC claimed in GSTR-3B furnished for the fiscal year. Prior to furnishing the table, the same would be essential to ensure that the basic conditions to avail of ITC would meet. The registered person is required to show the following:

- He is in possession of a tax invoice or debit note provided via a supplier registered under this statute, or same another taxpaying document (s) as defined in Rule 36.

- He would obtain the goods or services in which the goods or services furnished via the supplier to the recipient or other individual as per the guidance of such registered person, it is treated that the enrolled person has obtained the goods.

- Under Sec. 41 or Sec. 43A, the recipient must not assure that the supplier is obligated to file the tax. Rule 36 specifies that input tax credit is provisional until shown in GSTR-2B. But the apex court decision in Eicher Motors supported by the Dai Ichi Karkaria sees that the credit was an indefeasible right until precise conditions would not meet. Hence in the GST, the same would resemble to be correct instead that a concession or deduction.

- The recipient has filed the return under Sec 39 which he has furnished Form GSTR-3B.

Other Points to be Considered for Table 6 in GSTR 9

- In which the goods against the invoice would be obtained in lots or instalments, the enrolled individual is qualified for availing of the credit related to the whole invoice on the receipt of the last lot or instalments.

- Under the Income Tax Act 1961, in which the enrolled individual would claim for the depreciation, on the tax element of the cost of the capital goods along with the plant and machinery, the ITC on the mentioned tax elements is not permitted.

- The enrolled individual would need to proceed via the workings of the Fiscal year 2020-21 to find if the information on RCM (Reverse Charge Mechanism) liability is shown in FY 2021-21 yearly return. If yes, again the disclosure is not needed in the fiscal year 2021-22. When the information does not be shown as per the press release, the same sort of information would need to be displayed in FY 2021-22.

- The enrolled individual might obtain the identity when expenses that are responsible for the GST beneath RCM. if yes, the liability might be released. The same sort of information is to be provided in the fiscal year where the tax is to be paid.

- A question can come on the eligibility of credit of GST paid beneath RCM after October of the next year since the time limit is the last date to file a return for the month of October. The same might be seen in that the credit might happen merely for the matter in which the self-invoice is needed to get raised. The same could be argued that the self-invoice date is to be recognized for revealing time restrictions. Therefore the same would not be free from litigation. For the case of the RCM payments on the procurement from the enrolled individuals, this argument does not get happened since the same is not required to raise self-invoice.

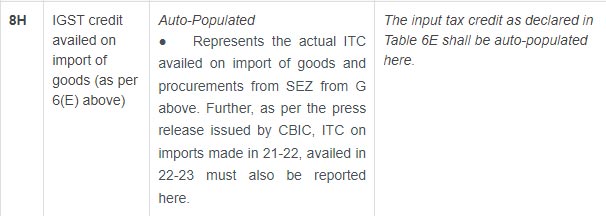

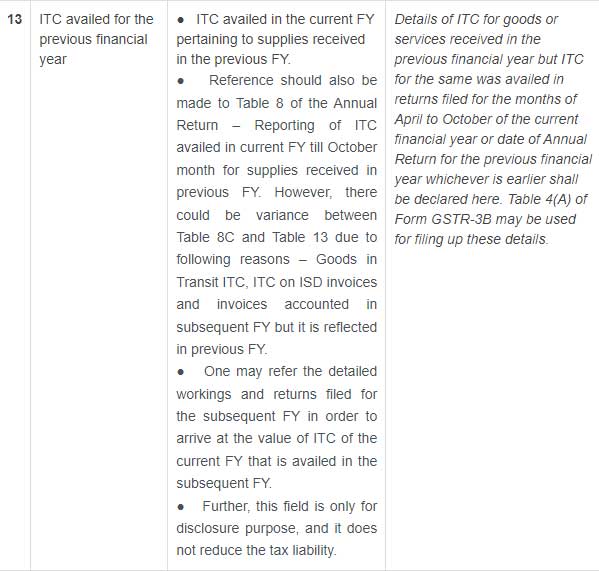

- Towards the objective of table 6E the same would make transparency in the press release of June 2019 that the credits claimed on goods imported in the next year April to October can also be summed. It creates a distinction in table 6J that results via comparison of the total credit opted actually for the fiscal year with the breakup.

- From our perspective, to address the problem that arises in table 6J, the other way could be to opt merely for credit claimed in the fiscal year. The same needs the adjustment in Table 8 which is discussed post Table 8 below.

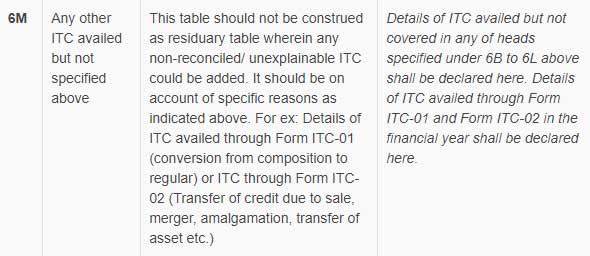

- For the intention of row 6M, the mentioned information could be recognized in which ITC-01 would need to get furnished.

- The application furnished for enrollment in 30 days from the date upon which the individual would become responsible for the registration in which he is qualified to opt for the input tax credit on the inputs contained in the stock and semi-finished or finished goods kept in stock on the day preceding the date from which he becomes obligated to file tax.

- The voluntary enrollment was received, and the Input tax credit on the inputs kept in stock and semi-finished or finished goods kept in stock on the day immediately preceding the date of grant of registration can be claimed.

- If there would be a transformation from the composition to the regular scheme to avail credit on the stock.

- When the exemption of the goods or services would apply to tax.

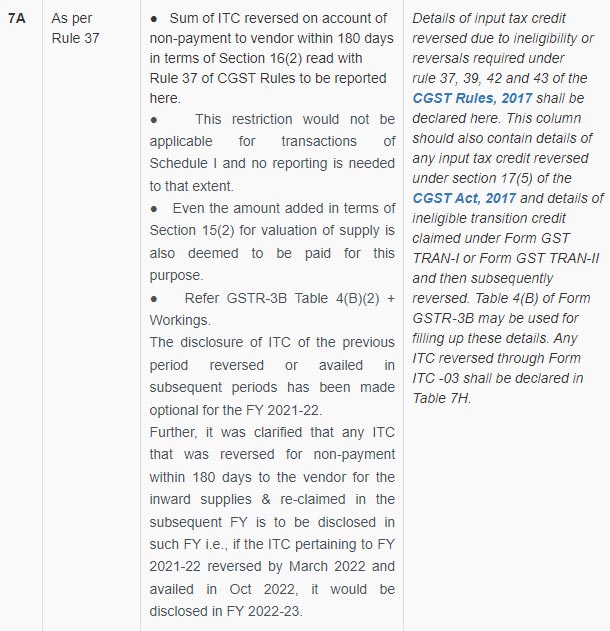

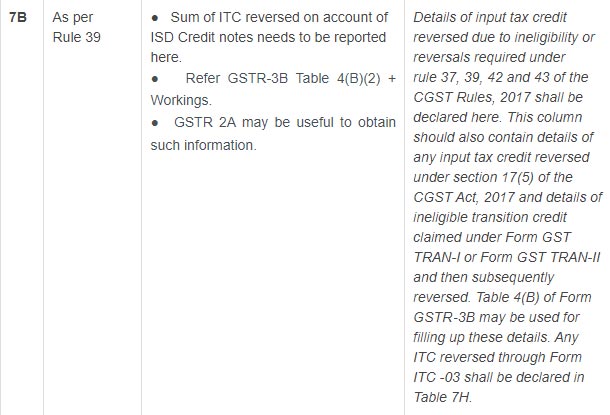

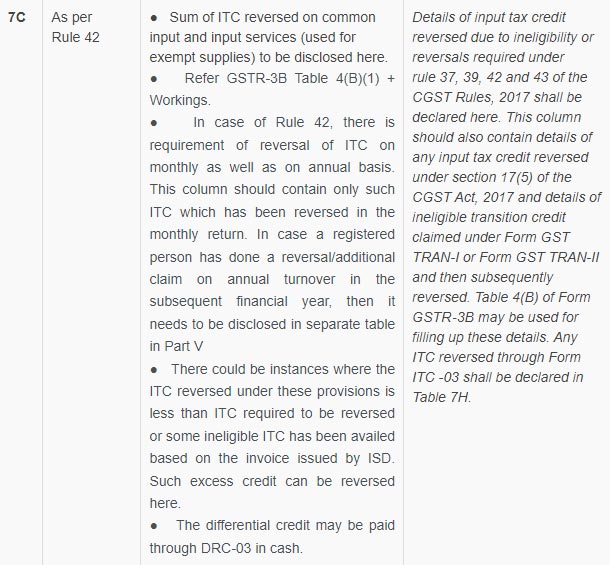

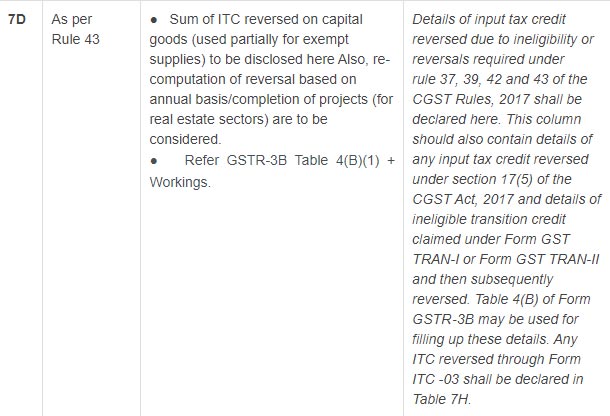

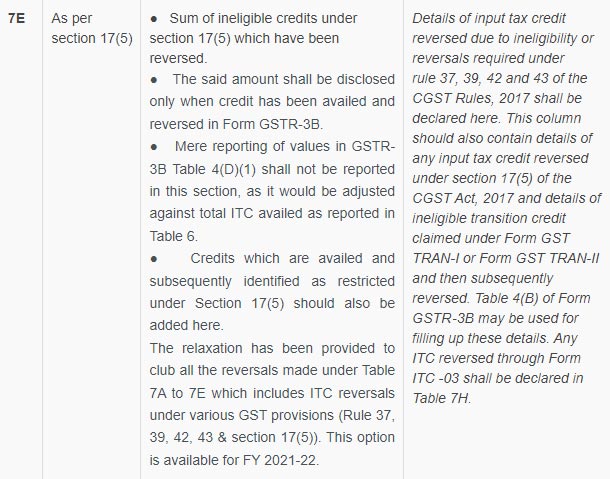

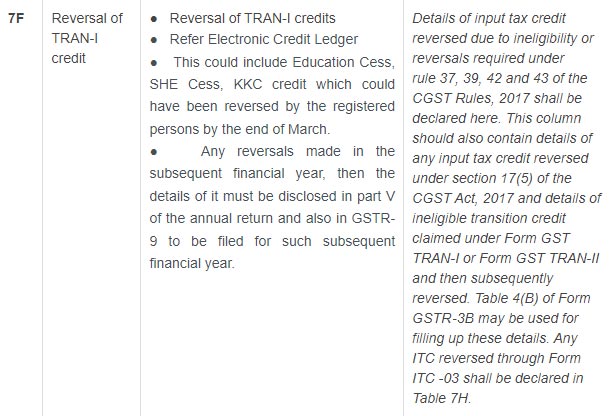

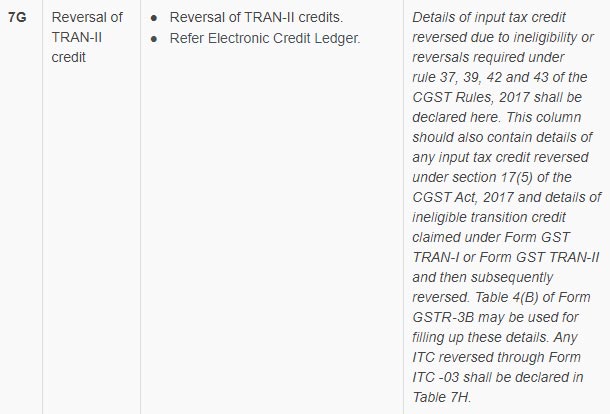

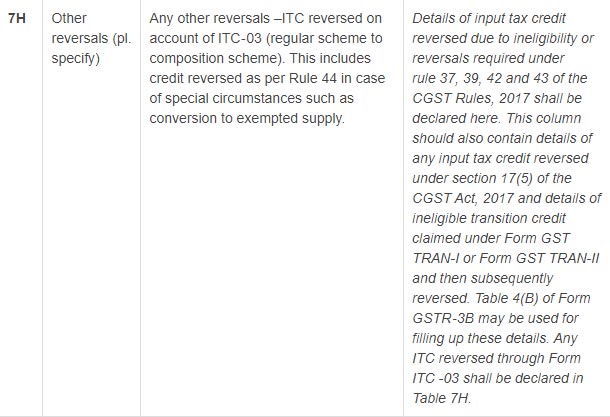

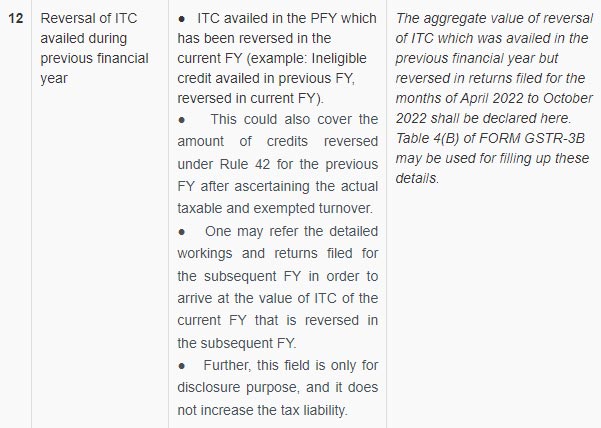

Table 7 furnishes that for reporting of ITC reversed via the registered person and Ineligible credits for the fiscal year.

Additional Points for Table 7 in GSTR-9

As per the press release provided via CBIC on 03rd July 2019:

- There would be no ITC that could be reversed or claimed via yearly return.

- When the assessees see that they are responsible for reversing any ITC then via Form GST DRC-03 separately, they might accomplish the same.

- In our opinion, no revenue implications because of the disclosure of the ITC amount to be reversed in table 7 of the GSTR-9 since the same would results in the payment via DRC-03, hence the credit reversal would take place when the same is voluntarily reversed by way of DRC ‑ 03 and only disclosure of the same incurred in the Annual returns.

- Towards the intention of claiming the back the credit reversed for rule 37, no time restriction would be there. As the acknowledgement is paid to the supplier The credit could be claimed.

- The information must be shown in table 12 and not in table 7 when any Input tax credit claimed for the fiscal year 2021-22 would be reversed in the Fiscal year 2022-23.

- For the intention of the reversal of the credit in table 7E, the enrolled individual must relate to the limitation of the ITC on the inputs, input, and capital goods. The sales promotion policies like free supplies to the sales quantity, buy 1 get 1 free supplies, and distribution of goods to distributors like gold coin, dairy, pens, and others would be learned towards the credit impact. A person can direct for the GST circular no.92/11/2019 on 07.03.2019 in which transparency would be provided on the sales promotion schemes, samples, and discounts.

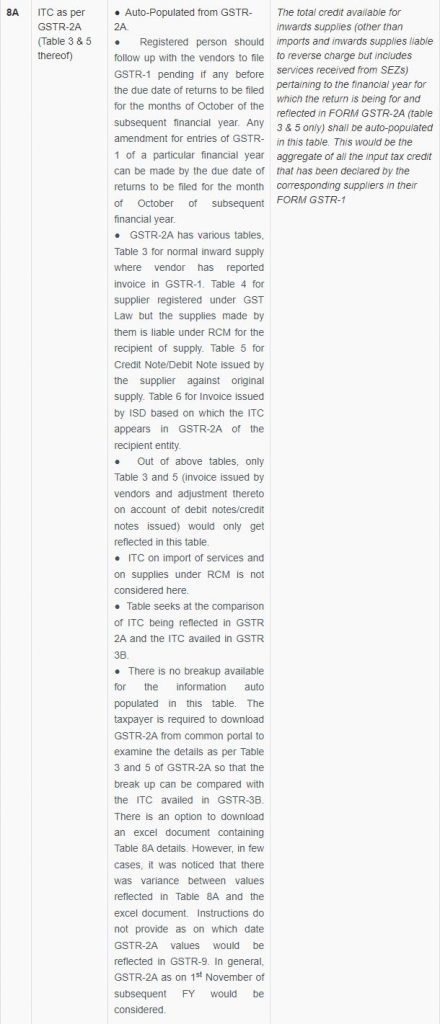

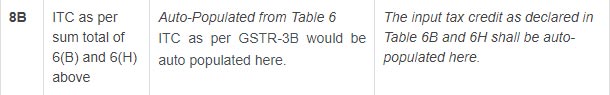

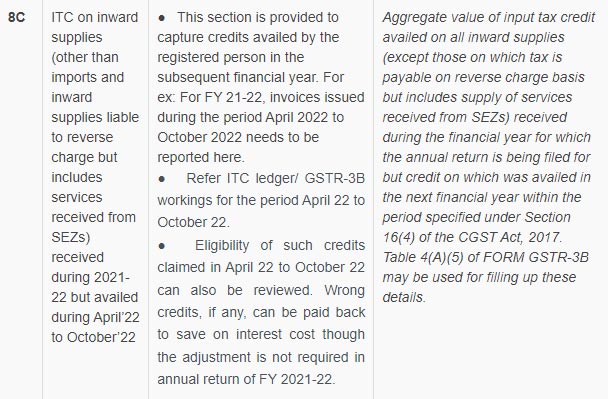

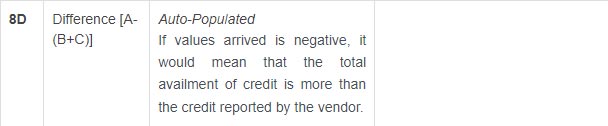

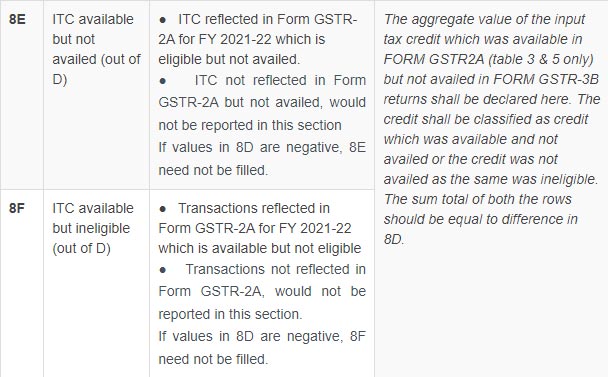

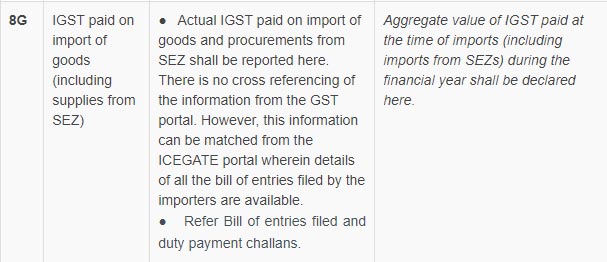

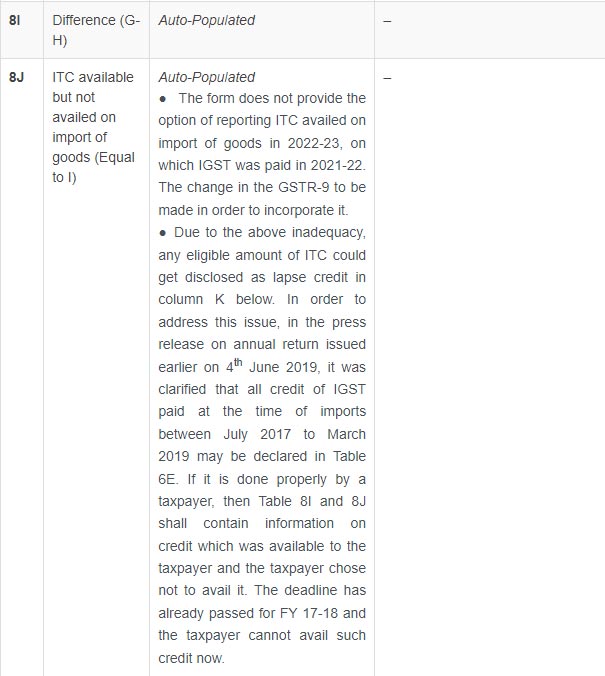

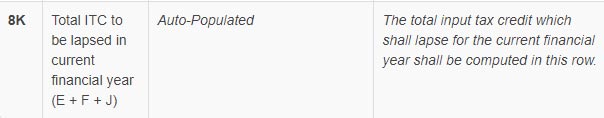

Table 8 furnishes for Input tax credit summary which is available under GSTR-2A & IGST paid on the goods import and a comparison with claimed ITC.

Additional Points for Table 8 in GSTR-9

- GSTR-2A statement would be faster, it could be revised in the data and when the data would be uploaded via the vendors. The same might consists of bogus entries for reasons like false GSTIN used by vendors, the wrong type of tax updated, and others.

- Without any data, the inward supply would not term the disallowance of credit when the conditions of section 16 would be fulfilled.

- The variation between table 8A and Table 8B+Table 8C would be needed to be explored. When the outcome in table 8D would be negative the reasons are to be revealed. Wef Oct 19 rule 36(4) will come into force, till the eligibility as per section 16 must suffice. Hence rather than above, it could ensure the eligibility and the availability of the document.

- When the table 8D would be positive the cause can be the short credit claim via the taxpayer the entries that do not fed via the vendors, entries for restricted credits in 8A such as section 17(5), used towards exempted supplies, etc. Reasons to be revealed for choosing the precise measure.

- When 8D is positive because of the credits missed out or because of the ineligible credits as per section 17(5), the information is to be furnished in Table 8E and 8F. Table 8D could be compared with a total of 8E + 8F to assure the preciseness.

- For the matter of tables 8A to 8D, the taxpayer would secure the choice to furnish the information in a separate file that has been converted to the PDF form in GSTR-9C. Via professional certification, the same sort of form need not secure the certification.

- Related to Table 6E, the same would be specified that the IGST paid on the import for the whole fiscal year for April to October of the next year could be comprised vide press release. It renders the reconciliation difference in table 6 since the matching performed with the actual credit availed for the Fiscal year excluding information for April to October of the next year. The same shall be performed to address the technical problems in the format in which there is no provision incurred in table 8 to display and adjust the IGST furnished in the fiscal year while claimed for the next fiscal year. The same can be directed to the disclosure of the amount in table 8K as missed credit.

- Hence in our opinion, the other way would release the information of the IGST paid on the import to the scope of input tax credit claimed for the fiscal year in table 8G along with table 6E could comprise merely the information of the IGST paid in the fiscal year. The same shall track the technical problems that may come in the form. Table 8G could comprise the IGST value paid in the fiscal year where the same would not be qualified for the credit that will get missed. The other way to comply, with the precise workings, would be to maintain them for preventing future confusion.

- The IGST filed however not claimed can be reviewed to know the causes. When not qualified, it could be left to get missed. When the same would be missed then the action for performing the claim the credit. The same is essential to find out that there would be a view that the restriction mentioned in section 16(4) for claiming the credit by the month of October of the subsequent fiscal year is only for invoices and debit notes. The ground to avail credit on import is a bill of entry which is not limited via the time boundary.

Tables 12 and 13 give a report of transactions related to the former fiscal year which are reported via the enrolled individuals in the period April 2022 to October 2022 in the returns

Closure: The purpose of the statement during the GST bill would be presented in 2014 that furnishes that the major purpose was to eliminate the cascading effect of tax. The same complied with the CENVAT law instead of the VAT statute of States.

Apex court’s decision in the Eicher Mothers that would be assisted by the Dai Ichi Karkaria sees that the credit was an indefeasible right until precise conditions would not be fulfilled. Hence in GST, the same would resemble to be correct instead of the concession or deduction.

Hence the claim of the ITC must be appropriate to the statute as mentioned and any reversal and revealment must be as per the law and rules specified in it.