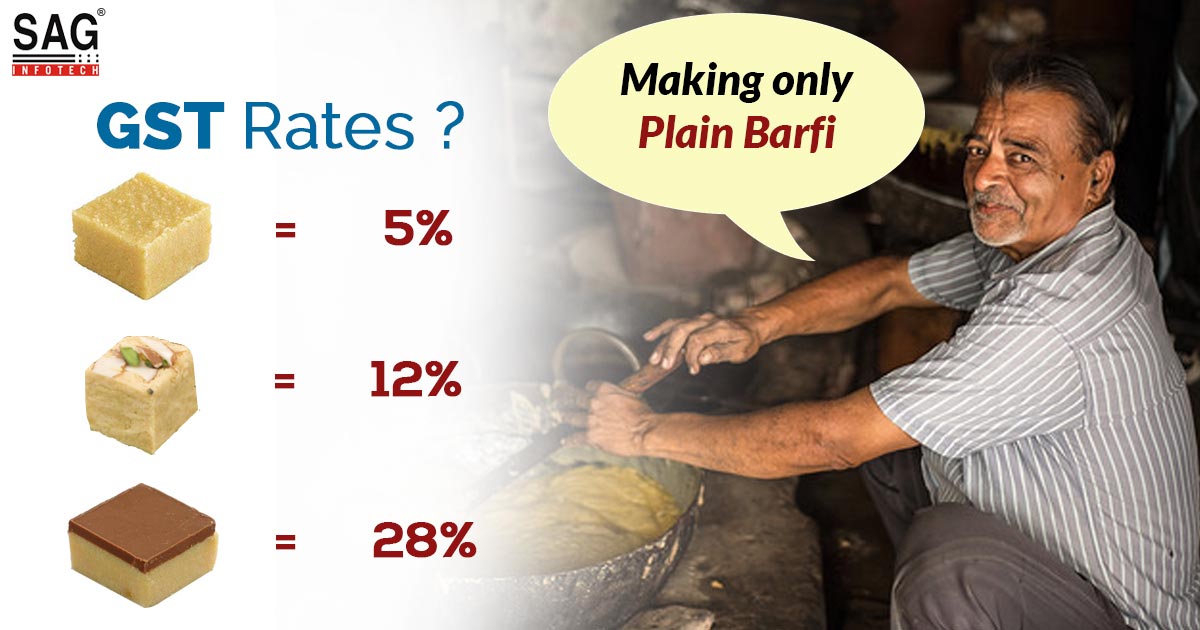

Sweet Makers are in the midst due to the new indirect tax regime as new GST rate depends on the variant of sweet. GST Council has decided different rates for different sweets which create confusion for sweet makers.

Let’s clear with an example, ‘Plain Barfi’ which is one type of ‘sweet’ levies 5 per cent GST rate under the new regime whereas Barfi flavoured and bundled with chocolates as famous with the ‘Chocolate Barfi’ name could be taxed at 28 per cent. In fact, plain Barfi toppings with dry fruits, nuts, and cardamom are taxed at 12 per cent GST.

More complex food items such as food which is prepared with several ingredients such as vermicelli, fruit, jelly, ice cream, jam, chocolate shavings and so on are the easy ones for the new regime and taxed 28 per cent higher taxation rates.

Confusion due to the GST rates, sweet makers are dealing safely with the new regime by cutting back the variety of sweets. Mahesh Rajasekhar from sweet business, said: “We are making only plain Sandesh, plain Badusha, plain Barfi and plain peda.” By adding that K C Das is a mithai Wala he has stopped preparing chocolate and mango sandesh.

Recommended: Are Restaurants Charging Correct GST Bills? Know and Save Money

Suresh Nair, partner of indirect tax at Ernst & Young said, Chikki is also a variant of sweet which is prepared from equal proportion of jaggery and groundnut certainly leaves a lot of room for interpretation He further added that “Chapter 2008 says nuts such as groundnut and cashew, whether roasted, sweetened, salted or otherwise, are taxable at 18%.”

“If it is plainly roasted cashew, we would have to tax it at 18%. Instead, we would add some more ingredients like Aloo Bhajia, namkeen, mixture, etc, to make it a snack that can be taxed at 12%. Even better, make it a sweet for taxation at 5%,” said K T Srinivasa Raja, founder of Adyar Anand Bhavan (A2B) and the member of Chennai Hotels Association (CHA).

Due to the lower taxation rates, sellers are getting crazy. Sweet items such as fruit jellies, pies, pastries, and mousse impose 18 per cent GST rates. Some of the shopkeepers are renaming and repackaging the labels of sweet items to pay 5% tax. Shopkeepers stated that to avoid 18 percent tax rate on sweets they can use Indianised method on western desserts such as custards, macaroons, cakes, tarts, and pastries.

Spelling mistake .

When I am typing gst google types get. It also afraid from GST, i think. Again down down.

I have paid Rs. 40 extra for macaroons as GST. Modi down down

WE HAVE TO LEARN FROM YOU, HOW TO CONFUSE BUSINESSMEN.

HAVE YOU ANY AUTHENTIC CONFIRMATION FROM GST COUNCIL FOR DIFFERENT PERCENTAGE OF GST ON DIFFERENT TYPE OF SWEETS