Goods and services tax is applicable across the nation with simplified rules and regulations. But in case you are still doubtful and are not sure about the generation of bills in a restaurant, you must be prepared to understand the changes included in the bill provided by the restaurant.

If you think that you are charged at a higher rate than it is supportive to know how GST is computed for the restaurant bills. You should learn what goes into them to make these bills sensible.

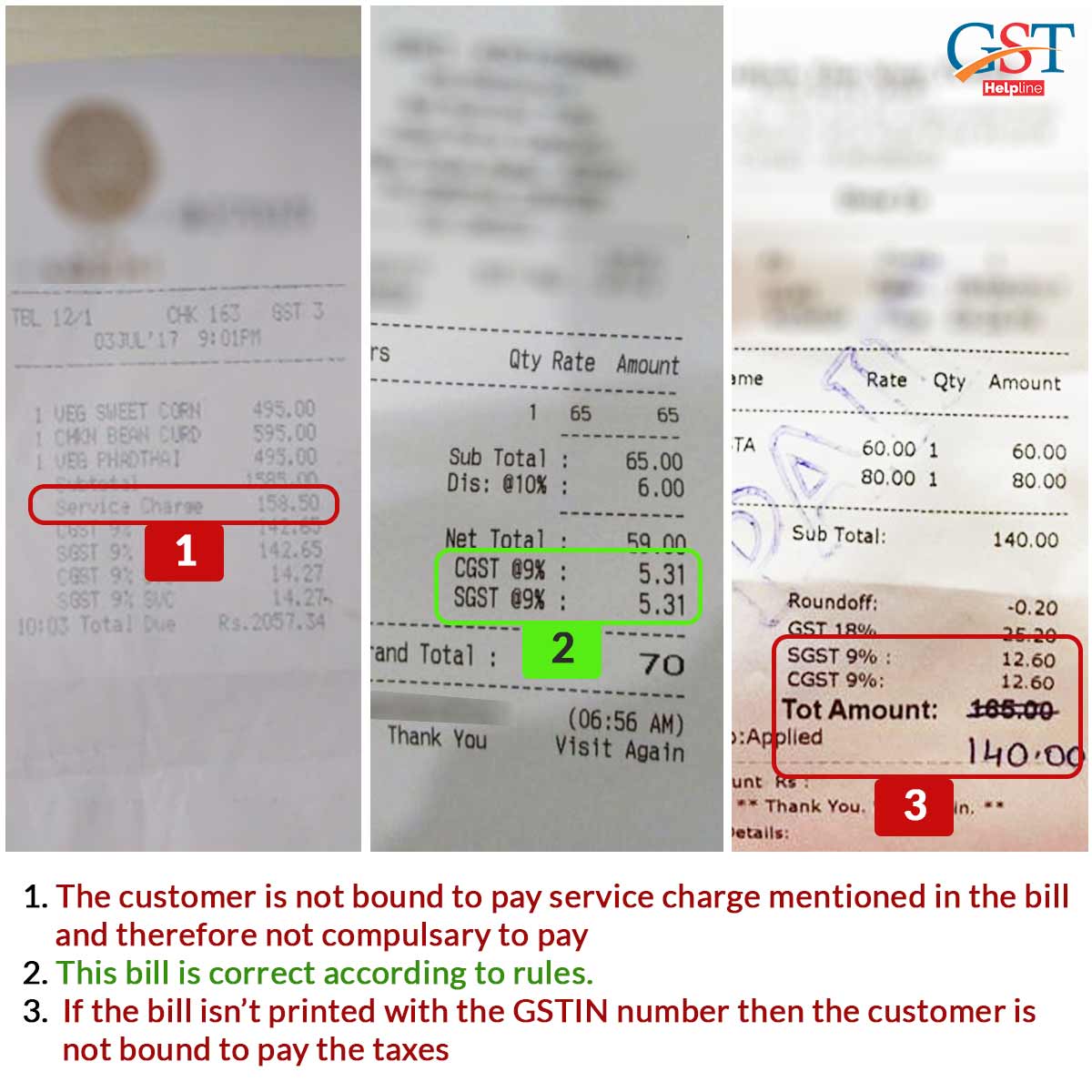

Service Charge- The service charge is not an obligatory fee that customers need to pay; it is not the law. Customers have the right to take the case to a consumer court if they feel that their fee has been levied inappropriately.

GST- Goods and services tax has been applicable at rates of either 5% or 18% on the total amount of the bill.

56th GST Council Meeting Update

An important update has been made under the 56th GST Council Meeting for restaurant taxes. They cited what ‘specified premises’ specify, which indicates that independent restaurants cannot organise themselves as ‘specified premises.’ Consequently, these restaurants could not opt to pay a higher GST rate of 18% benefiting from ITC. Rather, they shall carry to pay a lower GST rate of 5% without the ITC option.

This revision supports the earlier tax structure, where:

- A restaurant that is not located in a hotel, guest house, or other lodging with a daily tariff of ₹7,500 or more will charge a 5% GST without ITC.

- A restaurant located within a hotel or similar lodging with a daily tariff of ₹7,500 or more will charge an 18% GST with ITC.

In some recent scenarios, there have been some faults in the bills generated in the restaurants that must be understood by a responsible consumer.

Started on September 22, 2025, the updated GST system, which has the motive to make the taxes easier by using the two rates- 5% for essential items and 18% for most other goods and services. Consequently, many food items that are used by the restaurants, such as snacks, sauces, pasta, instant noodles, butter, and ghee, shall have a lower GST rate of 5%.

For restaurants, it is good news as it helps reduce their costs. It is essential to acknowledge that the 5% tax rate for dining services at restaurants remains applicable in many locations, as businesses are unable to claim deductions for the tax they pay.

Read Also: Meaning of IGST, CGST and SGST with Input Tax Credit Adjustment

This update seeks to facilitate the tax system, reduce classification disputes, and provide clearer guidance for businesses and consumers.

Where to File the Complaint if the Trader Does GST Fraud?

- Email: helpdesk@gst.gov.in

- Phone: 0120-4888999, 011-23370115

- Twitter: @askGST_Goi, @FinMinIndia

Today I visited a restaurant (in Gwalior, MP) for some snacks/starters. After finishing the food when I requested for the bill the bill amount was INR 330 which included 10% service charge (Food Bill: INR 300 + Service Charge: INR 30, Total Bill: INR 330). I refused to pay the service charge since I was not happy with the service (the food was stale despite my repeated requests for freshly prepared food).

Then they gave me another bill with added CGST but the total bill amount was the same, i.e., INR 330 (Food Bill: INR 300 + CGST: INR 30, Total Bill: INR 330).

I just want to know if they charged the CGST per the existing rates/laws or they are charging the Goods & services tax according to their own whims.

Kindly clarify & if they are charging incorrectly then can I complain (& to whom)

Thanks in anticipation.

Regards

Hi Well i am running only QSR restaurant & we are charge 5% GST to customer .i just want to know few things.

1. Is it only restaurant can take 18% gst & claim ITC.

2 is it only working restaurant can move from 5% GST to 18% GST to claim ITC

Restaurant manue card rate with GST or without gst ???

Hume kaise pata chalega ??

It is without GST

in Pannalal Restaurant they gave a bill which include 4 charges as gst

Cgst @2.5%

Cgst @9%

Sgst @2.5%

Sgst @9%

can anyone explain how this is calculated because it is more than 18%

It can not be treated as more than 18%, it states that some items have 18% gst while some have 5% gst

I went to a restaurant located in a hotel where i asked for the room tariff. The room tariff , on the reception counter, was informed to be Rs 4000.

Since, the reported tariff( it was nowhere displayed in the hotel premises) was less than Rs 7500, the applicable GST rate was expected to be 5%. However, when the bill was paid, i noticed that the GST has been charged @ 18%. On enquiry, i was replied that the room charge is Rs 8000 and that is the reason, i have been charged GST @18%.

Since i have availed only the dining service and on website also, the charges on various hotel booking sites are displayed in the range of Rs 3000 to rs 4000, it appears that hotel is charging GST wrongly with an intention to have the benifit of Input Tax Credit.

Pl advise if a consumer court case is suitable?

I went to a hotel, where not even a single table to sit and eat is available, we have to go to the counter, pay the amount and take a token(bill) where 5% GST is applied later use that token and collect food by SELF SERVICE and later we have to eat by STANDING OUTSIDE the hotel since there is not even a single table to sit.

My question here is: Do we have to pay GST in such a case? Please suggest.

The bill provided is a proper bill with CGST 2.5% and SGST 2.5% along with the GSTIN number mentioned.

Yes, you need to pay GST

Mere ko gst bill chaiye back date me mill jayega

In a restaurant, I was charged ₹29 for water bottle whose MRP is ₹19 and above that, GST OF 5%…can I make legal allegation on the hotel in consumer court.

There may be service charges included.

Your bill may include service charges of the restaurant.

In the new GST rule the restaurants are also selling the MRP product like cold drinks on that also they are charging the sitting charge not mentioned in anyhow in the bill for example if you are taking a 200 ml cold drink who is MRP is 15 rupees they will charge you 18 rupees on that they will take GST is it legal please let me know

As per recent clarification issued by the department, MRP includes all applicable taxes on it. So a supplier can’t charge over and above MRP from customers.

The current rate 5% for food eat in the restaurant and 12% for pre-packed & pre-cooked from restaurants. Is it applicable to both regular taxpayer and composite taxpayer?

please clarify

No, the rate is not same for the composite taxpayer and a regular taxpayer. For composition dealers 1% rate is applicable