The Surat bench of the ITAT states that if a rental income is proposed for taxation in one assessment year, it will be reduced by the assessing officer from the income of another assessment year. The case was remitted by the bench to the AO’s file to validate the taxpayer’s claim.

The taxpayer has furnished the revised income tax return specifying a total income of Rs 1,09,93,760, which was chosen for the investigation under CASS. AO, based on the perusal of 26AS and the information of the taxpayer, discovered that there is a mismatch between the receipts as per 26AS and the furnished taxpayer’s income returns.

The taxpayer had specified a rent of ₹9,41,930, but as per 26AS, the rent received from M/s. Ashish Publicity was ₹17,20,000, on which Tax was deducted at Source (TDS). Therefore, the AO added ₹7,78,070 to the taxpayer’s total income.

Before the Commissioner of Income Tax (Appeals), the taxpayer has filed an appeal. Taxpayer said to CIT(A) that the TDS return includes the information of the rent obtained from Ashish Publicity for two years at a time, and thus, ₹17,20,000 is shown in Form 26AS.

The same amount comprises rent of Rs 8,00,000 for AY 2016-17 and ₹9,20,000 for AY 2017-18. The taxpayer’s claim was not accepted by the CIT(A) as it was not able to provide any lease agreement with M/s Ashish Publicity to support its claim, and therefore, the appeal was dismissed. Therefore, a plea was furnished to the ITAT.

Read Also: Easy to Compute Rental Income in Property for Tax Purposes

Ramesh Malpani, the taxpayer’s authorised representative, furnished that the rent of 2 years was paid by Ashish Publicit, and it was proposed in AY 2016-17 (₹8,00,000) and 2017-18 (₹9,20,000). He cited that the case may be remitted to the AO for the claim verification of the taxpayer.

Mukesh Jain, the senior departmental representative of the revenue, relied on the findings of the lower authority.

The order passed by the Assessing Officer (AO) has been set aside by the bench comprising Pawan Singh and Bijaynanda Pruseth and remitted the case to the file of the AO to validate the taxpayer’s claim that if the rent of Rs 8,00,000 was shown via the taxpayer in AY 2016-17.

The AO must lessen the specified rental income from the income of AY 2017-18 if the amount of ₹8,00,000 was offered for taxation in AY 2016-17, the bench ruled.

After that, the bench laid on Rule 37BA(3) of Income Tax Rules, 1962, as per which the tax credit deducted at source and paid before the Central Government will be provided for the assessment year for which this income is assessable.

AO asked to withdraw the credit of TDS claimed on the total rent of Rs 17,20,000 in the existing assessment year, post verification concerning the rent proposed for taxation for the preceding AY 2016-17.

The taxpayer was asked to provide all the information in support of his claim to the AO. Therefore, the appeal was permitted.

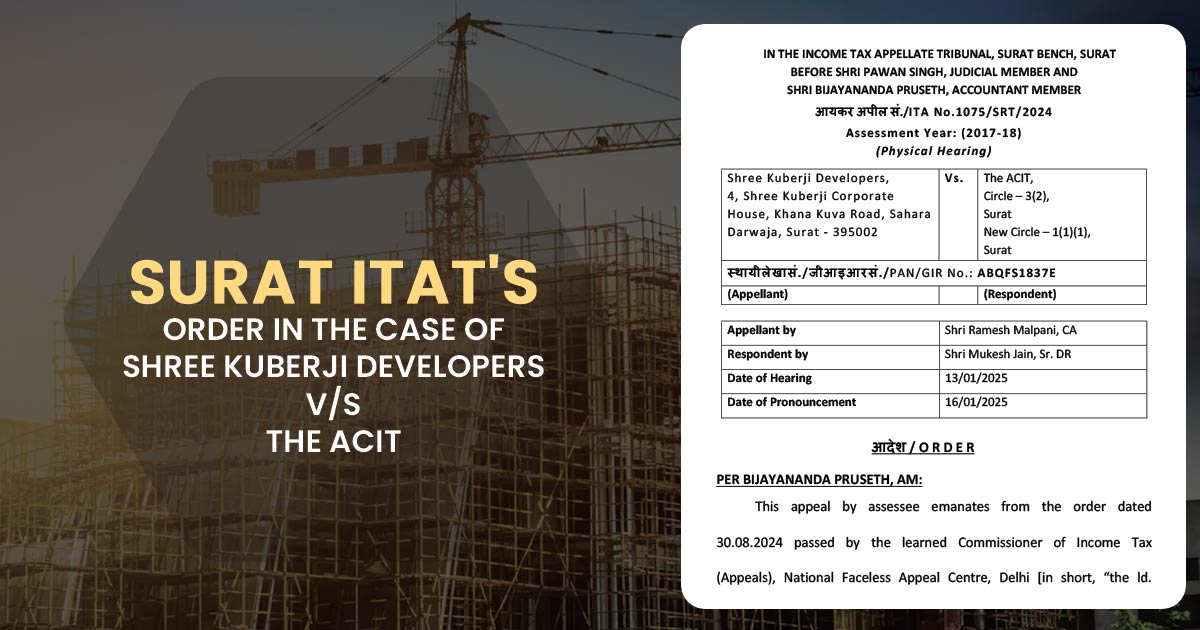

| Case Title | Shree Kuberji Developers vs. The ACIT |

| R/Special Civil Application No. | ITA No.1075/SRT/2024 |

| Appellant by | Shri Ramesh Malpani |

| Respondent by | Shri Mukesh Jain |

| Surat High Court | Read Order |