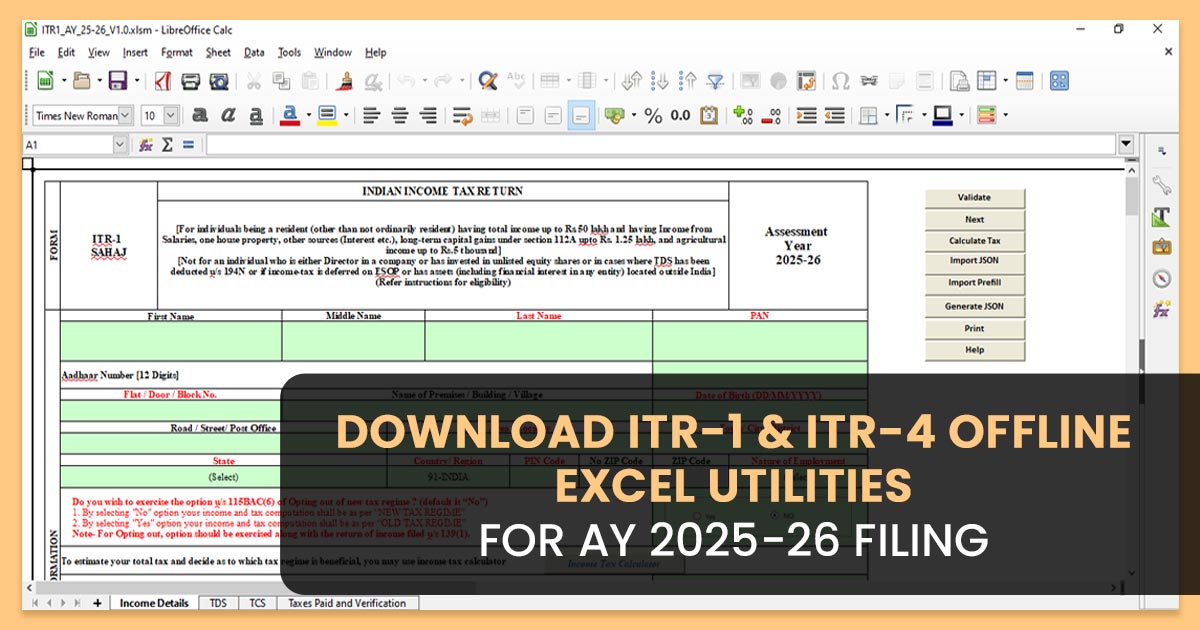

Recently, the Income Tax Department released Excel-based utilities (V1.0), a JSON schema, and validation tools for FY 2024-25 (AY 2025-26). The department has included the ITR-1 (Sahaj) and ITR-4 (Sugam) forms. Taxpayers can download these offline utilities from the official 2.0 e-filing portal. As the Excel utilities have just been made available, the online ITR filing option is not yet active.

Purpose of Excel Utilities for ITR-1 and ITR-4 Forms

The Income Tax Department furnishes the ITR-1 and ITR-4 Excel utilities (V1.0) that are offline tools. The taxpayers are enabled to download these utilities, fill in their income details offline, validate the information, and then generate a JSON file. After that, the same file can be uploaded on the e-filing portal for submission.

Who is Eligible to use the ITR-1 Excel Utility?

The ITR-1 (Sahaj) Excel utility V1.0 is prepared for Indian residents (except those who are not ordinarily residents) with an annual income of up to ₹50 lakh. This form is suitable for individuals earning income from salaries, owning house property, or receiving other income such as bank interest and small amounts from agriculture (up to ₹5,000). As per Section 112A of the Income Tax Act, taxpayers can claim an exemption on long-term capital gains up to ₹1.25 lakh.

Who can use the ITR-4 Excel Utility?

Income earned up to ₹50 lakh under the ‘Presumptive Taxation Schemes’ as per Sections 44AD, 44ADA, or 44AE qualifies for filing through the ITR-4 (Sugam) Excel utility. This form is suitable for resident individuals, HUFs, or firms (excluding LLPs).

This guidance pertains to resident individuals, HUFs, and firms (not an LLP) who meet these criteria:

- Total income is up to ₹50 lakh

- Income from business and profession is calculated under Sections 44AD, 44ADA, or 44AE (presumptive taxation)

- Other Sources such as own house property, interest income, and agricultural income up to Rs 5,000

- They also have long-term capital gains U/S 112A, up to ₹1.25 lakh

Revised ITR Filing Date

The Income Tax Department has revised the ITR filing due date for the fiscal year 2024-25 (assessment year 2025-26) from July 31, 2025, to September 15, 2025. The extension was granted due to delays in the release of ITR form notifications.

Itr