Know About Statement of Financial Transaction

Statement of Financial Transaction (SFT) poses the report of the mentioned financial transactions by the particular individual along with the stated reporting financial institutions.

These people who enrol, maintain or record these particular financial transactions are compulsory to submit SFT to the income tax authority or these people, authorities or agencies.

Latest Update

- Statements of Financial Transactions (SFT) for depository transactions format, procedure and guidelines are now available on the official e-filing portal via a corrigendum to notification No. 3 of 2021. Read more

- CBDT Notification 01/2023: Statement of Financial Transactions (SFT) and Guidelines for Submission (Abolishing of 5,000 rupee limit) to Notification 2 of 2021. Read Circular

Specified Financial Transactions

Financial transactions particularly needed to be reported beneath Section 285BA are as follows:

- Transaction of purchase, sale/exchange of goods or property or right or interest in a property.

- Transaction for providing services

- Transaction beneath a works contract

- Transaction through an investment created or an expenditure incurred

- Transaction for taking or accepting any loan or deposit

Aggregation Rule for Particle Financial Transactions

As this is seen from the mentioned financial limit for the particular financial transactions except SI No. 10 and 11, aggregation is needed to examine if the financial limit is over.

During aggregation, the amounts mentioned below would be remembered:

Rule 1: All accounts that secure a similar nature as mentioned in column (2) of the above table, maintained towards that individual in the same FY, would be considered.

For instance, If Mr A has two savings accounts of Rs 5 lakh each, then check out the financial limit of Rs 10 lakh; the amount in both savings accounts is required to be aggregated.

Rule 2: All transactions of that nature as mentioned in column (2) of the table recorded concerning that individual under the Financial year, would be aggregated.

For instance, if Mr A buys shares worth Rs 5 lakhs in September in FY and Rs 6 lakhs in November of that Fiscal year, the value of both the shares is required to be aggregated to see the fiscal limit of Rs 10 lakhs.

Rule 3: Inside the case in which the account is maintained or the transactions get recorded in the name of more than one individual, such as a joint account, attribute the entire value of the transaction or the aggregated value of all the transactions for all people.

For instance, Mr A and Mr B secure two joint savings accounts of Rs 3 lakhs and Rs 7 lakhs, aggregate of Rs 10 lakhs is attributed to both Mr A and Mr B individually to check for financial limit.

Particular Forms to be Used for SFT Filing

SFT would be submitted either in Form 61A (other reporting entities) or Form 61B (prescribed reporting financial institution). SFT would be submitted in an electronic way beneath the (DSC) digital signature certificate to the Director of Income-tax (Intelligence and Criminal Investigation) or the Joint Director of Income-tax (Intelligence and Criminal Investigation).

SFT will be submitted electronically beneath the digital signature certificate to the Director of Income Tax (Intelligence and Criminal Investigation) or the Joint Director of Income Tax (Intelligence and Criminal Investigation). A Post Master General or a Registrar or an Inspector General might file SFT in a medium that a computer reads as a Compact Disc or Digital Video Disc (DVD), along with the verification in Form-V on paper.

Steps to Procedure to Submit SFT

SFT will be submitted via the mentioned process:

- If formerly enrolled on an e-filing portal, log in and go to My Account ⏩ Manage ITDREIN (Income Tax Department Reporting Entity Identification Number).

- Tap on ‘Generate New ITDREIN’

- Choose a type of form and report entity category, and then tap on Generate ITDREIN.

- Upon the grounds of the selection, a suitable ITDREIN shall be generated, and a confirmation email and SMS will be sent to the enrolled email ID and mobile number respectively.

- ITDREIN generated would get prompt beneath My Account>Manage ITDREIN

- Proceed to e-file ⏩ Upload Form ‘X’ (appropriate Form No prompts as per the selection made during registration)

- Validate and insert the PAN, Form Name, FY, Reporting entity category, Half-year, and upload type, that is, if the original/correction form /Nil statement.

- On the successful validation of the mentioned information, upload the file, engaging a certificate of the digital signature.

- A success message would get prompted on the screen on successful uploading, and the confirmation email and SMS would be furnished to the enrolled email ID and the mobile number respectively.

- The uploaded file might be either accepted or rejected. In case of rejection, the cause for rejection is to be noted, and a correction form will be submitted via the mentioned process.

Last Due Date for Furnishing SFT

SFT in Form 61A will be submitted on or before 31st May of the Financial year, quickly following the FY where the transactions are to be recorded or enrolled.

The statement of the reportable account in Form 61B will be submitted by the mentioned reporting financial institution towards each calendar year on or before 31st May of the subsequent year.

What is Form 61?

As per Rule 114B of Income Tax Rules 1962, an entity is required to obtain the PAN of the transacting party for the transactions specified. In case the transacting party does not have a PAN, Form 60 is to be filled out by the transacting party. Details of these Form 60 are to be reported in Form 61 for the period 1st April to 30th September of the financial year by 31st October, and 1st October to 31st March of the financial year by 30th April.

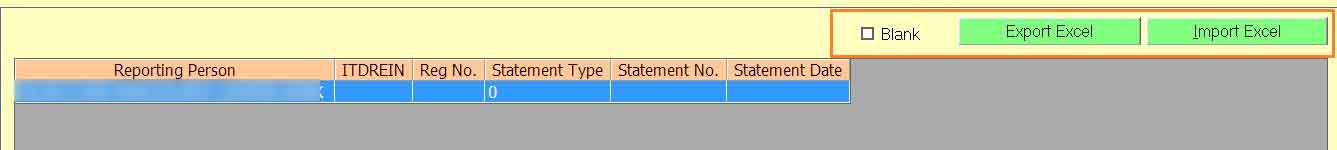

Import/Export Facility for Preparation of Form 61 Via Genius

Blank as well as detailed export/ import options are also available for the preparation of Form 61 of SFT.

Simple Process to Generate a Form 61 Via Genius Return Software

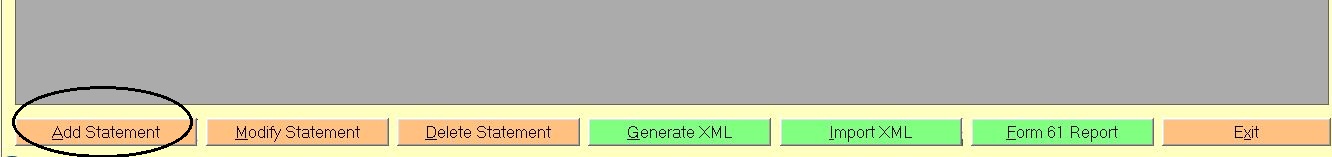

Step 1: Go to SFT ⏩ Form 61 ⏩ Add Statement

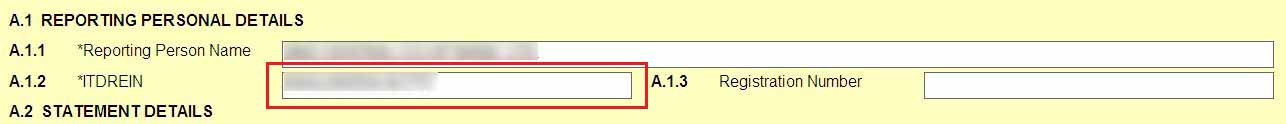

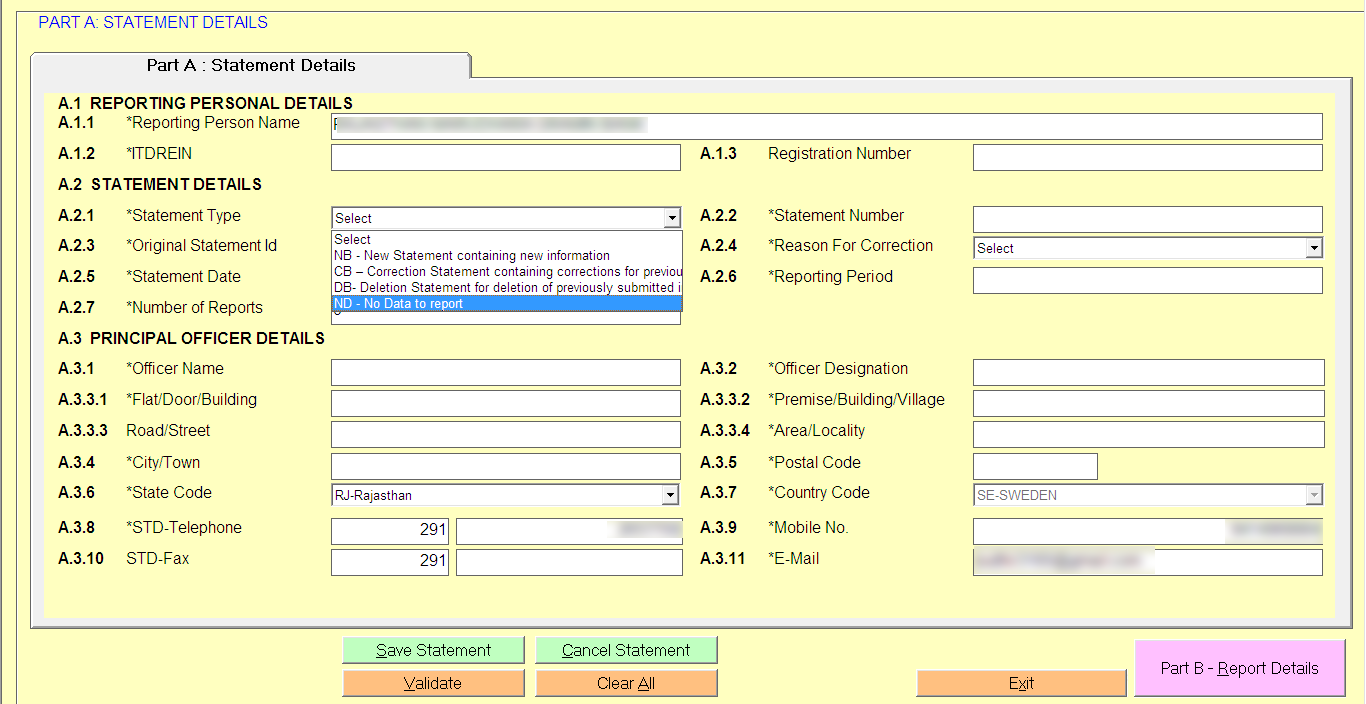

Step 2: All The * Mark Fields Are Mandatory

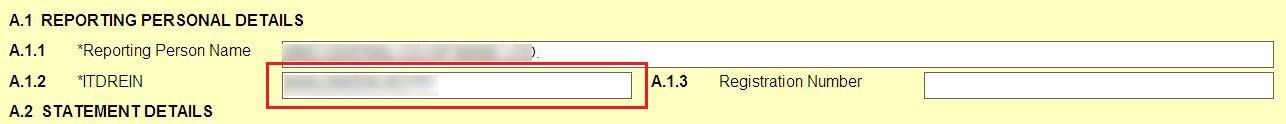

Step 3: It will Be Generated From The Income Tax Site by logging in to the e-filing portal using the Login ID and Password By Visiting Incometaxefiling.gov.in. Go To My Account ⏩ manage Itdrein ⏩ generate Itdrein

Step 4: Itdrein Should Be In The Format Specified Below

Step 5: Select the Statement Type. However, If There Is No Data To Report, then the Statement Type should be Nd

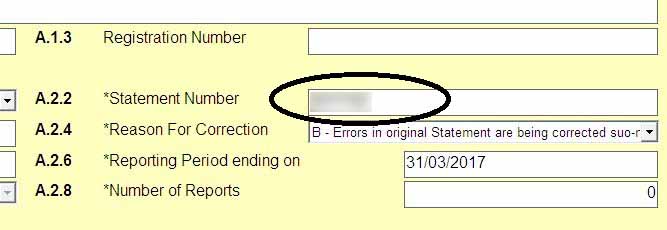

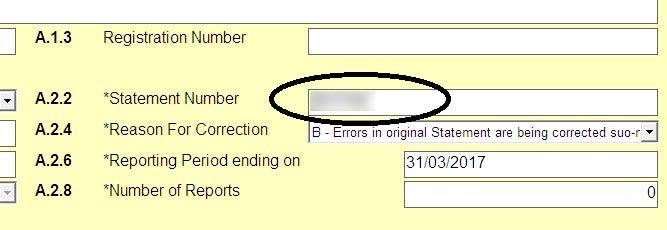

Step 6: The statement Number Should Be In The Format Specified Below.

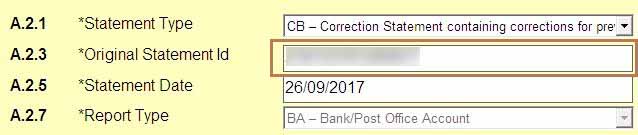

In Case the Original Statement Is filed, then the Statement ID should Be Zero ‘0’. However, If The Correction Statement Is Filed, the Statement ID of The Original Statement that is Being Corrected Should Be Mentioned In The ‘original Statement ID’.

Step 7: Statement ID should Be In The Format Specified Below.

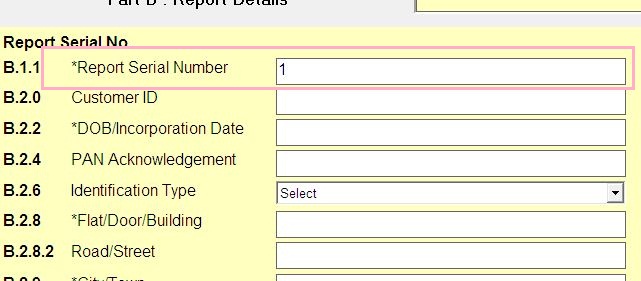

Report Details: All the * Fields are Mandatory

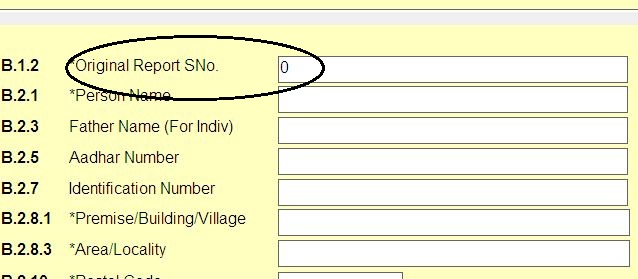

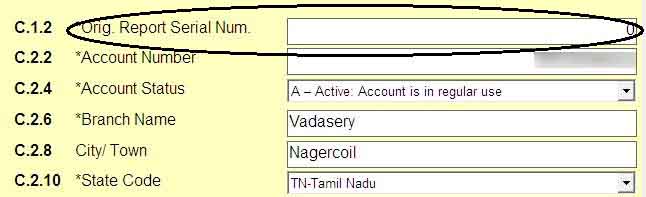

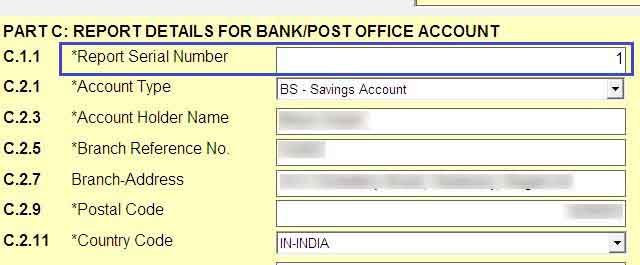

The report serial number of the original report that has to be replaced or deleted should be mentioned in the element ‘original report serial number otherwise, fill it as zero ‘0’.

The report serial number should be unique within the statement. For example, if one report is submitted, then mention it as one, and if two reports are submitted, then mention it as two.

What is Form 61A?

As per Rule 114E of the IT Rules 1962, a reporting entity is required to file a statement of financial transaction in Form 61a. A reporting entity has to report in the specified SFT reportable transactions of the nature specified in this rule for the relevant financial year on or before the 31st of May immediately following the financial year.

Import/Export Facility for Form 61A SFT Via Genius Software

Blank as well as detailed export/ import options are also available for the preparation of Form 61a of SFT.

How To Generate Form 61A via Genius Software?

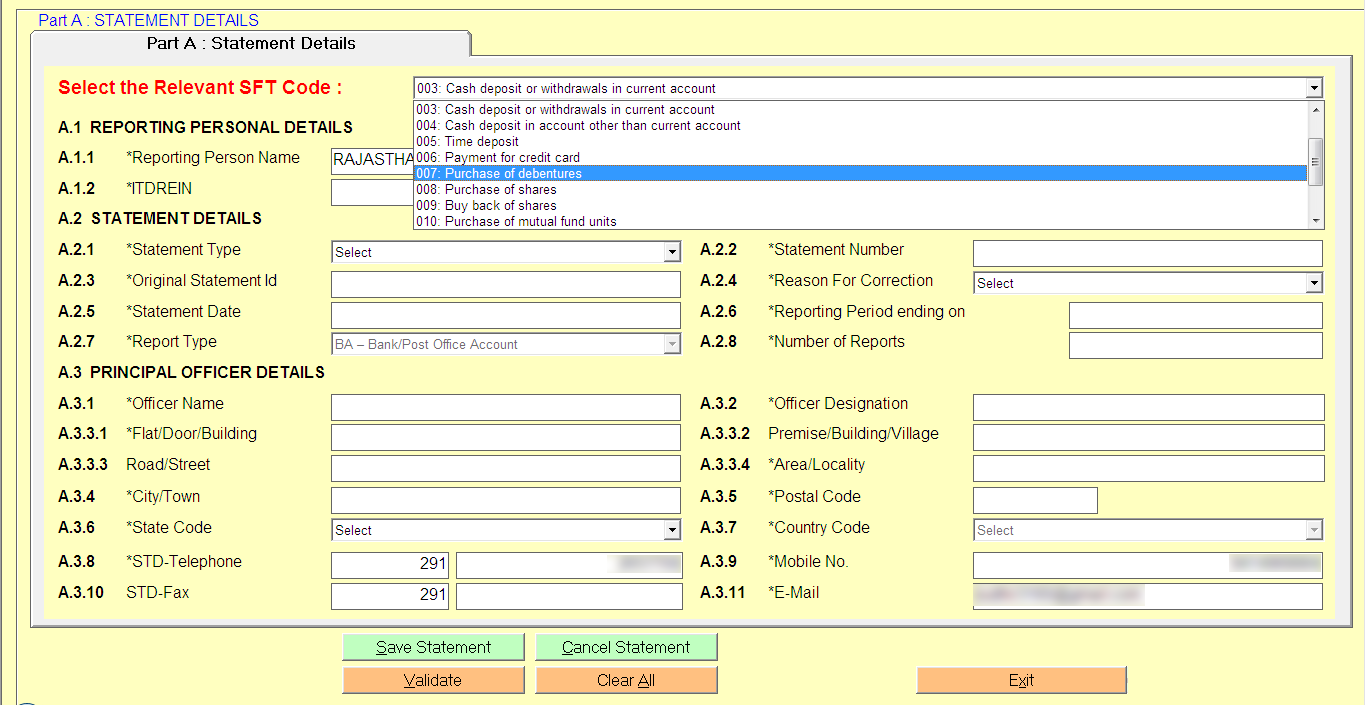

Step 1: Go to SFT ⏩ form 61A ⏩ Add Statement

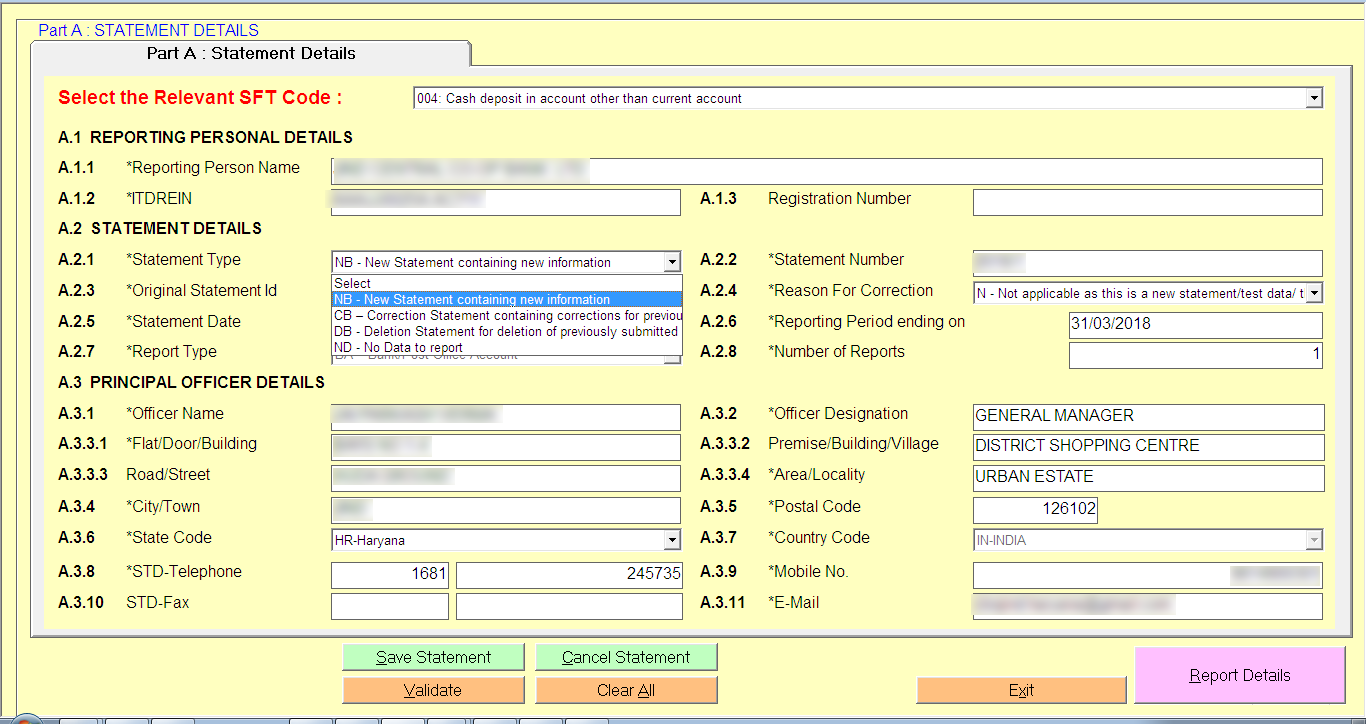

Step 2: Select The SFT Code According To The Financial Transactions That The Notified Person Want To Report

Step 3: All The * Mark Fields Are Mandatory

Step 4: It will Be Generated From The Income Tax Site by logging in to the e-filing portal using the Login ID and Password By Visiting Incometaxefiling.gov.in. Go To My Account ⏩ Manage Itdrein ⏩ Generate Itdrein

Step 5: Itdrein Should Be In The Format Specified Below

Step 6: Select The Statement Type, However, If There Is No Data To Report Then the Statement Type should Be Nd

Step 7: The statement Number Should Be In The Format Specified Below.

In Case the Original Statement Is filed, then the Statement ID Should Be Zero ‘0’. However, If The Correction Statement Is Filed, the Statement ID of The Original Statement that is Being Corrected Should Be Mentioned In The ‘original Statement ID’.

Step 8: Statement ID should Be In The Format Specified Below.

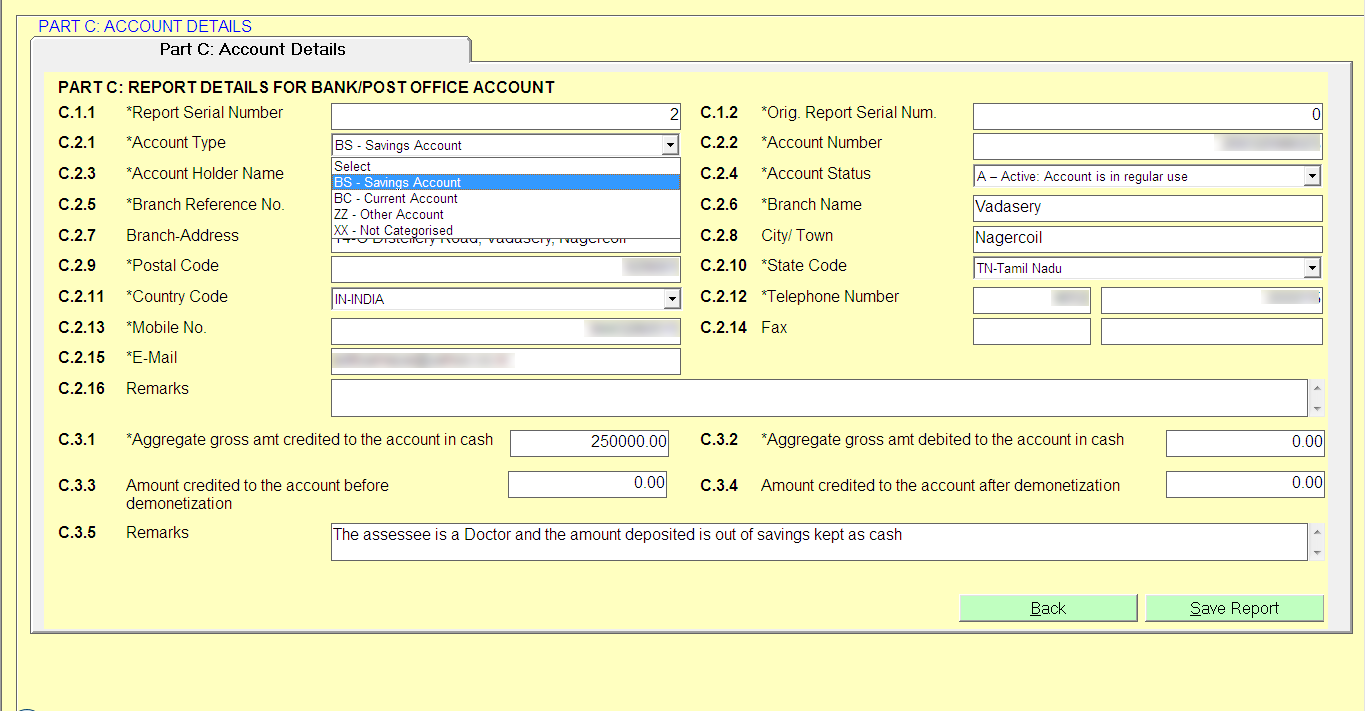

STF Form 61A Report: All The Mark Field Mandatory

Step 1: Select the account type of your bank.

Step 2: The Report Serial Number Of The Original Report That Has To Be Replaced Or Deleted Should Be Mentioned In The Element Original Report Serial Number. Otherwise, Fill It As Zero ‘0’.

Step 3: The Report Serial Number Should Be Unique Within The Statement. For Example, If One Report Is Submitted, then mention it As One, And If Two Reports Are Submitted, then mention it As Two.

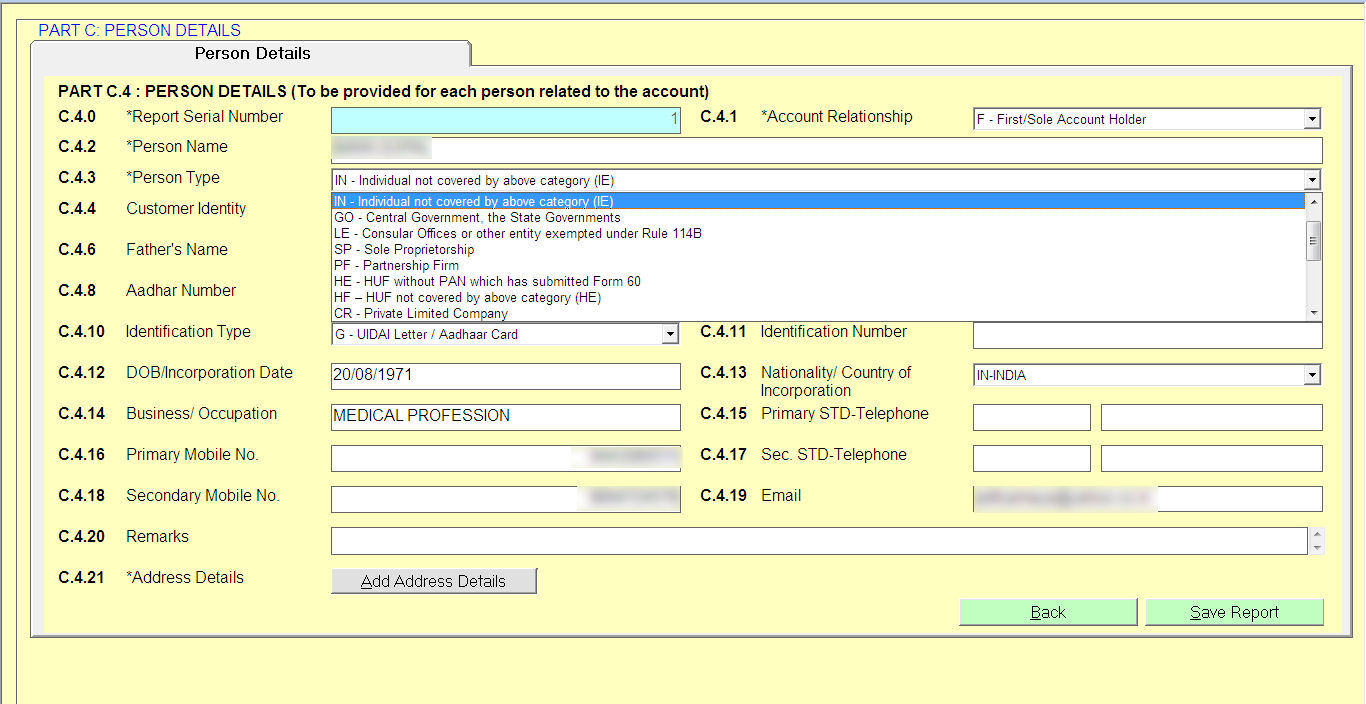

STF Form 61A Personal Details: All The Mark Field Mandatory

Step 1: Select The Type Of Person Example, Whether You Are An Individual, a Partnership Firm, a Sole Proprietorship, etc.

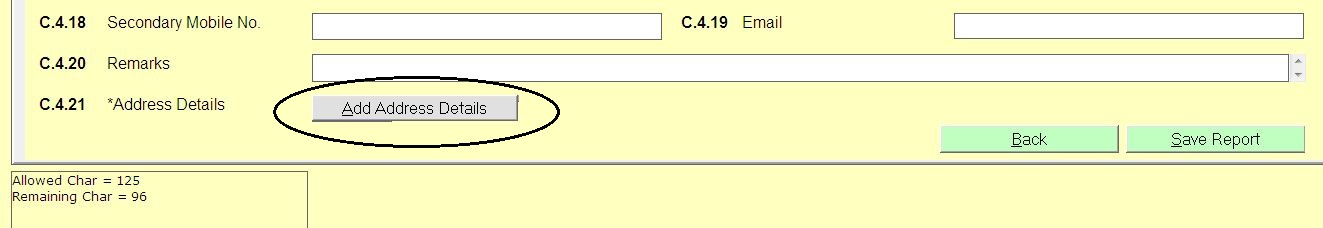

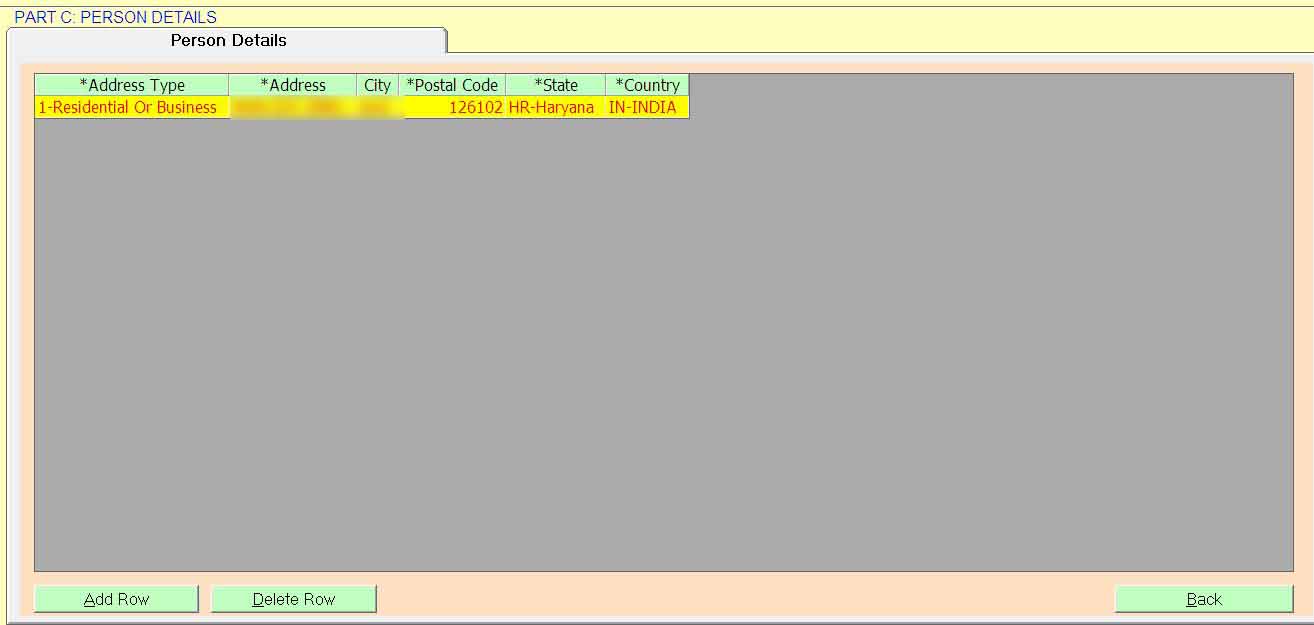

Step 2: Address Details Are Also Mandatory. First, Go To Address Details ⏩ Then Add Address Details.

One can easily file SFT returns via Genius tax software by SAG Infotech, as it has covered all the compliance as per the government and has been topping the return filing solutions for a decade.

I want ti purchase this software

You can buy here – https://saginfotech.com/Genius.aspx