The purpose of this post is to explain the process of Sections 206AB and 206CCA filing under income tax using Gen TDS Software. The Income Tax Act inserts section 206AB after section 206AA. The latter requires the provision of a Permanent Account Number (PAN) to deduct TDS. In the Income Tax Act, section 206CCA for TCS is inserted after section 206CC.

Short Definition of Section 206AB Under the I-T Act

When you make payments to those who haven’t submitted an income tax return in the previous year, you should deduct TDS at higher rates than usual.

What is Section 206CCA Under the I-T Act?

From the amount made via buyers collect TCS at higher rates.

Important Features of Gen TDS Software

There is a need to file TDS and TCS returns for the assessee who comes beneath a certain category. Gen TDS delivers an easier and more user-friendly interface for filing TDS and TCS returns online under the guidelines and laws of TRACES and CPC, India.

The process of generation of pre-determined TDS amount, preparing returns, and calculating interest and penalty fees (if necessary), including the late filing fees (if applicable) shall proceed by the Gen TDS software. This program is listed as an authorized TDS software on the official tax information network website for the Indian government.

Procedure to E-file Section 206AB and 206CCA Via Gen TDS Software

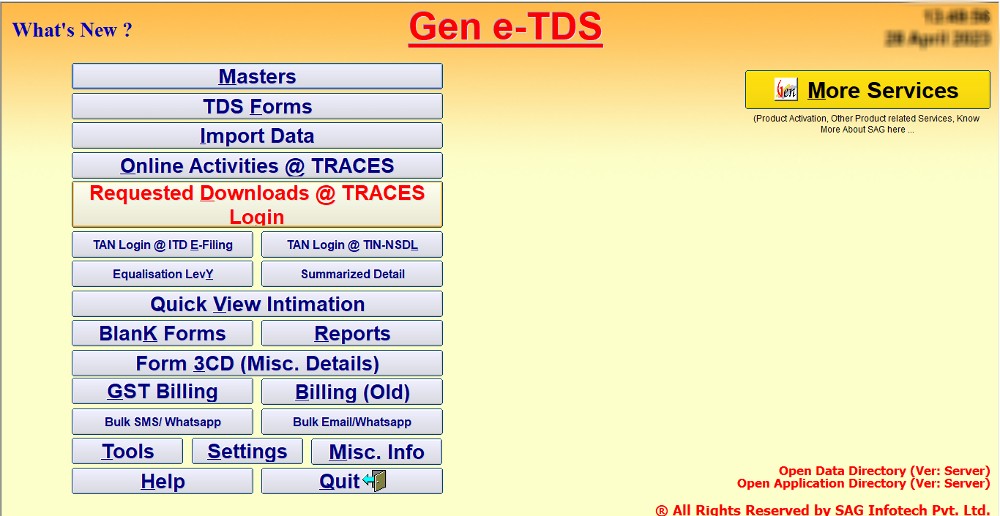

Step 1:- First Install the Gen TDS Return Filing Software on the Laptop and PC.

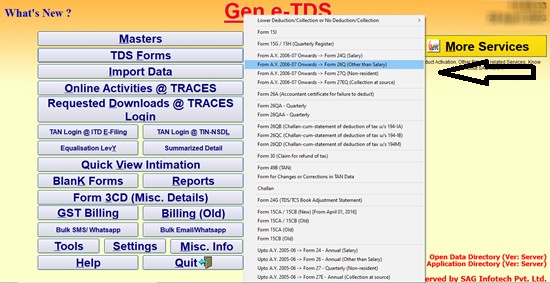

Step 2:- After that select the Form in which you want to check the Bulk Compliance Check.

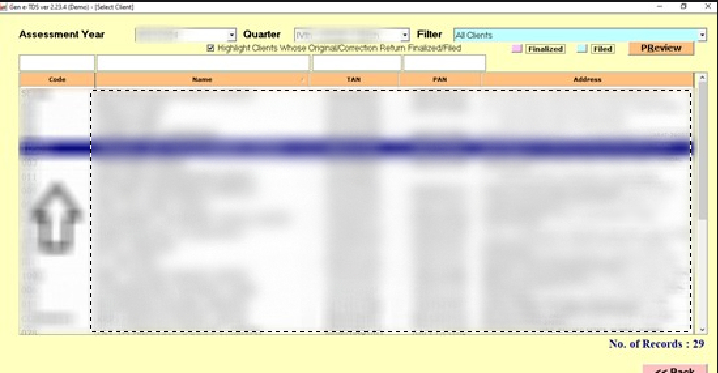

Step 3:- Now Select the Client.

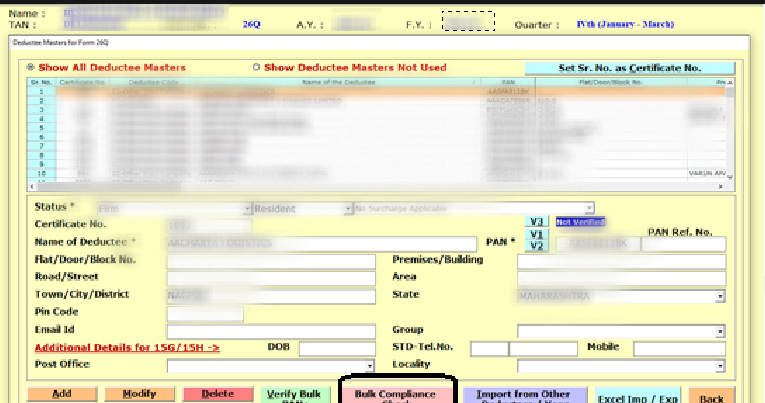

Step 4:- Click on the Deductee Master tab.

Step 5:- Click on Bulk Compliance Check.

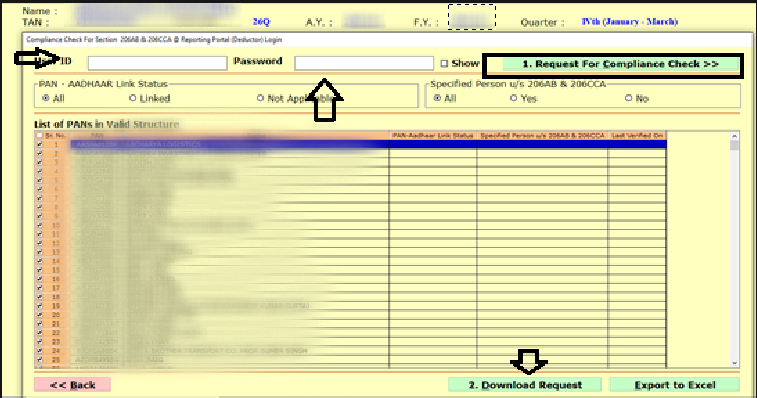

Step 6:- Enter the User ID and Password and then click on Request for Compliance Check. After some time of Requesting the Compliance Check Click on Download Request to check whether the person is a specified person or not.