The Supreme Court of India has rejected a request from the Union of India regarding the refund of unused taxes related to a system where higher tax rates apply to goods that are typically bought rather than sold.

The Court pointed out that this matter had already been resolved in a past decision. Furthermore, the Court instructed the Revenue Department to contribute ₹10,000 to the Advocate-on-Record Association.

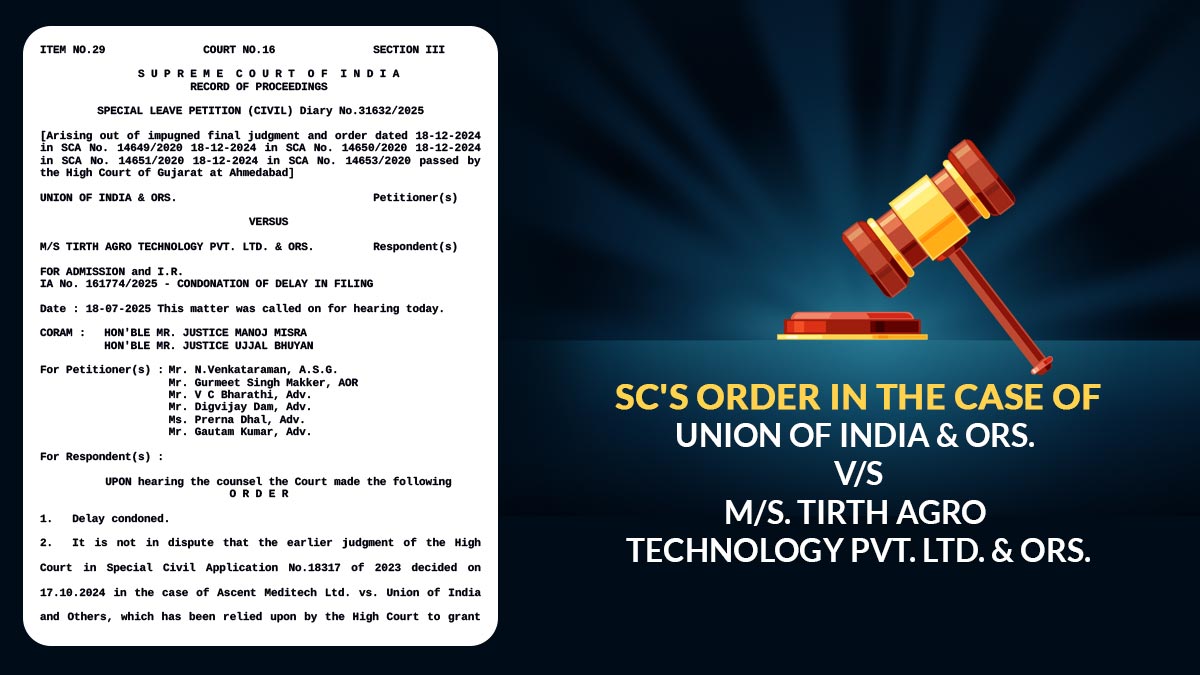

From an impugned judgment passed by the High Court of Gujarat at Ahmedabad, the present case, filed by the Union of India and Others against Tirth Agro Technology Pvt. Ltd. and others (Tirth Agro), has emerged.

From refund applications u/s 54(3) of the Central Goods and Service Tax (CGST) Act, 2017, read with Rule 89(5) of the CGST Rules, 2017, the controversy has emerged. Before 5 July 2022, the formula did not include input services, limiting refunds to the input tax credit accumulated on input goods.

Under Rule 89(5), GST Notification No. 14/2022 revised the formula to include both input goods and input services proportionately to determine refunds, but a following CBIC circular dated 10 November 2022 mentioned that the benefit would apply prospectively. Multiple writ petitions have arrived from this, including the one filed by Tirth Agro before the Gujarat High Court.

The Gujarat High Court, in its ruling on 20th December 2024, followed its earlier decision in Ascent Meditech Ltd. vs Union of India (2024), holding that the July 2022 amendment was in fact clarificatory and curative and thus retrospective in nature. The Gujarat High Court in Ascent Meditech (supra) quashed the CBIC circular to the extent it refused retrospective effect and directed authorities to recompute refund claims filed within the statutory two-year period u/s 54(1) by applying the amended formula.

The Union of India, dissatisfied with the ruling of the High Court, approached the Apex Court via the present SLP. A bench of Justice Rajesh Bindal and Justice R. Mahadevan heard the case.

V.C. Bharathi, Kiran Bhardwaj, and Gurmeet Singh Makker represented the applicants, and Malika Josi and Suhaas Ratna Josi represented the respondents.

The Court cited that the Gujarat High Court had relied on its previous ruling in Ascent Meditech Ltd. (supra), and the Union’s challenge in that case had been dismissed before by the Apex Court in SLP (C) No. 8134 of 2025 on 28 March 2025. The Bench cited that in June 2025, the present petition had been filed and that no mention had been made concerning the factum of dismissal of the petition by the High Court.

Therefore, SLP has been dismissed by the Apex court while levying the costs of Rs 10,000 on the Union of India, which was directed to be deposited with the Advocate-on-Record Association.

| Case Title | Union of India & Ors. Vs M/s. Tirth Agro Technology Pvt. Ltd. & Ors. |

| Diary No | 31632/2025 |

| For Petitioner | Mr. N.Venkataraman, A.S.G. Mr. Gurmeet Singh Makker, AOR Mr. V C Bharathi, Adv Mr. Digvijay Dam, Adv Ms. Prerna Dhal, Adv Mr. Gautam Kumar, Adv |

| Supreme Court | Read Order |