The Supreme Court of India has rejected a public interest petition that called for stricter checks in the Goods and Services Tax (GST) registration process. This petition, brought by lawyer Rudra Vikram Singh, aimed to prevent the misuse of stolen Aadhaar and PAN details, which people were using to create fake companies.

The bench, including Chief Justice of India D.Y. Chandrachud and Justice K. Vinod Chandran, does not entertain the appeal, marking that the applicant may instead make a representation before the Union Government, which can be considered on its merits in as with the law.

The petition specified the rising threat of identity theft being used for GST fraud, where corrupt elements allegedly get GST registrations utilising stolen or forged Aadhaar and PAN details, and subsequently issue bogus invoices to take input tax credit (ITC) wrongfully.

As per the applicant, the same practice had resulted in losses to the national exchequer and damaged the integrity of the GST regime.

Mr Anirudh Tyagi, the applicant’s counsel, said that even after repeated assurances of the government and technological interventions, the existing GST registration framework does not have enough safeguards to avert the misuse of personal data in the process of registration. He asked the court to direct the rollout of multi-layer verification measures, including live facial verification and stronger linkage with Aadhaar authentication logs.

Read Also: SC Declines PIL Challenging TDS Deduction Obligation on Private Employers

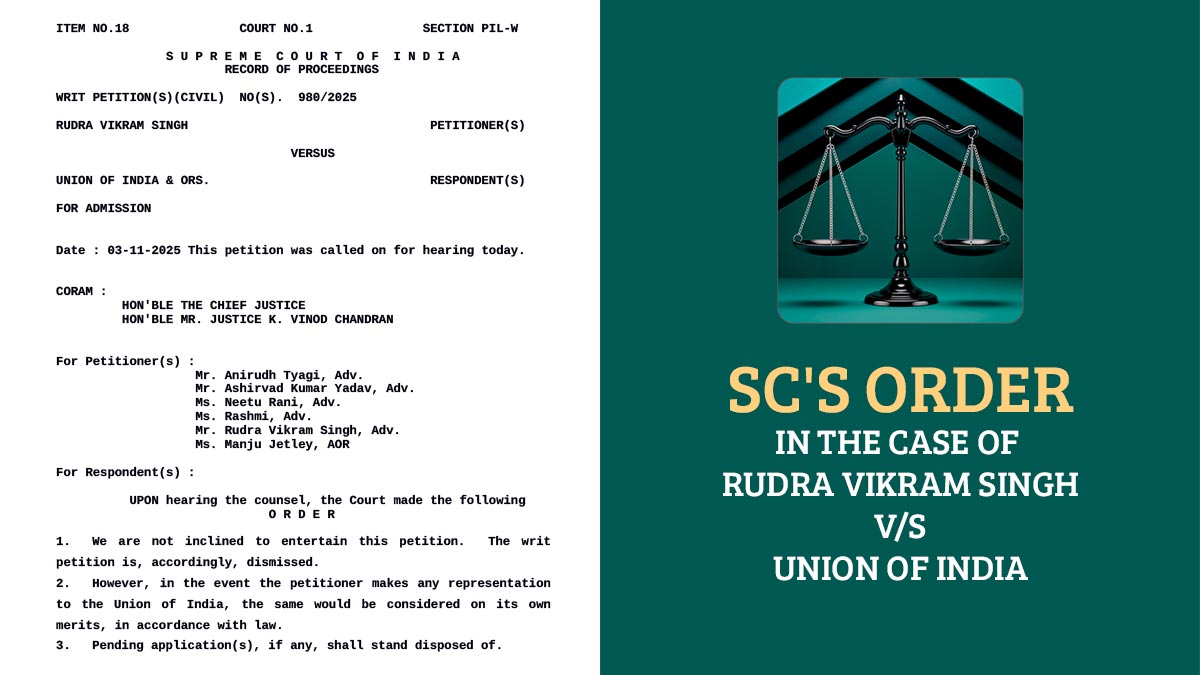

However, the Supreme Court declined to interfere in the case at this stage, expressing briefly in its order, “We are not inclined to entertain this petition. The writ petition is, accordingly, dismissed. However, in the event the petitioner makes any representation to the Union of India, the same would be considered on its own merits, in accordance with law.”

For executing the robust vetting procedure to prevent the bogus registrations, which are frequently seen after large-scale tax evasion, the appeal has asked for directions to the Central Board of Indirect Taxes and Customs (CBIC) and the Goods and Services Tax Network (GSTN).

The rise in GST-related fraud involving bogus firms has been considered by the government. Many of these were registered using the stolen identities of unsuspecting citizens. Via risk-based registration systems, physical verification drives, and AI-enabled analytics to detect suspicious entities, CBIC has tightened scrutiny.

Recommended: FM Announces Auto-Approval of GST Registration Within 3 Days for New Applicants

The Court’s dismissal means that there will be no immediate judicial intervention. However, experts assumed that this issue raises important policy concerns and could lead the government to examine and strengthen the current GST registration safeguards, especially considering the rise in identity theft incidents related to tax fraud.

| Case Title | Rudra Vikram Singh vs. Union Of India |

| Case No. | No (S). 980/2025 |

| For Petitioner | Mr Anirudh Tyagi, Mr Ashirvad Kumar Yadav, Ms Neetu Rani, Ms Rashmi, Mr Rudra Vikram Singh, Ms Manju Jetley |

| Supreme Court | Read Order |