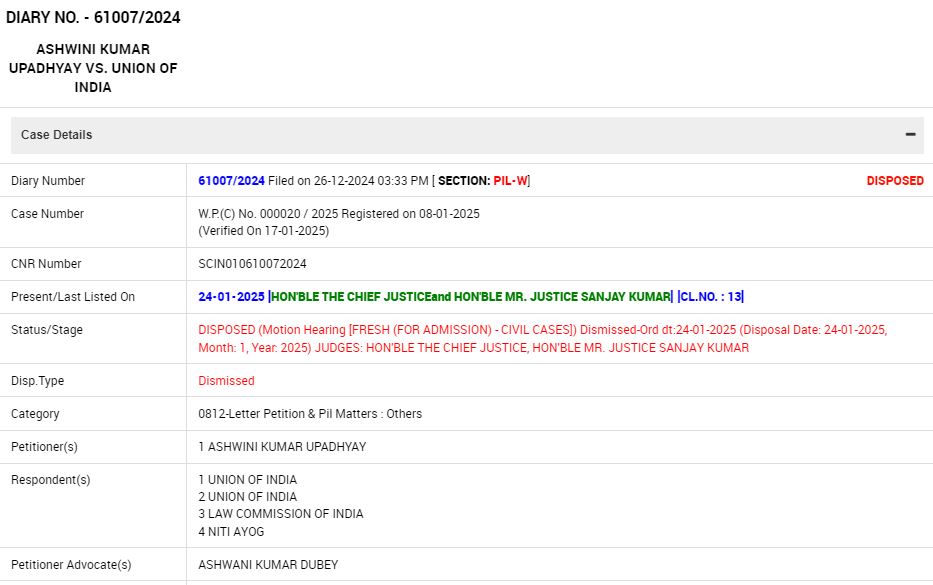

On January 24, the Supreme Court refused to entertain a Public Interest Litigation contesting the provisions of the Income Tax Act, which impose an obligation on private employers to deduct tax at source (TDS) on the salaries paid by them.

A bench including Chief Justice of India Sanjiv Khanna and Justice Sanjay Kumar mentioned that the appeal furnished via the BJP leader Ashwini Upadhyay was “badly drafted” and asked him to approach the High Court.

“This is a very badly drafted petition. You move the High Court. There are judgements where the provisions of the tax law are upheld,” CJI told the petitioner who appeared in person.

The petition was dismissed furnishing the privilege to the applicant to approach the High Court. The court mentioned in its order that it had not specified anything on the merits of the case.

PIL claims that the TDS provisions levy the onerous task on the private peoples to collect tax at source on behalf of the Government. It was furnished by the applicant that TDS taxpayers (the private employers who are tasked with deducing tax on the salaries paid by them and credit the same to the government) are “encumbered with the onerous task of tax collection by putting in their resources, that too without remuneration, and are subject to heavy penalties in case of non-compliance or error.”

As per the applicant, “The costs of deducting tax at source including salaries for staff, professional fees paid to chartered accountants, salary paid to the staff for complying with the provisions of TDS and other such experts and other costs of office, often range from 10 to 20% of the tax collected by way of TDS. It is pertinent to note that government Assessment officers (hereinafter referred to as AOs) are not subject to the same heavy penalties as TDS assesses.”

Also, the PIL mentioned that the taxpayers are incorrectly held obligated if any faults emerge in the process of collecting the tax but the same liability is not discovered if the Assessing Officer (AO) incurred a mistake.

“TDS assessees (responsible for deducting and collecting tax at source) are not paid compensation/remuneration for their work, not even a nominal amount. They are not provided any training either, unlike the already highly qualified AOs who are provided intensive training, nonetheless. If AOs commit any error in collecting tax by way of assessment allowing disallowable expenses or not taking taxable income, they are not liable for any punishment. Conversely, TDS assessees are made liable and also become subject to disallowances.”

“AOs are empowered to rectify errors committed by them. Also, they have the power to recover the under-assessed tax dues through rectification. Both of these privileges are not shared by the TDS assessees, where commonsensical logic dictates that the person not having the requisite expertise should be allowed such privileges. Article 14 and its spirit stands defeated from such legal provisions and procedures.”

Also, the states mentioned that since Article 23 restricts forced labour the fact that the government levies TDS collecting liability on the private peoples and entities without filing them is a breach of Article 23.