The Supreme Court has emphasized the need for the Central Board of Indirect Taxes and Customs to set realistic timelines for taxpayers to correct bona fide errors in forms while filing GST returns.

The bench of CJI Sanjiv Khanna and Justice Sanjay Kumar was hearing a challenge to the Bombay High Court order which authorized the taxpayer to correct its form GSTR-1 after skipping the due date under S. 39(9) of the CGST Act. Central Board of Indirect Taxes and Customs (CBIC) has contested the order.

Before the High Court, the applicant has furnsihed a writ petition against the non-grant of permission to rectify its form GSTR-1 for the period of July 2021, November 2021, and January 2022.

Under Section 39(9) of the CGST Act, the stated time cites that the rectification of such omission or wrong particulars has to be made on or before the 30th day of November, following the end of the fiscal year to which such information is related.

The applicant has furnished the returns on time though after certain time in December 2023, it has skipped the due date as per S.39(9). It was observed by the HC that despite filing is performed with errors it has caused no revene loss to the state and permitted the petition.

The present bench kept the impugned order and also noted the requirement for the CBITC to amend its provisions on rectification of bona fide errors while filing GST returns. It was ruled by the court that-

The present bench keeps the impugned orders and noted the requirement for CBITC to revise its provisions on the rectification of bona fide errors while filing GST returns. The court ruled that-

“Central Board of Indirect Taxes and Customs must re-examine the provisions/timelines fixed for correcting the Bonafide errors. Time lines should be realist as lapse/defect invariably is realized when input tax credit is denied to the purchaser when benefit of tax paid is denied to the purchaser when benefit of tax paid is denied.”

Also to considers the procedural and financial implications that the taxpayers may face as of these Bonafide errors and software limitations cannot be a valid grounds to disallow rectifications.

Recommended: Supreme Court Affirms Businesses’ Right to Correct Clerical or Arithmetical Errors in GST Return Filings

“Purchaser is not at fault, having paid the tax amount. He suffers because he is denied the benefit of tax paid by him. Consequently, he has to make a double payment. Human errors and mistakes are normal, and errors are also made by the Revenue. The right to correct mistakes in the nature of clerical or arithmetical error is a right that flows from the right to do business and should not be denied unless there is a good justification and reason to deny the benefit of correction. Software limitation itself cannot be a good justification, as software is meant to ease compliance and can be configured. Therefore, we exercise our discretion and dismiss the special leave petition.”

The Court noted that the rulings of the High Courts in Bar Code India Limited v. Union of India and others and Yokohama India Private Limited v. State of Telangana prima facie, do not lay down good law in this concern. Yet, the Court stated that it shall consider the correctness of these rulings in another case.

High Court Statements

The Bombay High Court single bench of Justice KR Shriram marked that the new digitally based GST filing process may need patience to deal with human errors by taxpayers who are still adapting the same. It held:

“The GST regime, as contemplated under the GST Law, unlike the prior regime, has evolved a scheme which is largely based on the electronic domain. The diversity in which the traders and the assessees in our country function, with the limited expertise and resources they would have, cannot be overlooked, in the expectation that the present regime would have in the traders/assessees complying with the provisions of the GST Laws. There are likely to be inadvertent and bonafide human errors, in the assesses adapting themselves to the new regime. For a system to be understood and operate perfectly, it certainly takes some time.”

The department needs to mark the practical challenges that one may face while adapting the GST regime and permits for the correction of bona fide errors without pulling the taxpayers into litigation.

“The provisions of law are required to be alive to such considerations, and it is for such purpose the substantive provisions of sub-section (3) of Section 37 and sub-section (9) of Section 39 minus the proviso, have permitted rectification of inadvertent errors.”

“It is considering such objects and the ground realities, the law would be required to be interpreted and applied by the Department. This necessarily would mean, that a bonafide, inadvertent error in furnishing details in a GST return needs to be recognized, and permitted to be corrected by the department, when in such cases the department is aware that there is no loss of revenue to the Government. Such freeplay in the joint requires an eminent recognition.”

“The department needs to avoid unwarranted litigation on such issues, and make the system more assessee-friendly. Such an approach would also foster the interest of revenue in the collection of taxes.”

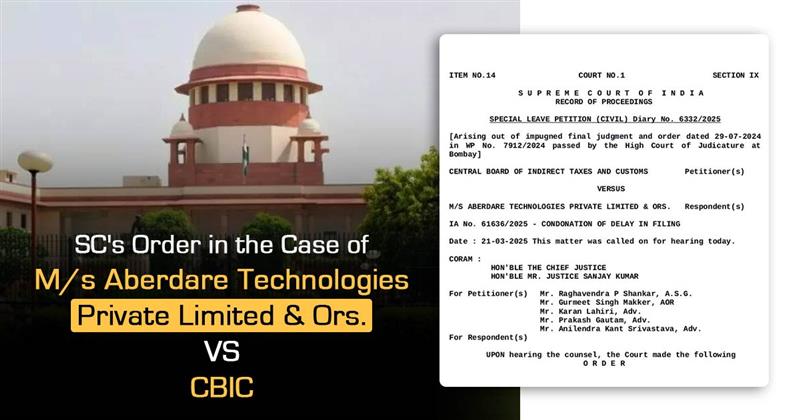

| Case Title | CBIC vs. M/s Aberdare Technologies Private Limited & Ors |

| Diary No. | 6332/2025 |

| Date | 21-03-2025 |

| Counsel For Appellant | Mr. Raghavendra P Shankar, A.S.G. Mr. Gurmeet Singh Makker, AOR Mr. Karan Lahiri, Adv. Mr. Prakash Gautam, Adv. Mr. Anilendra Kant Srivastava, Adv. |

| Counsel For Respondent | UPON hearing the counsel, the Court made the following |

| Supreme Court | Read Order |