The Hon’ble Supreme Court, in a ruling, affirmed that the right to correct clerical or arithmetical errors is a fundamental right for businesses, acknowledging that human errors in GST return filings are inevitable and should be rectified.

It was ruled by the court that the right to correct accidental mistakes, whether clerical or arithmetical, is an integral part of the right to do business and must not be refused on mere technicalities.

The court stresses the mistake of the seller in notifying the GST information cannot be directed to the refusal of the ITC to the buyer, particularly when the tax has been filed before the government.

When there is no revenue loss, then the rectification must be allowed, and the software limitations cannot be used as an excuse to restrict the legal claims.

Hon’ble court asked the government to re-examine the timelines to improve the bona fide errors, as refusing Input Tax Credit due to such mistakes burdens the purchasers.

Read Also: How GST ITC Issues Harming Indian Companies and Suppliers?

The court recognizes that errors are human even within the revenue and thus appointed Ld. Mr. Arvind P. Datar Sir, as an Amicus Curiae to assist in the case.

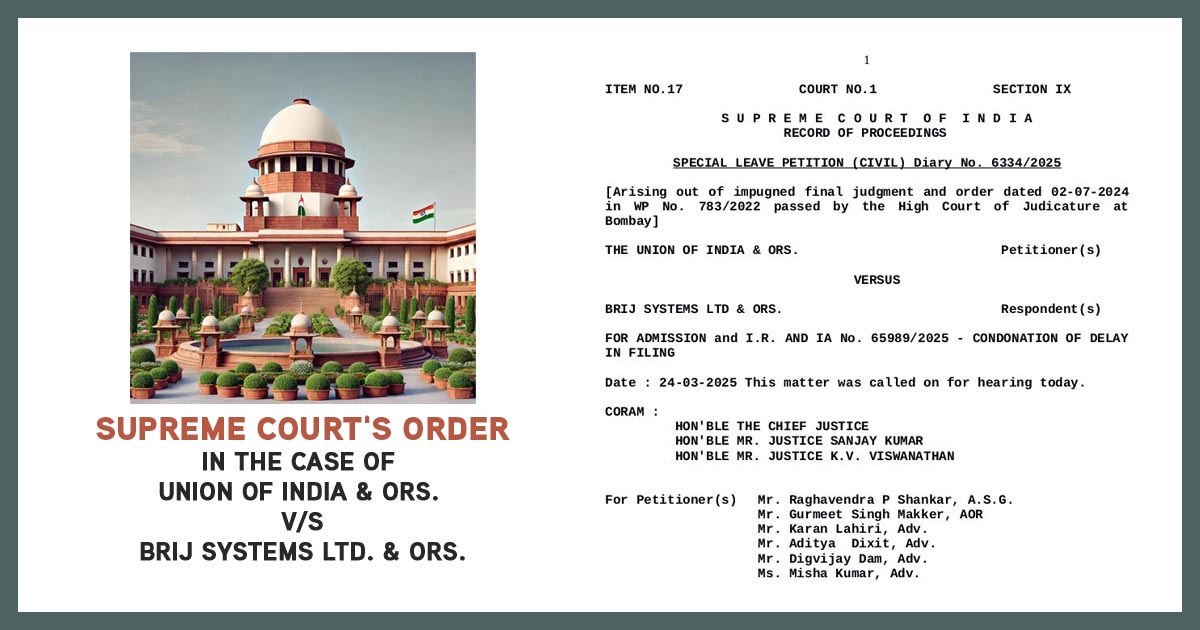

| Case Title | Union Of India & Ors. vs. BRIJ Systems Ltd & Ors. |

| Date | 24.03.2025 |

| Counsel For Appellant | Mr. Raghavendra P Shankar, A.S.G. Mr. Gurmeet Singh Makker, AOR Mr. Karan Lahiri, Adv. Mr. Aditya Dixit, Adv. Mr. Digvijay Dam, Adv. Ms. Misha Kumar, Adv. |

| Counsel For Respondent | Mr. Ayush Agarwala, Adv. Mr. Kunj Mehra, Adv. Mr. Prakash Jha, Adv. M/s. PBA Legal, AOR |

| Supreme Court | Read Order |