The Calcutta High Court supported a taxpayer’s right to a fair hearing under the Goods and Services Tax (GST) system. This decision allows the taxpayer to file a new appeal due to technical issues that prevented them from accessing the online system.

The High Court, in a petition filed by Aparajita Mukherjee (the applicant), noted her inability to access the GST portal, which prevented her from filing a statutory appeal against the tax demand order issued under Section 73 of the CGST/WBGST Act, 2017.

Before that, the court had asked the related CGST officer (respondent no. 5) to appear personally and ensure compliance with its order on 30th July 2025.

The officer in the forthcoming hearing reported to the court that the direction had been duly followed and that access to the GST portal had been restored. It said that the delay in execution was not intended and has emerged because of the late communication. Considering the compliance and the bona fides expressed, the bench dispensed with the further personal appearance of the officer.

The court, since the applicant, who does not submit a plea, has arrived from the lack of access to the GST portal, it is a platform integral to filing appeals and other compliances, she must not suffer prejudice for circumstances outside her control.

The Bench highlighted that the refusal of digital access denied the applicant her right to appeal, which includes a vital safeguard under the GST law.

In accordance with the recent directive, the single bench presided over by Raja Basu Chowdhury has stipulated that should the applicant submit an appeal regarding the order dated August 26, 2024, within a timeframe of four weeks, the appellate authority is mandated to consider the appeal on its substantive merits, contingent upon adherence to procedural requirements.

The authority is asked to dispose of the appeal by passing a reasoned order in conformity with the law, keeping in mind the observations made by the high court concerning fairness and access.

The Court, on the issue of a show-cause-cum-demand notice on 29th May 2024 was reported that adjudication had not been finished till now. The court, while noting that the applicant must have a chance to defend herself, permitted her to submit another response within 2 weeks, which needs to be duly acknowledged via the proper officer post-granting a personal hearing.

Read Also: Calcutta HC: GST Authorities Cannot Recover Full Tax Demand Before Appeal Period Ends

The High Court emphasised that the decision-making body should consider whether the use of Section 74, which pertains to tax claims arising from fraud, intentional misrepresentation, or concealment of information, was appropriate in light of the specific circumstances of the case.

The court, disposing of the writ petition and the related application, withheld levying costs but reiterated that technical or procedural lapses by tax authorities should not diminish the legal rights of taxpayers.

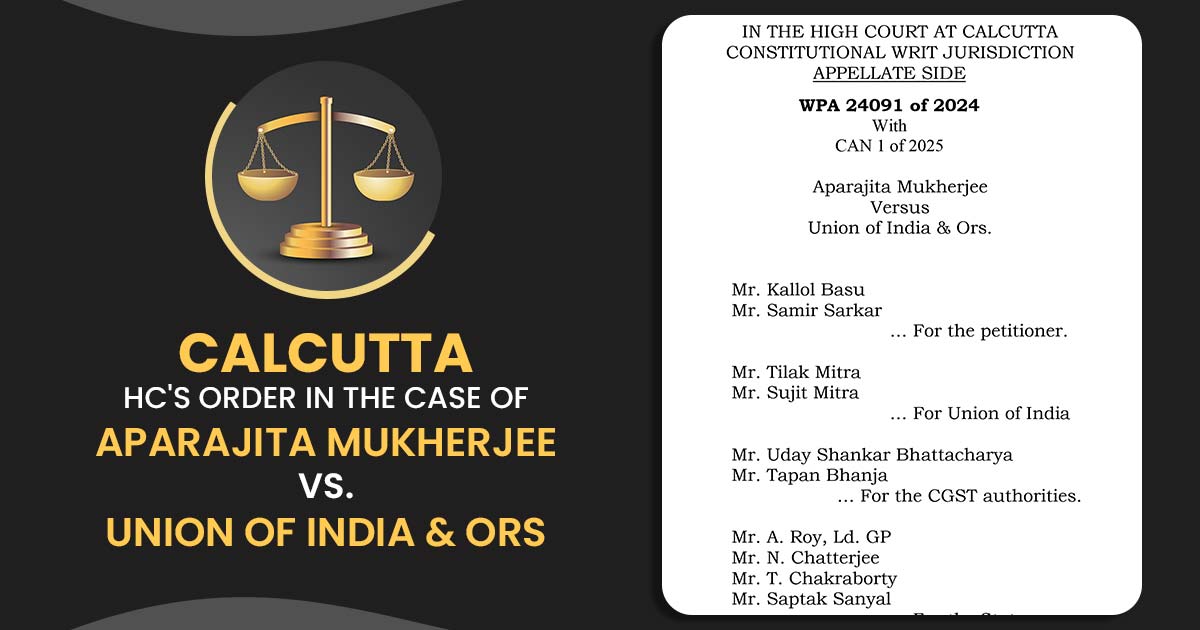

| Case Title | Aparajita Mukherjee V/S Union of India & Ors |

| Case No. | WPA 24091 of 2024 |

| Counsel For Petitioner | Mr Kallol Basu, Mr Samir Sarkar |

| Counsel For Union of India | Mr Kallol Basu, Mr. Samir Sarkar |

| Calcutta High Court | Read Order |