The Bombay High Court has determined that an assessee should not face penalties for delays in the submission of their tax return attributable to the late guidance provided by their chartered accountant.

The bench mentioned that the delay is not because of any negligence on the taxpayer’s end but due to insufficient suggestions via the CA, a fact considered by him in his affidavit.

Justices B.P. Colabawalla and Amit S. Jamsandekar expressed the view that the applicant should not face significant disadvantages due to the delayed advice provided by the Chartered Accountant. This is particularly important considering the complexity of the issue at hand, which lacked well-established judicial precedents at the time.

The taxpayer in the same matter has submitted a petition contesting the order rejecting the application of the taxpayer for the condonation of the delay in submitting its income return for the AY 2018-19.

The deadline for filing a return of income, for the Assessment Year 2018-19, in which a taxpayer was returning a loss, u/s 139(3) read with Section 139(1) of the Income Tax Act, 1961, was 31st October 2018.

On 30th March 2019, the taxpayer filed its return within the said time u/s 139(4).

Therefore, the taxpayer dated 15th June 2023 has submitted an application for the condonation of the delay of 5 months u/s 119(2)(b) of the Act. The taxpayer has submitted the same application at the said time in the specified circular, i.e., within 6 years.

The department denies condoning the delay based on the fact that the taxpayer has been unable to practice due diligence to ensure the timely filing of its income return, and the delay is due to the taxpayer’s lack of supervision and therefore, this does not include genuine hardship.

The delay has arrived due to the taxpayer’s Chartered Accountant was not prepared with the legal and accounting treatment to be given apropos the compensation obtained in the form of Transferable Development Rights (TDR) in lieu of compulsory acquisition of specific immovable property, and, therefore, the taxpayer asked for appropriate legal advice.

As per the bench, grave hardship will be suffered by the taxpayer if the delay is not condoned, because genuine losses shall not be allowed to be carried forward.

The bench sought the taxpayer as to why the application u/s 119(2)(b) was filed merely on June 15, 2023, i.e. more than 4 years after the return was filed.

Taxpayer, he was unaware of the process of 119(2)(b), and profits of A.Ys.2019-20, 2020-21, and 2021-22 were not enough to adjust the huge losses of A.Y.2018-19 amounting to Rs. 4,47,30,811.

Read Also: Income Tax and GST Compliance Calendar of November 2025

The bench considered the taxpayer’s clarification that it was merely in June 2023 when the taxpayer released that the business norms had rectified for A.Y. 2022-23 and a there were a big profits and there was a chance of the loss being set off and the taxpayer was unable to set off it against the losses for 2018-19, thus the taxpayer submitted the Application with department.

The bench in the above permitted the petition and condoned the delay in the return income filing.

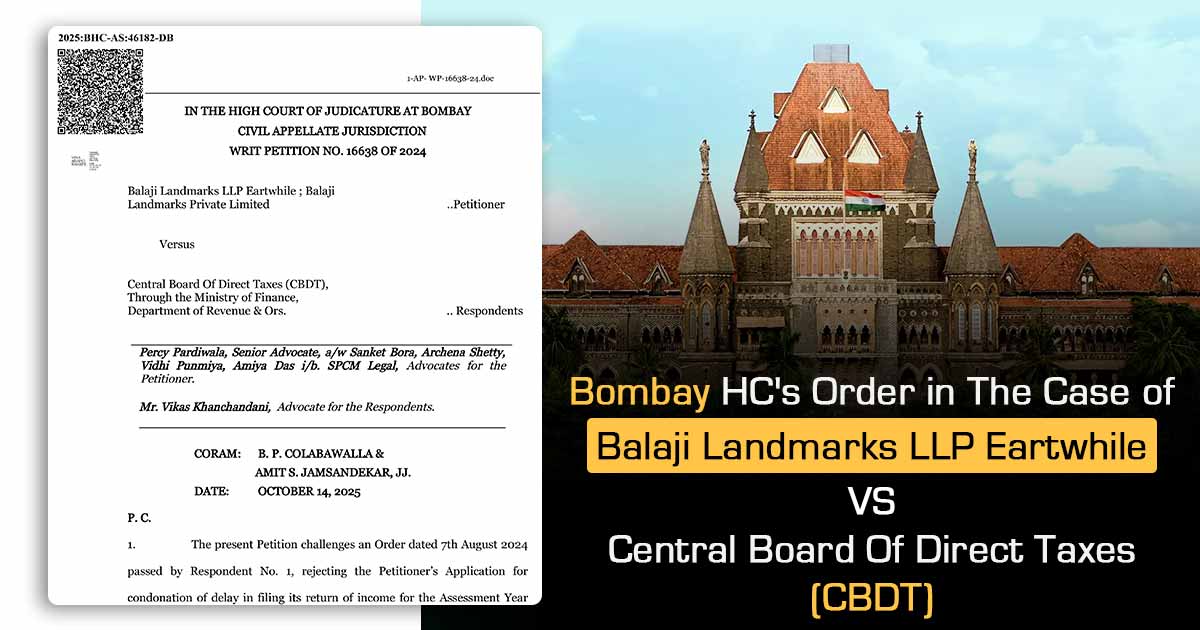

| Case Title | Balaji Landmarks LLP Eartwhile vs. Central Board Of Direct Taxes (CBDT) |

| Case No. | No. 16638 OF 2024 |

| For Petitioner | Percy Pardiwala, Archena Shetty, Vidhi Punmiya, and Amiya Das |

| For Respondent | Mr. Vikas Khanchandani |

| Bombay High Court | Read Order |