The rules related to the Re-Issue of Income Tax Refund Requests were very simple to follow.

Unlike the initial processing of the Income Tax refund when the refunds were directly credited to your bank account, now the PAN association with the bank account & pre-verification of the bank account is mandatory to get your income tax refund claim accepted by the IT department.

It is mandatory to link your Permanent Account Number(PAN) with your bank account. Besides, pre-validation of your bank account on the e-filing website Income Tax is another compulsion by the newly introduced rules because now refunds are issued only via electronic mode instead of paper cheques.

Both the compliance are easy to adhere to. The former rule simply demands you to ask your bank delegates to link your PAN to your bank account while to adhere to the latter, one simply has to go to the e-filing website of Income Tax and validate his/her bank account. However, many of the assessees did not stand by the new norms and this led to the rejection of their refund claim.

Well! No Issues. In such cases, when the income tax department has dismissed your income tax refund due to technical faults, you still have another chance to claim your refund. This is by making a refund re-issue request.

Steps to Make Re-issue Tax Refund Request on Income Tax Portal

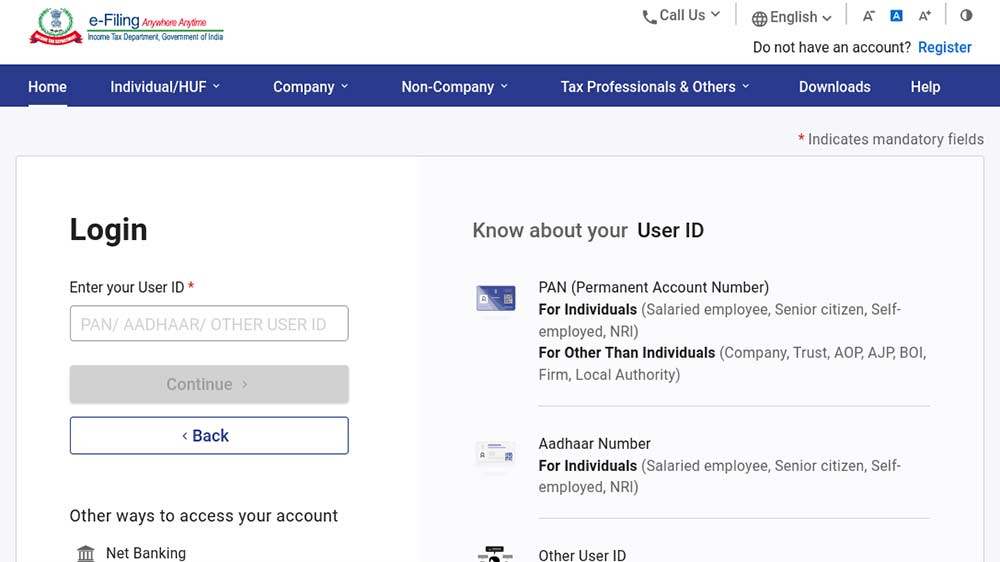

Step 1. Login to the Income Tax e-filing website. Use your ID and password to log in successfully.

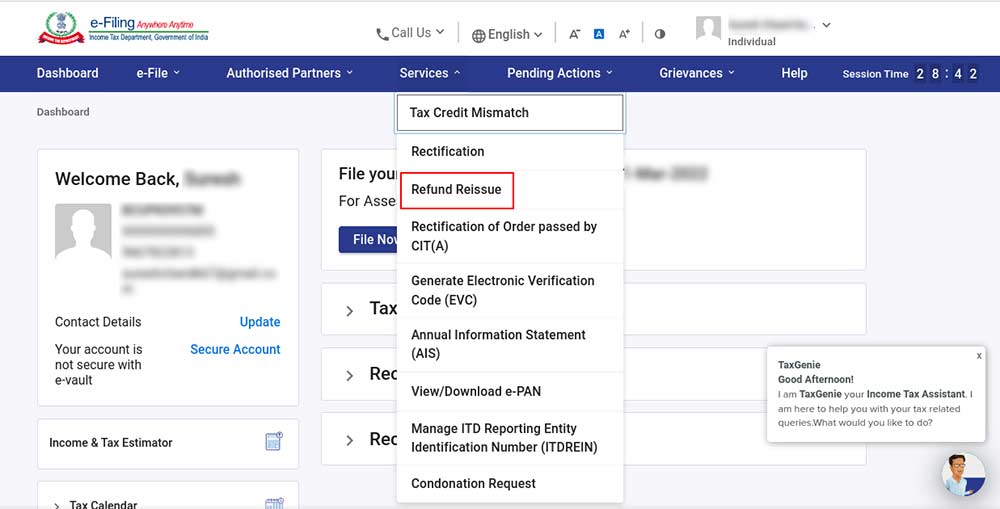

Step 2: Go to the ‘Services option’ and ‘Select Refund Reissue’.

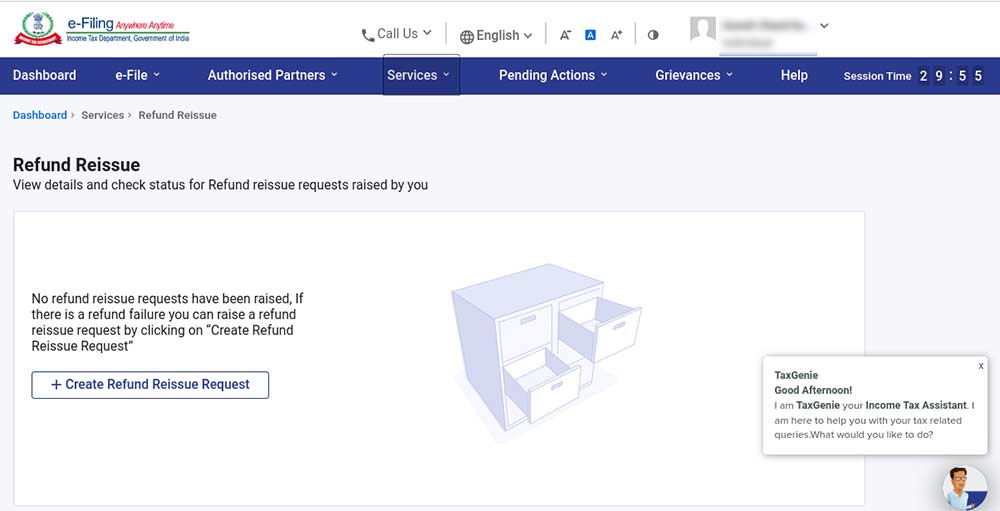

Step 3. Now click on Create Refund Reissue Request.

Step 4. Select the Return for which you want to create a Refund Reissue Request.

Step 5. Select Bank Account > Select method of verification> Verify it

Step 6. After Verification click on Submission of Request.