The TRACES website provides a convenient solution for taxpayers and deductees to address their concerns and complaints. Through the “Request for Resolution” module available on the TRACES website, users can raise and track their grievances effectively. This guide will explain the process of submitting and monitoring tax-related complaints on the TRACES website.

How to File Grievances on the TRACES Website for Deductees/Taxpayers?

To raise online grievances, an option “Request for Resolution” is available on the TRACES website from assessment year 2013-14. This online module allows taxpayers/deductees to submit a request and track its progress on the TRACES website.

Important Points to Remember

- Only registered taxpayers can raise grievances under the “Request for Resolution” option.

- A request for resolution can be filed for Part A/I and Part B/V of Form 26AS/Annual Tax Statement (ATS).

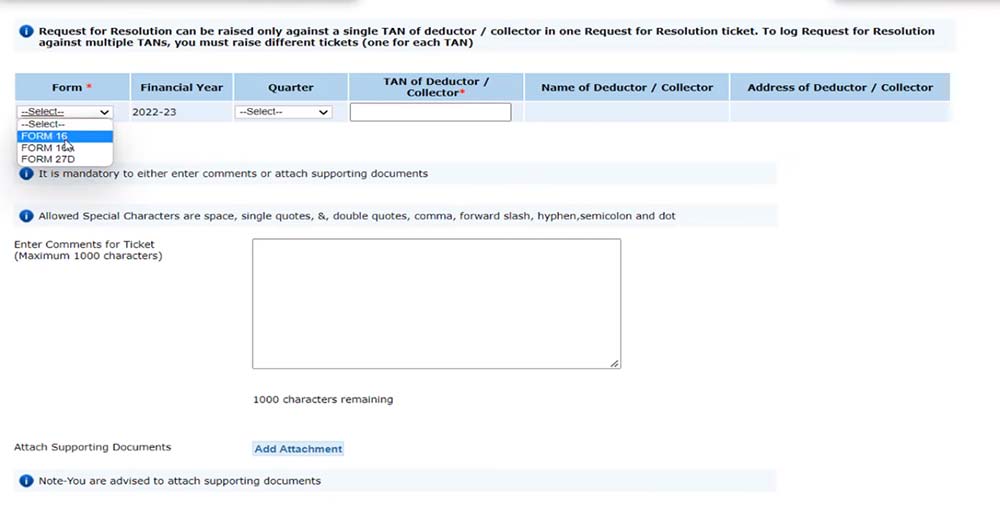

- Taxpayers/deductees can raise requests only against a single Tax Deduction and Collection Account Number (TAN) of the deductor/collector in one ticket. If there are multiple TANs involved, separate tickets need to be raised for each TAN. However, issues pertaining to different TDS statements for a single TAN can be submitted in one ticket.

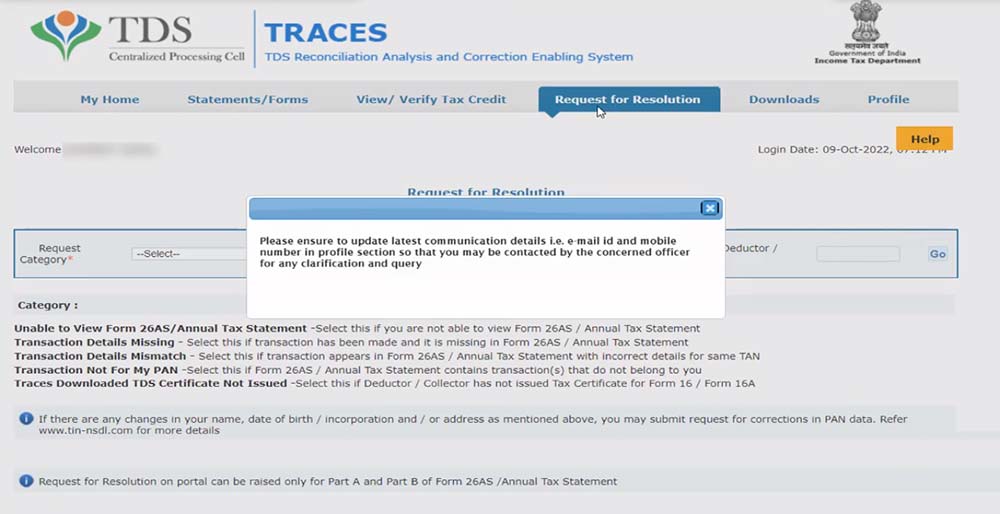

- While raising a request, it is mandatory to provide comments (up to 1000 characters) or attach supporting documents if required. Supporting documents should be attached in .doc, .docx, .xls, .xlsx, .pdf, or .zip formats, with a file size limit of 2 MB. It is also essential to update the latest communication details such as email ID and mobile number in the profile section.

Types of Request for Resolution are Available

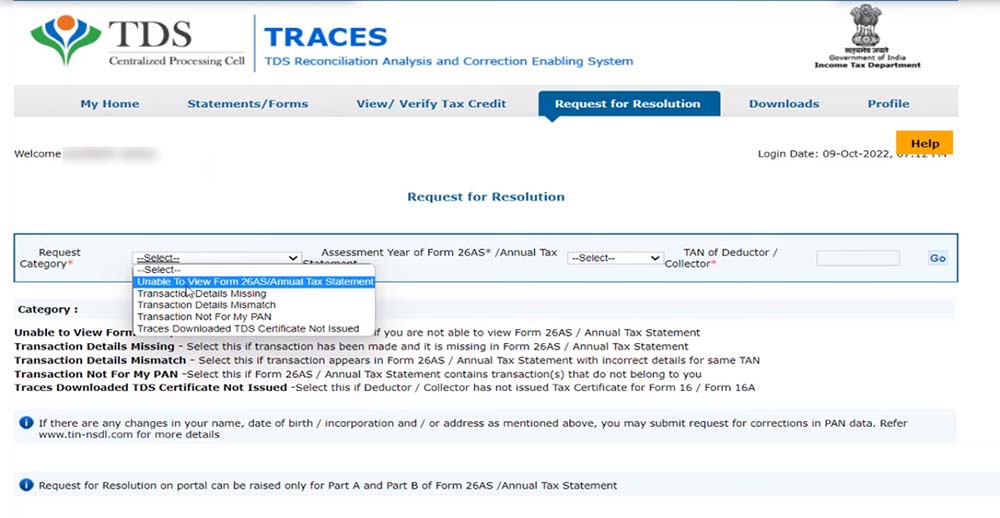

The following categories are available for users to select while raising a request for resolution:

- Unable to view Form 26AS/ATS

- Transaction details missing

- Transaction details mismatch

- Transactions not for my PAN

- TRACES downloaded a TDS certificate not issued

Resolving Assessment Year Issues

Online grievances can be raised by taxpayers/deductees through the “Request for Resolution” option on TRACES starting from the assessment year 2013-14 onwards.

Steps to Raise a Request for Resolution

Step 1: Log in to the TRACES website as a taxpayer using your User ID (PAN of the taxpayer) and Password. Upon logging in, the landing page will appear.

Step 2: Click on the “Request for Resolution” tab.

Step 3: Select the suitable category from the dropdown list for which you need to raise a Request for resolution.

Step 4: Select the relevant Assessment Year.

Step 5: Fill in the TAN of the deductor and provide the necessary details of the missing/mismatched transactions appearing in Form 26AS, including “Section Code, Amount Paid/Credited, TDS Deducted, Transaction Date,” etc.

Step 6: Briefly describe the issue in the comments box and attach any supporting documents.

Step 7: Submit the request. Upon successful submission, a unique “Ticket number” will be issued.

Steps to Track a Request for Resolution

Taxpayers have the option to verify the progress of their raised ticket by accessing the “Resolution tracking” within the “Request for Resolution” tab. There are two search options available:

Search Option 1: Taxpayer/deductee can check the status of the raised request by entering the request number.

Search Option 2: Taxpayer/deductee can track the request by selecting the appropriate ticket status and ticket creation date.

Ticket Status after Raising a “Request for Resolution”

- Open: The ticket is pending with the deductor/Assessing Officer (AO).

- In progress: The resolution of the ticket is underway.

- Clarification Requested: Deductor/AO has requested clarification. Keep in mind that tickets with this status will be closed automatically if no clarification is received within 30 calendar days, and the taxpayer cannot reopen later.

- Request for Closure: The taxpayer has received the ticket for closer. Tickets with this status will be automatically closed if no action is taken within 30 calendar days, and they cannot be reopened by the taxpayer.

- Closed: The ticket has been closed by the deductee/taxpayer or automatically closed by the system due to no action taken within the given timeframe.

- Reopened: The deductee/taxpayer has reopened the ticket after its closure.

Read Also: Quick to Correct Form 26QB Online on the TRACES Website

Conclusion: The TRACES website offers a user-friendly platform where taxpayers and deductees can submit and keep track of their tax-related complaints in a convenient manner. By following the steps outlined in the “Request for Resolution” process, individuals can effectively address their issues and track the progress of their resolution requests. Whether encountering problems with Form 26AS or other tax-related matters, TRACES offers a streamlined approach to seek redressal and ensure prompt resolution of such concerns.