Form 26QB has significant importance in the process of deducting tax at source (TDS) for property sales. However, occasional errors and mistakes may occur during the submission of this form. If you come across any inaccuracies in your Form 26QB, there’s no need to worry, as you can rectify them.

This article has been written to provide a comprehensive guide on how to correct Form 26QB effectively.

Fill Form for ITR & TDS Compliance Software

What is the Process to Correct Form 26QB-TDS Online?

Below is the authentic process to easily correct the 26QB form with important queries for taxpayers.

The 26QB-TDS Form on Property Sale

Form 26QB is an e-form also known as a “challan-cum-statement.” It is used for deducting tax under Section 194-IA of the Income Tax Act, 1961, regarding property transactions.

The deductor, who is the buyer of the property, is required to file Form 26QB electronically on the Income Tax Department’s e-filing website (www.incometax.gov.in) within 30 days from the end of the tax deduction month.

What are the Steps to Correct Issues/Mistakes on Form 26QB?

The deductor, i.e., the buyer of the property, can rectify errors or mistakes in Form 26QB online by logging into the TRACES website. For easy understanding and utilisation of the 26QB correction functionality, relevant e-tutorials are available on the home page of the TRACES website.

In Form 26QB, Who is Eligible to Apply for Corrections?

Only deductors (buyers of the property) who are registered on the TRACES website can submit a request for correction in Form 26QB. The option for “26QB” correction can be found under the “Statements/Forms” tab.

Is it Possible to Correct Certain Aspects of Form 26QB?

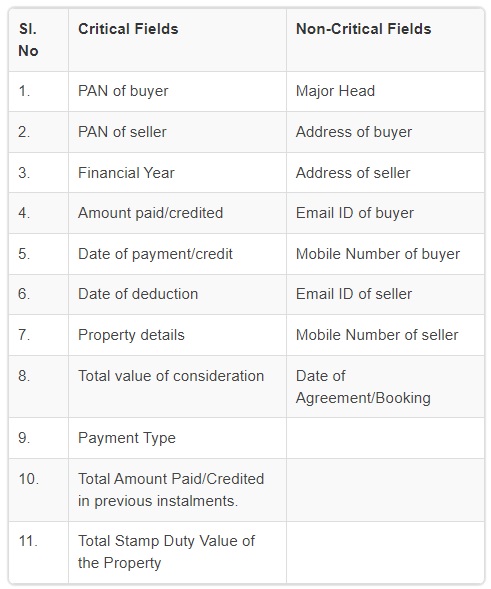

Corrections can be made in both critical fields (allowed for correction only twice) and non-critical fields. The following fields are categorised as critical and non-critical for correction purposes:

How Does Form 26QB-TDS Need to Be Corrected?

The steps for correcting Form 26QB are outlined below:

Step 1: Log in to the TRACES website as a taxpayer using your registered User ID and Password.

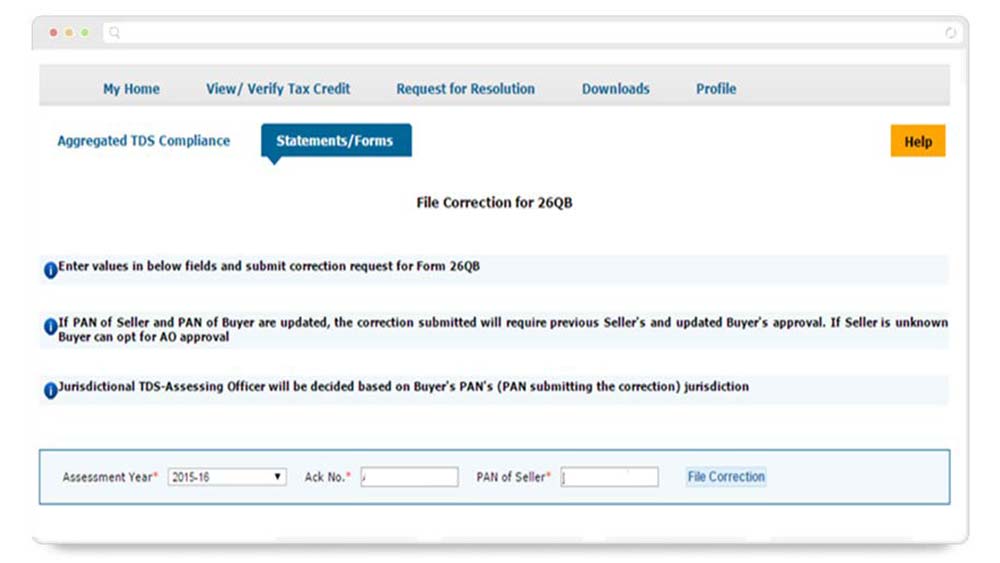

Step 2: Under the “Statements/Forms” tab, select the option “Request for Correction” to start a correction request.

Step 3: Enter the relevant details such as“Assessment Year,” “Acknowledgement Number,” and “PAN of Seller” based on the filed 26QB form. Click on “File Correction” to submit the correction request. Upon submission, a request number will be generated.

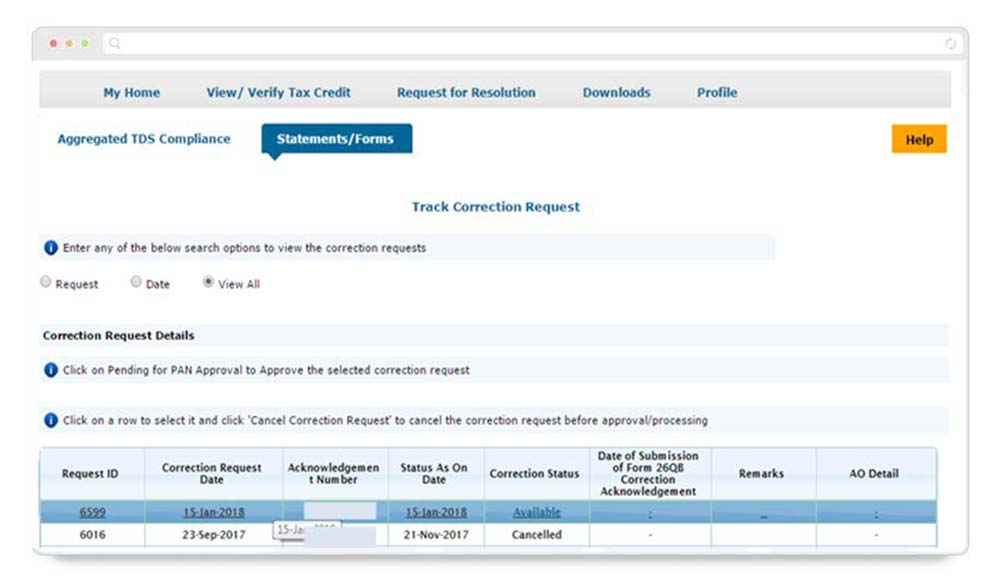

Step 4: Go to the “Track Correction Request” option under the “Statements/Forms” tab and start rectifying after you see the status as “Available”. Click on the “Available” status to proceed.

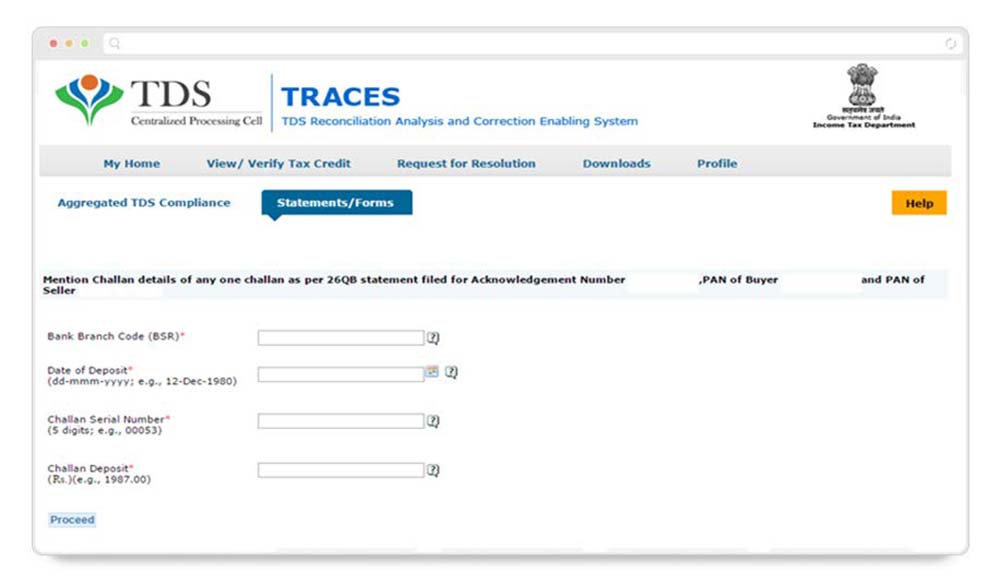

Step 5: Provide the CIN (Challan Identification Number) details as per the filed 26QB statement, then click on “Proceed.”

Step 6:Select the field that needs to be edited in the 26QB form. After clicking on the “Edit” tab, a message will appear on the screen. Click on “Save” to save the updated details, and then click on “Submit Correction Statement.”

Upon submission of the Correction Statement, a “Confirm details” screen will be displayed, highlighting the updated details in yellow.

The profile details will be populated as updated on TRACES. Click on “Submit Request” to finalise the correction request.

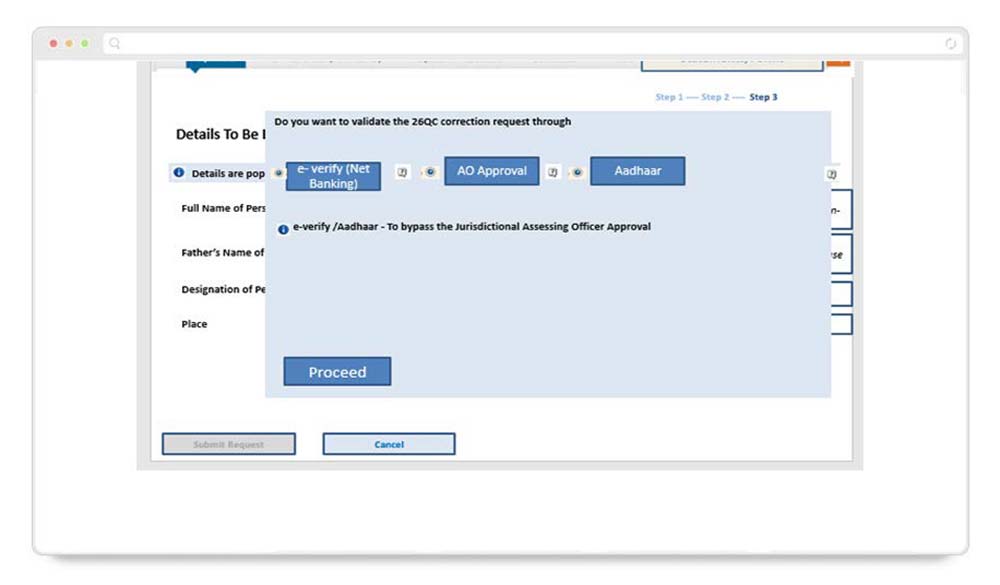

Step 7: After submission, it is necessary to validate the correction request. If your Digital Signature Certificate (DSC) is registered, you can validate the request using the DSC. If your DSC is not registered, you can validate the correction request using options such as e-verification (Net Banking), AO Approval, or Aadhar OTP.

Read Also:- Filing Revised TDS Return Online: Step-by-Step Guide

The profile details will be populated as updated on TRACES. Click on “Submit Request” to finalise the correction request.

Important Points to Remember

- After successfully submitting the correction, the applicant will be issued a Correction ID. This ID can be used to track the status of the correction.

- If your DSC is not registered, you need to provide a hard copy of the acknowledgement of the Form 26QB correction, along with identity proof, PAN Card, documents related to the property transfer, and proofs of payment to the Jurisdictional Assessing Officer (AO) for verification.

- Users can submit 26QB Correction statements without requiring approval from the Assessing Officer by using e-verification (Net banking)/AADHAR/DSC validation.

- Users can submit 26QB Correction statements without requiring approval from the Assessing Officer by using e-verification (Net banking)/AADHAR/DSC validation.

- There is no e-verification option available for NRI taxpayers.

What is the time limit duration of correcting Form 26QB from the date of original filling of TDS challan online

I have applied for correction with dsc, it is now pending for seller approval, how will he approve the same as he is unable to register in traces as taxpayer?

Please guide

I filed for 26QB correction as a buyer and the status says Processed. But the correction is not reflecting in 26AS. How would I know if this has been corrected? I had submitted to AO approval. Is there any action from my end. I saw an email coming from income tax office but when i opened the email it vanished. So, not sure if there is any action that needs to be taken.

i received 26qb late payment demand notice while making demand payment i add wrong PAN and Ack number what to do ?

I have paid the whole TDS amount of the under construction building in one go , as suggested by the builder . The Form 16 B generated shows only the 1 % of TDS amount as paid to the builder in the recent installment , and their is no mention of the full amount . Is this ok as except the challan statement 26QB , I donot have any other proof that the amount in full has been deposited.

I filed 26QB correction, i have dsc enabled and chose approval by seller. After seller approved it it is now stuck with AO and they dont reply. How can this be resolved, they dont pick up my request despite several tries to connect via email. I am an nri.

1. Raise a Grievance on TRACES

Submit a grievance explaining:

Correction filed with DSC and seller approval done.

It’s pending with AO and there’s been no response for X days.

Mention your PAN, Acknowledgment Number, Date of Filing, etc.

2. Contact the Jurisdictional AO (Official Route)

If the AO is not responsive on email:

Try calling their office directly (some AOs have staff landlines).

Contact the Addl. CIT or Jt. CIT of the same circle via email copying your AO.

Clearly mention your NRI status and inability to visit physically.

3. Use e-Nivaran (Alternative Grievance Portal)

Hi Sir,

How to download form 26QB after its revison? Any option to get it?

Step 1: Log in to TRACES (TDS Reconciliation Analysis and Correction Enabling System)

Step 2: Go to the Form 26QB Section

Step 3: Request for Revised Form 26QB

Step 4: Download the Revised Form 26QB

2 Buyers Being NRI , husband and wife purchased flat and deducted TDS but instead of deducting and submitting 26qb from both husband and wife’s account , statement was filed for full amount from husbands account, what is the way forward considering NRI for refund and correction of 26QB , first alteration of 26qb and then refund or some other process ? any hinderance that can come and needs to be taken care of including dsc and e verification ?

File an online correction request via TRACES portal under the husband login .

You will need to split the transaction:

Revise original 26QB to reduce the amount to what husband actually paid.

Create a new 26QB for the wife’s share and file it with her PAN.

You will likely need to contact TDS CPC/Assessing Officer for manual intervention since NRI cases and joint holdings often require backend correction.

Refund of Excess TDS

Once the correction is accepted, and amount bifurcated, only then can refund be processed.

The party in whose name TDS was over-reported (i.e. the husband) can claim refund for the excess paid in his income tax return.

e-Verification / DSC Requirements

e-Verification or DSC is required during correction.

For NRIs, DSC is often mandatory since Aadhaar OTP-based e-verification is not available.

Make sure the DSC is registered on the income tax portal of both parties (if filing from both sides).

Hindrances & Cautions:

TRACES portal doesn’t allow online split of 26QB easily — often needs physical or AO-level correction.

For NRIs, avoid using Aadhaar e-verification — instead use registered DSC.

Ensure correct PAN-Aadhaar linking status, even for NRIs (though not mandatory, sometimes mismatches cause issues).

Refunds can take several months, especially if manual intervention is involved.

Property of joint owner sold to a single buyer. Buyer had paid the purchase amount to both owner but had deducted TDS from only one seller account. Seller also claimed in only one account but the credit not given by the Department as the receipt/income was mismatching. Now if buyer want to rectify the form 26QB is it possible to file two separate form in the name of each seller dividing the amount. Amount from the seller whose account was taken earlier will be reduced and to be transfered to another seller’s account. Please guide

First, the buyer needs to cancel or revoke the original Form 26QB that was filed incorrectly. The buyer should then file two separate Form 26QBs, one for each seller. The amount that was originally deducted from one seller’s account should be transferred (divided) correctly between the two sellers based on their share in the sale proceeds. After filing the two corrected Forms 26QB, the buyer will receive a fresh acknowledgment, and the TDS credit will be properly reflected for both sellers in their respective accounts.

I corrected the challan details in the 26QB form due to an incorrect amount. After a month, the Assessing Officer rejected it, stating no supporting evidence was provided. Where should I submit the evidence, and what is the proper channel to do so?

If you’re responding to a demand or notice regarding the rejection of your 26QB, you’ll typically submit your supporting documents (like payment proof, corrected challan details, etc.) via the e-filing portal.

If the AO requires physical submission of documents, you may need to submit them directly to the AO at the Income Tax office that issued the rejection notice.

If you’re unsure of the exact procedure or need help understanding where to submit your documents, you can contact the Income Tax Department help-desk through the portal or call them directly for clarification.

We have purchased a property jointly and submitted form 26QB seperately for both the buyers on the installment payments made so far during last two financial years.

However, now we observed that the total value of the property has been shown in all the Form 26 QB without splitting into 50:50. But instalments amount paid and TDS deducted has been shown correctly.

So far, approximately 50% payment has been made and final payment of the property is pending.

Kindly review and guide regarding further course of action.

Each buyer should file Form 26QB individually, and the property value to be shown in each form should be their respective share in the property.

in case only one of the buyer (say if husband and wife are the joint buyers) has already filled the 26 QB with the whole 1% tax amount, what would be the procedure to correct it? Also what about the late fees in this case (as the whole amount is already with government, and it’s just the correction)?

Submit a revised Form 26QB with updated details, ensuring that both buyers are reflected properly, and checking the status on TRACES. Since the tax has already been paid, late fees should generally not apply unless the original filing was late.

I HAVE FILED 26 QB CORRECTION, BUT UPDATED BUYER PAN NUMBER REQUEST KAHA PAR SHOW HOGI PLEASE SUGGEST ME SHOW UNDER WHICH TAB ?

I have filed 26 Qb wrongly filed some mistakes in this any time limit of filling correction please Suggest me

I have successfully filed the correction request for 26QB and submitted for seller’s approval , it showed ( pending for PAN approval ) , later I approved the request of correction from Seller’s ID on traces and it got submitted to ITD and within 6 hours the changed from “Accepted” to ” Processed ” after which I again submitted the request for 16B ( corrected ) and it was also made available within 1 hours , so now the system is very efficient .

We have made 1% TDS payments correctly, however in 26QB we mentioned a wrong amount in Total Value of Consideration (Property Value). Because of this Form 16B shows a shortfall amount of Rs. 3000/- odd. The developer is not willing to give possession of the flat and has asked us to pay him the amount to square of his books of accounts saying that 26QB does not match. I don’t see how paying the developer is solving anything. What’s the way forward.

File a revised Form 26QB with the correct property value and generate a new Form 16B. You should not need to make an additional payment to the developer. Once the form is updated, the developer will have the correct documentation to reconcile their records, and possession should follow.

sir if a file the revised 26QB with DSC of the buyer, can i avoid AO approval? I have to correct the date of agreement. If i do it with buyers DSC then will it get corrected automatically, without the approval of the AO. Thank you for the reply in advance

if the revised Form 26QB is correctly filed with the necessary DSC and no discrepancies exist, it can help avoid the need for AO approval but to legally correct or amend an agreement, the AO’s approval is generally required.

Yes , we can avoid the approval from AO , by sending the correction request to Seller and not the AO , and later accepting the correction from seller’s Traces ID and all these options are given by the Traces and this entire process is completely legal with no manipulation

WHENEVER I FILL ACKNOWLWDGMENET NUMBER THIS ERROR COMES

There is no data available for the specified search criteria

Reasons can be:

1. There is no statement filed for the searched criteria. Please verify Assessment Year, Acknowledgement Number and PAN Buyer and Seller

2. No challan has been deposited yet for the 26QB

Reason may be that your payment has been failed. You can check your payment history on income tax.

How did you resolve this?

For 26QB correction , is there way in which we can skip AO approval while submitting the request

Users can submit 26QB Correction statements without requiring approval from the Assessing Officer by using e-verification (Net banking)/AADHAR/DSC validation.

I need to correct the date of tax deduction of date in the 26QB form . The tax was deducted on 1st March 2024 . Earlier my CA submitted the correction request and was stuck in AO approval and after that it got rejected to not providing the supporting documents .

Is there any way we can skip the AO approval process when i am submitting another correction request .

“Users can submit 26QB Correction statements without requiring approval from the Assessing Officer by using e-verification (Net banking)/AADHAR/DSC validation.”

I need to correct the date of deduction of date in the 26QB form . The tax was deducted on 1st March 2024 . What is the last date to file the correction request

There is no time limit to file the correction request. Correction request can file anytime.

Successfully revised 26qb however unable to download revised challan , is there any way?

Go in taxpayer login then go in e-pay tax then go in payment history then download challan receipt.

Time limit for filling correction in 26QB

I am an NRI and have deducted TDS on payment of an installment to a corporate builder. While filing Form 26QB, I mentioned amount paid including GST. While confirming the details of the corrected Form 26QB, I get the error “Major Head does not correspond to the Category of PAN of Buyer”. What should I do?

hi were you able to find a solution for this error? I am struggling with the same

During correction which head to be selected 0020 or 0021

Code 0020 is for income-tax paid by companies and Code 0021 is for income- tax paid by non-corporate taxpayers.

What to do if only one name(PAN) entered in 26QB instead of two names as property purchased was in joint ownership?

I have submitted corrected form of 26QB.

I received the mail from ITD saying correction is processed without default

Question: How long it will take to reflect correct amount of TDS in form 16B

There is no fixed time period. Normally it takes 2-3 days but sometime it can take more time.

while filling up the 26QB form my payment date is 19th, July 2024 ..however the system is picking up assessment year as 2024-25… it should be 2025-26… what should I do? I have not made the payment yet.

What if, i amend the amount to 0, than how to utilize that amount. How to delete the form so that amount can be made zero.

Remove payment credit amount and TDS deduction amount from entry then amount available on un consume challan.

We 4 people have bought land together, so do we have to deposit TDS together or separately?

please reply

How can file for correction? I need help filing the correction.

My correction request was rejected with reason saying

“Vishal Gupta has not submitted the required documents to this office till date. Hence, the application is hereby rejected.”

It is not clear on what documents are required to be submitted and where?

Can you confirm if there is any additonal step after the correction step has been submitted and approved by the seller?

You can done correction in form 26QB only twice so if you file request for correction single time you can again Login to TRACES for correction under Statemen/Forms tab and select the option of “request for correction” and submit FUV FILE AND 27Q FORM.

Hey Vishal,

If you received a mail from department, requesting documents. You should reply over that mail with the requested Docs.

Dear MAYUR BHAJE,

im also in same case, Did you received any mail from your jurisdictional ITO (Income Tax Office) ?

Please update and help to know what to do next.

Thanks – Parth

I filed on 30th march and want to rectify mistake on April 1. but when i submit rectification request, it is getting failed immediately in 2-3 mins. What could be possible reasons for this?

I have submitted for correction in 26QB on 18th March, however I did not see any options of above to for the approval like DSC option or E verification via AAdhar. They have just mentioned that post approval from Jurisdiction officer, I have to submit “Form 26QB correction acknowledgment and submit the duly signed document along with supporting document for the correction made “, but here I am confused like what documents and where to send all those. Kindly help me if anyone knows.

Hi Mayur,

You must have received a mail from your jurisdictional ITO (Income Tax Office) TDS in which you have to file some documents. You must have to reply to that mail with these documents for further processing.

My 26qb correction status shows “in progress” from 24th Jan 2024. today is 12th Feb. 19 days over. is it normal ? how long should i wait for it to turn to “approved” status, please?

Hi Swamy,

The reason for that is you have not filed the correction statement yet, i.e. it is just a draft, for for filing the same you need to submit the correction form.

I have corrected form 26qb online and now it’s require Sellers approval.

Wanted to know how my seller will aprove it i. e. in traces portal or income tax portal and the further procedure

Hello,

We have bought an apartment ( under construction, through a builder ) and under joint ownership. We are paying quarterly instalments to the builder. For the first installment, I entered in Form 26QB in the “consideration value of property” the total value + GST – as mentioned by the builder. Is this correct? Pls advise, Thanks

GST is not to be included in the consideration value for TDS purposes. The consideration amount means only the base price agreed between the buyer and the seller, not any taxes. TDS @ 1% is to be deducted only on the consideration value excluding GST.

I filled TDS on 30th Nov. I made a mistake & for that I logged in to TRACES. But when I enter Ack No & other details it doesn’t identify any records. What to do?